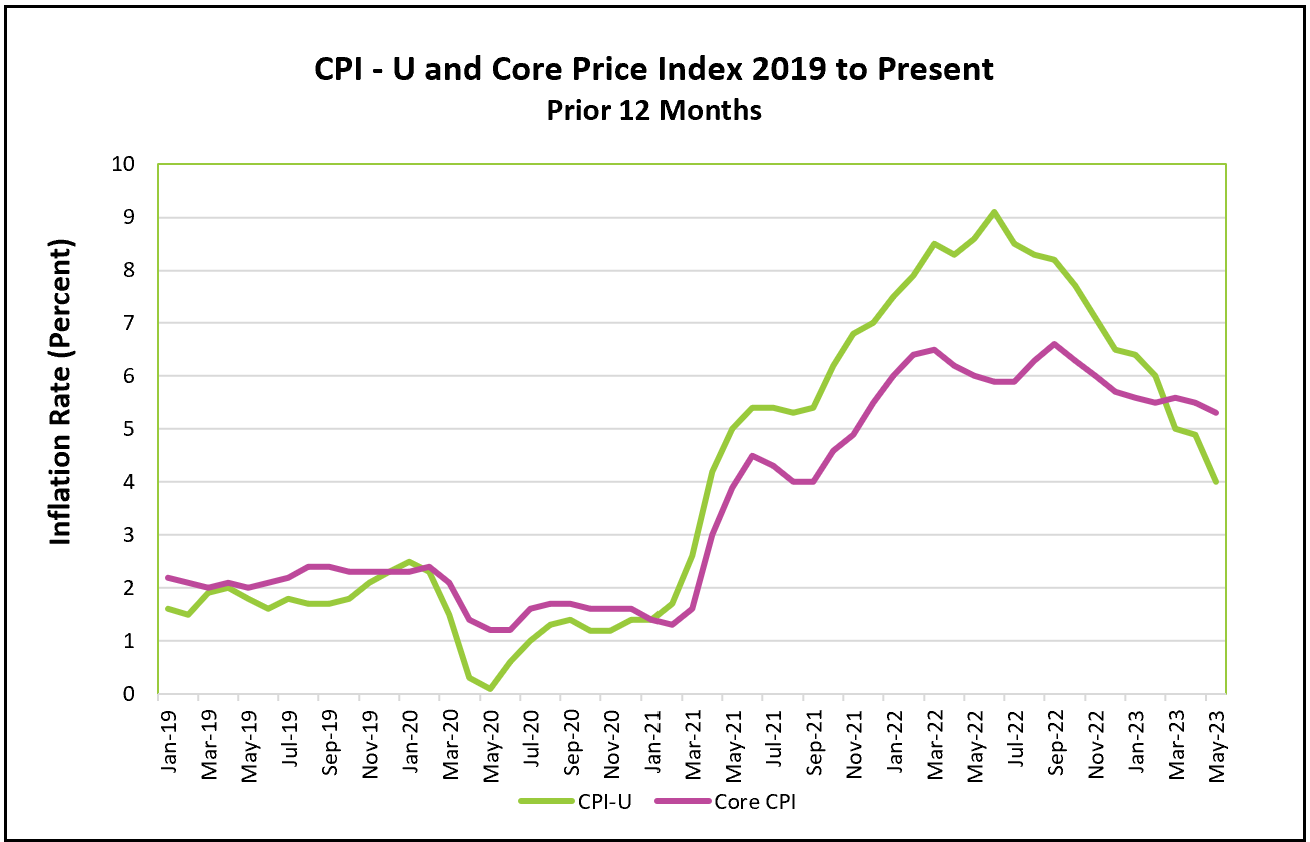

The Bureau of Labor Statistics released May’s CPI report this morning. It provides promising signs of inflation subsiding, with overall inflation reaching a two-year low. Factors such as falling gasoline prices and indications of declining rental rates contribute to this slowdown. However, core inflation remains stubbornly high, and policymakers at the Federal Reserve face the challenge of balancing the need to address inflation with sustaining economic growth. They will likely suspend their string of rate increases when they meet today and tomorrow.

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – May 2023, are summarized below.

The 12-month all-inclusive inflation index has decelerated for eleven consecutive months since it peaked at 9.1% in June 2022. May’s monthly index reached a two-year low of 0.1% because there was an easing of price increases across various sectors of the economy.

One major factor contributing to the inflation slowdown is the significant decline in gasoline prices, which fell by 5.6% in the past month. This decrease has alleviated some of the burdens on consumers and played a crucial role in driving down overall inflation. Food inflation, which experienced high inflation rates earlier in the year, has gradually decelerated. Grocery prices rose by only 0.1% in May, following two consecutive months of decreases. As a result, the 12-month increase in food prices has decreased from 13.5% in August 2022 to 5.8%.

However, core inflation, which excludes volatile food and energy prices, has remained stubbornly high, falling by only 0.3% since January. This can be attributed to the slow decline in rental rates and the recent increase in used car prices, which rose by 4.4% in April and May. While the shelter index has been a major contributor to both overall and core inflation, there are indications that rental rates are beginning to fall. The Wall Street Journal recently reported that new-lease asking rents rose just 2% over the past 12 months, compared to the government’s figure of 8%. This difference arises because the government gauge incorporates existing leases. Falling rental rates should help slow down the rise in the shelter index.

The Federal Reserve’s Federal Open Market Committee is considering increasing its benchmark interest rate. Since March 2022, policymakers have increased their benchmark rate ten times to slow the economy by making borrowing money for homes, cars, business equipment, and personal items using credit cards more expensive. Usually, it takes a year or more for the impact of rate increases to filter throughout the economy, so most analysts believe the Fed will temporarily pause their rate hikes to evaluate the economy’s trend. However, it is important to note that inflation remains significantly above the target rate of 2%, and future rate increases are probable.

Policymakers have watched wage inflation closely. The Bureau of Labor Statistics reported that inflation-adjusted wages rose by 0.3% between April and May. While higher real wages provide individuals with increased purchasing power, they also have the potential to prolong high inflation by providing the funds to increase consumer spending. Consumer spending has been a crucial pillar supporting the economy throughout these inflationary times. The upcoming release of Personal Income and Outlays - May 2023 by the Bureau of Economic Analysis (BEA) on June 30th will provide insights into consumer spending trends. It will also include May’s PCE price index, the price index preferred by policymakers at the Fed.