The inflation figures from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index (CPI) – May 2025

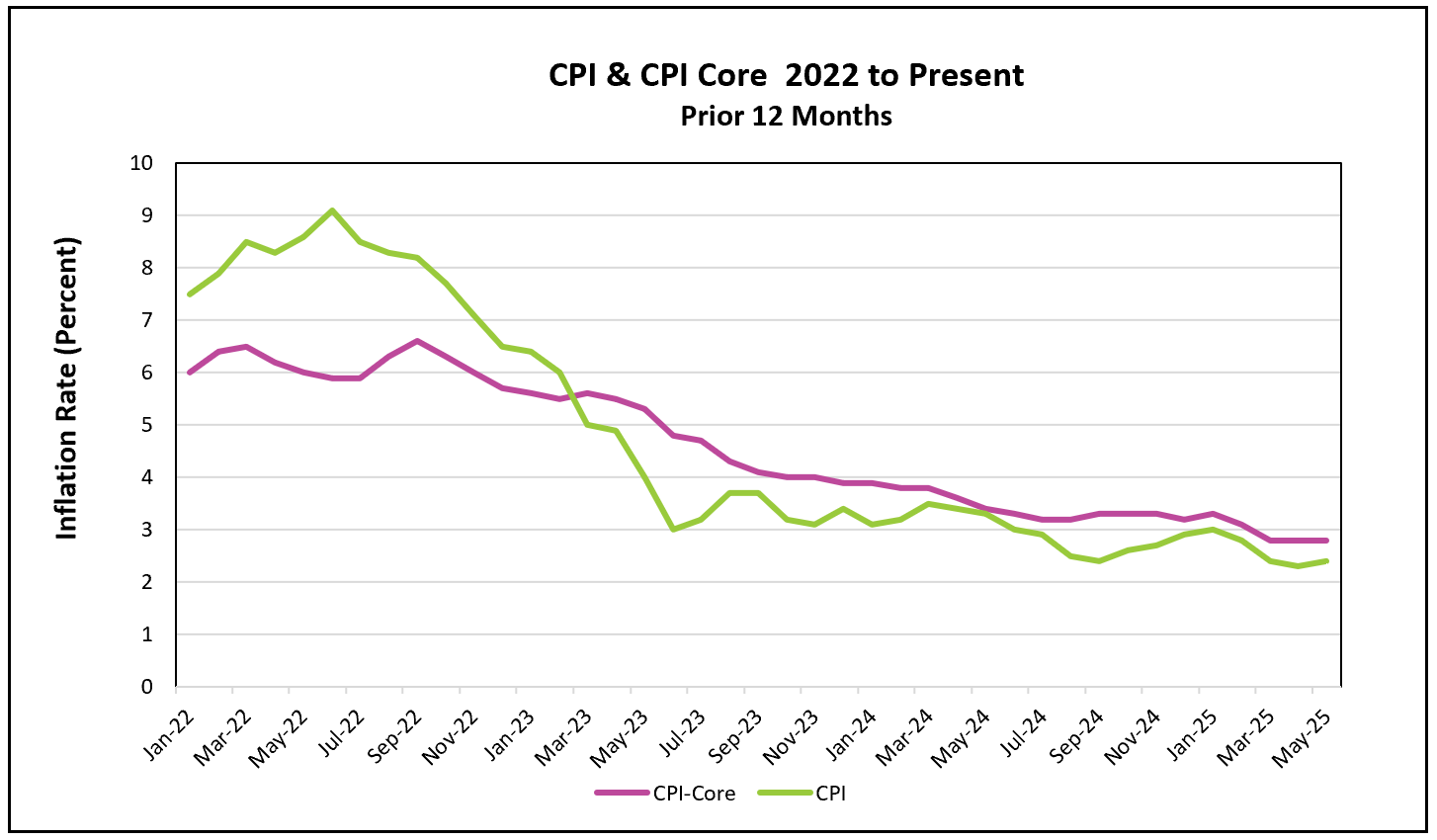

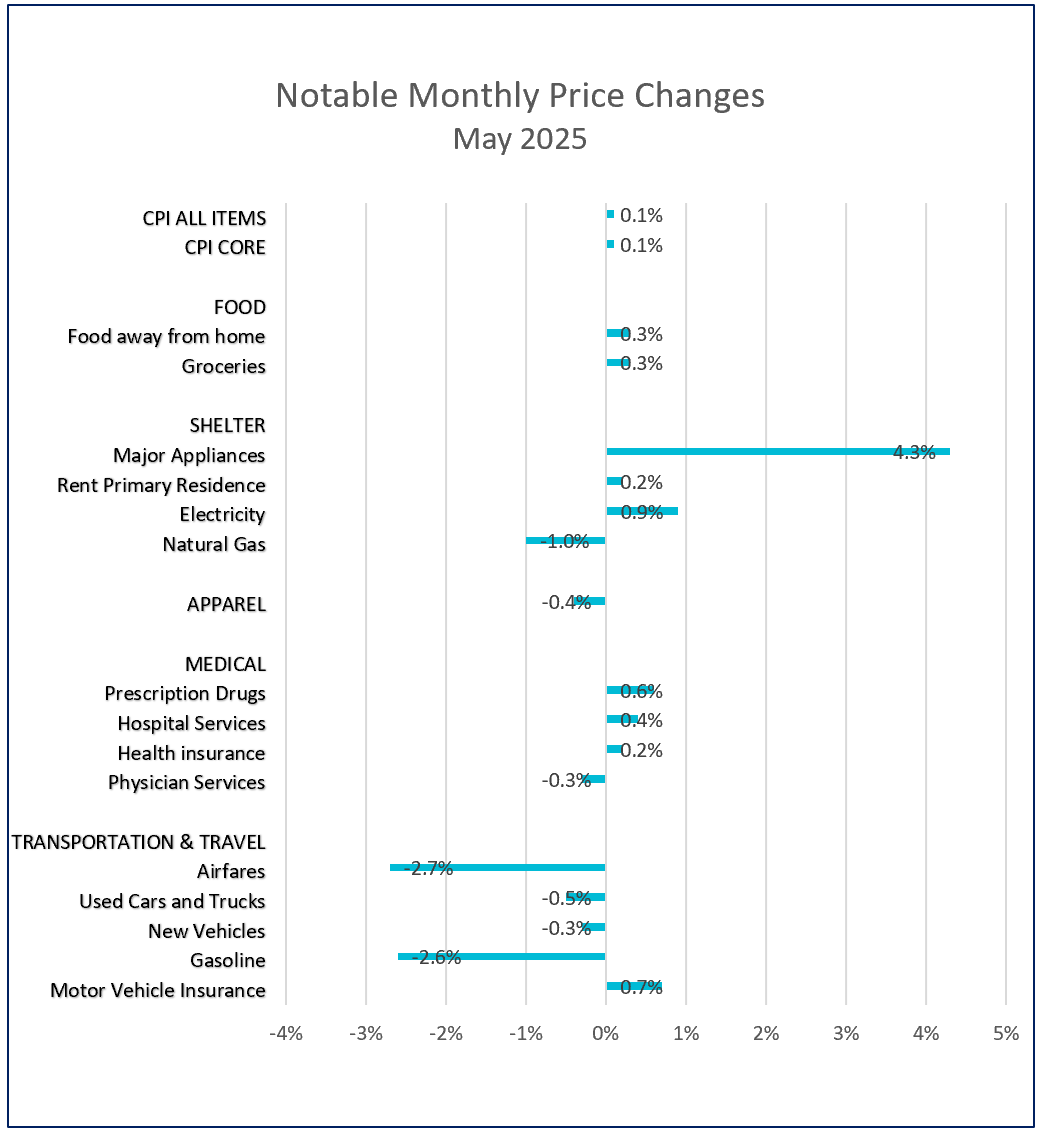

May’s inflation data brought a mixed message for policymakers and consumers. Headline inflation cooled slightly, with monthly price increases falling from 0.2% in April to 0.1% in May. Despite the moderation, the all-items 12-month inflation rate edged up due to the rising prices of groceries and some imported goods. These increases were partly counterbalanced by falling gasoline prices and a continued decline in shelter costs. Notably, the core CPI, which excludes volatile food and energy prices, rose 2.8% over the past year—unchanged for the third month in a row, suggesting underlying price pressures are stable but still elevated.

The breakdown shows that goods prices were flat while services rose 0.2%, reinforcing the view that inflation is being driven more by services than merchandise. Historically, shelter prices have been a major contributor to core inflation. After peaking at 8.2% in March 2021, the shelter index has eased steadily to 3.9%, reaching its lowest level since November 2021. Gasoline prices, which surged in late 2024 and drove up inflation during that period, have since reversed course, helping to cool the all-inclusive inflation figure in early 2025.

Despite the new tariffs, there is little indication that they influenced May’s inflation. Some tariff-sensitive goods such as appliances, car parts, bananas, and toys did experience price increases, but other sectors impacted by tariffs—like apparel, furniture, and new vehicles—saw prices fall. This inconsistency suggests businesses may still be shielding consumers from higher costs, possibly by drawing on pre-tariff inventories or out of fear that price hikes would alienate consumers already wary about the economy. A weaker demand has helped offset upward pressure. Economists caution against concluding the tariffs will have a minimal impact and predict prices will increase later in the year after the most severe tariffs are imposed.

Real wages have risen 1.4% year-over-year, giving consumers more spending power. However, as companies begin to feel the margin pressure from tariffs and other cost increases, economists expect more widespread price hikes in the months ahead. The restrained price movements in May reflect temporary cushioning. If companies begin passing on costs more aggressively, inflation could reaccelerate—especially if the labor market remains strong and the economy avoids a demand-driven slowdown.

Policymakers at the Federal Reserve remain in a delicate position. Inflation continues to exceed the Fed’s 2% target, limiting the likelihood of a rate cut when it meets next week. President Trump has been vocal in pushing for lower rates, but the Fed is expected to hold firm due to inflation concerns, a resilient labor market, and the uncertainty surrounding Trump’s trade policies. While potentially encouraging, the President’s newly announced trade deal with China lacks details and has yet to be evaluated for its economic impact. Should inflation continue to ease and the labor market show signs of softening, the Fed could find itself in a more favorable position to begin cutting rates later this year. For now, however, the central bank’s priority is ensuring that inflation expectations remain anchored and that tariff-related pressures don’t spiral into a broader inflation problem.

The Bureau of Economic Analysis (BEA) will release Personal Income and Outlays – May 2025 on June 27, offering additional insight into inflation and the economy’s aggregate demand. The report includes the Federal Reserve’s preferred measure of inflation, along with data on spending across all major sectors of the economy. HRE will publish a summary and analysis shortly after the report is released.