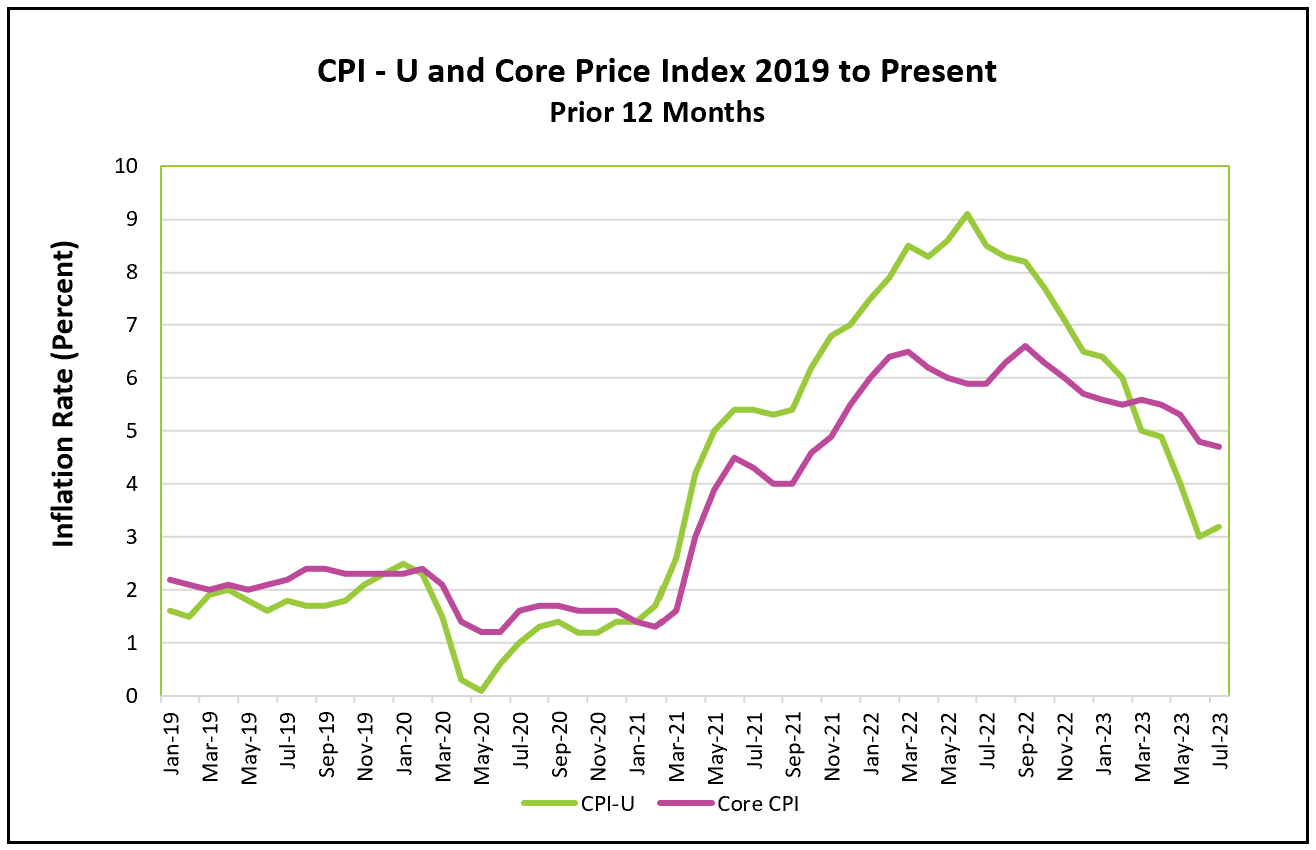

July’s 12-month consumer price index increased 3.2%, marking the first jump in prices in 13 months. However, an analysis reveals encouraging signs that inflation will decelerate in the coming months.

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – July 2023, are summarized below.

Traveling was less expensive in July than in June. Air fares fell 8.1%, hotels 0.5%, and renting a car was 0.3% less expensive. While the cost to dine out rose 0.2%, that was less than the 0.4% increase in June.

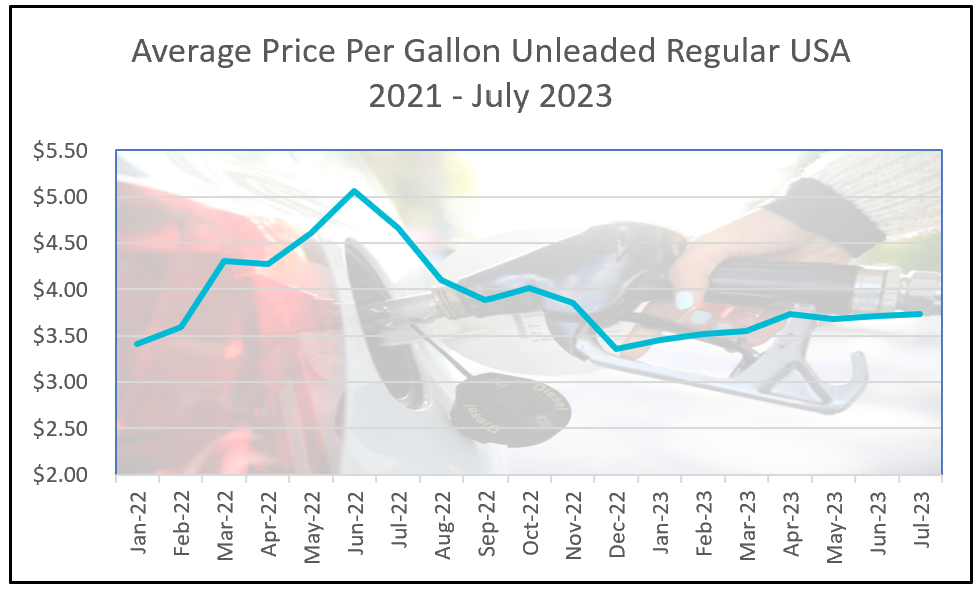

The Ukraine War pushed gasoline prices to historical highs in June 2022, which significantly influenced the consumer price index in reaching 9.1%. But falling gas prices were also a significant contributor to the deceleration of prices during the second half of 2022. Recently, gas prices have drifted higher, causing concern that they will slow the disinflation or even accelerate inflation in the coming months. The sharp decrease in gas prices explains why the all-inclusive CPI is lower than the core CPI, which excludes volatile energy and food prices.

Source: FRED

Economists find greater comfort in a falling core index than a falling all-inclusive index because they consider it a better barometer of trends. The core index has decreased or remained unchanged every month since February. The three-month rolling average of the 12-month core index equaled 3.4%, reaching its lowest point since April 2021.

The CPI would have been unchanged in July without the shelter index. It accounted for 90% of the jump in the all-inclusive CPI – good news for policymakers since the shelter index is a lagging index because it captures new and existing leases. Rental rates have recently decelerated, which should slow the shelter index’s increase in the year’s second half. Research by the Federal Reserve Bank of San Francisco concluded that “shelter inflation is likely to slow significantly over the next 18 months, consistent with the evolving effects of interest rate hikes on housing markets.”

Slowing the rise in labor costs is vital in diminishing inflation. Real wages (wages after accounting for inflation) rose 0.3% in July. (BLS: Real Wages – July 2023) When income growth exceeds inflation, it can fuel higher prices. Households have more money to spend on goods and services. Higher demand pushes up prices. In addition, businesses, particularly in service industries, raise prices to cover their higher labor expenses and maintain their margins. Despite wages increasing more than inflation, weekly compensation increased only 0.12% because the average workweek was shorter. That compares to 0.74% between May and June. (BLS: The Employment Situation – July 2023) A shorter workweek could be a sign of a softening of the labor market since employers usually cut hours before they lay off workers. The employment cost index fell in June, indicating that labor costs are falling, which should relieve inflationary pressures. (BLS: Employment Cost Index– June 2023) Another indication that wages should stabilize is that businesses have slowed their hiring, and more people entered the workforce, bringing the supply and demand for workers more in balance than a year ago when there were over two job openings for every available worker.

The base effect can result in a misinterpretation of data. Inflation peaked in June 2022, which means May’s 12-month CPI includes June’s peak rate for the following twelve months. July 2023’s 12-month index does not include the peak rate increase. Since the beginning inflation rate is less, the percentage change over the 12 months is less.

Despite the moderate increase in the 12-month overall rate, prices are trending lower, as evidenced by a lower 3-month trailing average and core rate. July’s increase was mainly because of the shelter index, a lagging index that is weakening. Economists expect disinflation to continue, making it unlikely policymakers at the Fed will raise interest rates at their September meeting if the current trend continues even though inflation remains above its 2% target. On August 31st, the BEA will release July’s Personal Income and Outlays report, which will provide the PCE price index, the inflation measure favored by policymakers at the Federal Reserve. For a summary and analysis of this release, visit HigherRockEducation.org shortly after its publication.