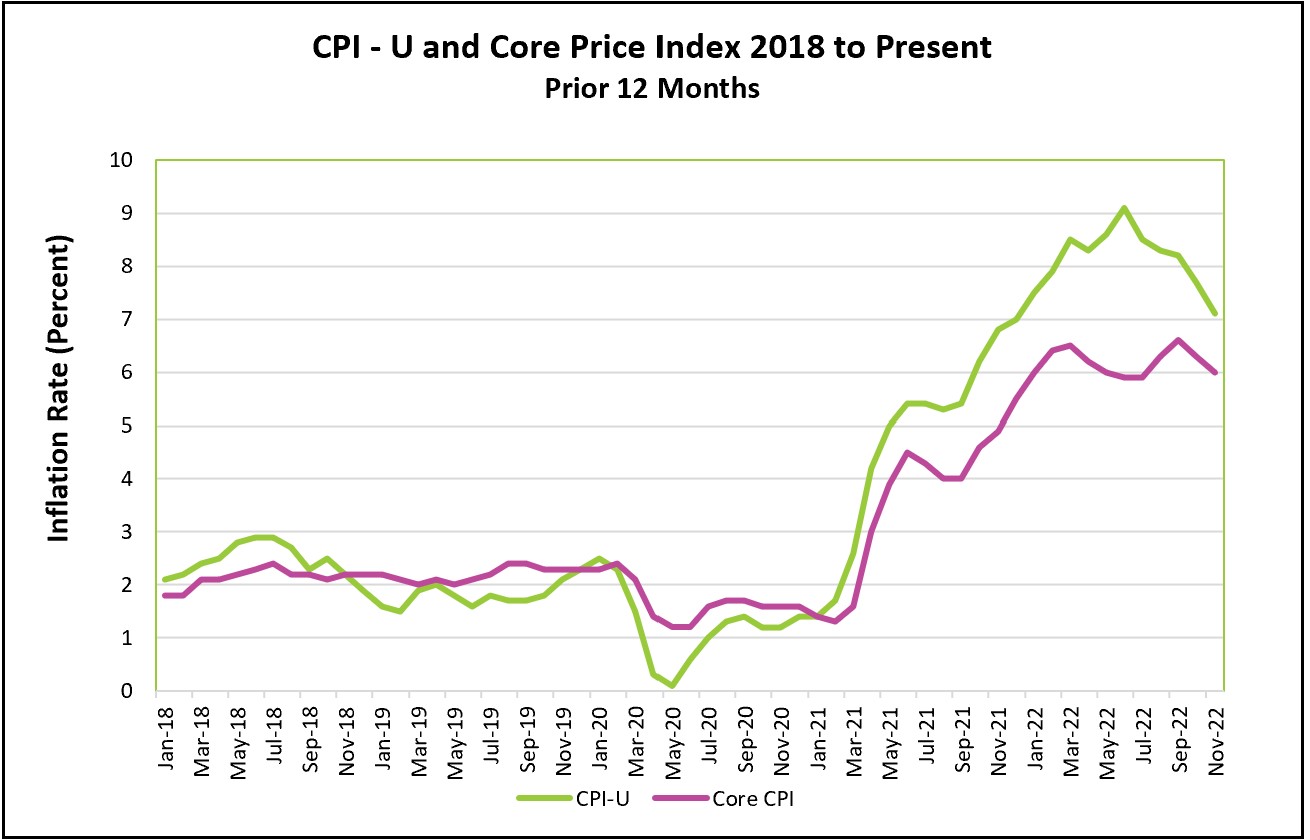

Disinflation prevailed in November. The consumer price index (CPI) decreased for the fifth consecutive month, falling from 9.1% in June to 7.1%, its lowest 12-month reading since December 2021. Wall Street celebrated, with the S&P 500 gaining 2% shortly after the news was released. Investors hope the Federal Reserve will slow its aggressive rate hikes. Is this the trend the Fed has been waiting for? You bet it is! Many of the underlying drivers of inflation have receded. Still, much work is needed – inflation remains much too high.

The highlights and analysis of Thursday’s Bureau of Labor Statistics press release are summarized below. You can access the full report at Consumer Price Index – November 2022.

Optimism prevails because November continued a string of months with broad-based disinflation. Price decreases were widespread and included used cars, transportation services, airline fares, and medical care. Those goods with smaller increases included necessities such as food (up 0.5%) and shelter (up 0.6%). However, inflation in these items remains more than the overall average (0.1%), which adds hardship to families on tight budgets who spend a larger proportion of their income on these necessities.

Prices began to surge in the latter half of 2020 as government stimulus checks increased the demand for goods that producers could not produce fast enough. Supply disruptions caused by the war in Ukraine, delays in securing resources and parts, transportation delays, and labor shortages contributed to shortages and higher costs. Suppliers increased their prices to cope with the higher costs and slow the increase in the quantity demanded for the goods they offered. Many of these hurdles have since been lowered, and goods are more readily available. Meanwhile, the pent-up demand for services such as travel and dining out exploded as people isolated themselves. Most of the pent-up demand has dissipated since the COVID threat has diminished, returning the demand for the services to normal levels. Inflation itself has contributed to a drop in demand as households contend with stretched budgets. Higher interest rates have slowed sales in interest-sensitive markets such as real estate, where sales have fallen because higher mortgage rates have increased the cost of home ownership. Higher rates will eventually impact car sales and business expansions.

Most analysts expect the Fed’s policymakers to increase their benchmark rate by 0.5% to between 4.25 and 4.5%, the highest since 2007 when they meet this week. The increase will follow the 0.75% increases implemented at their last four meetings. Chairman Powell will likely caution that there is a long way to go before reaching an acceptable inflation rate. Labor costs remain a concern and will continue to be as long as the labor market remains tight. Earlier this month, the BLS reported that wages increased by 0.6% in November. (The Employment Situation - November 2022) Meanwhile, there were more jobs than available workers, adding pressure on wages. Higher labor costs fuel inflation. First, they increase the cost of providing a good or service. Businesses may increase prices to maintain their profit margins, especially in labor-intensive service industries. Second, higher wages increase the economy’s aggregate demand by providing additional income.

Shelter costs are a concern because they were the most significant contributor to the increase in the CPI’s monthly all items index. Shelter prices make up approximately one-third of the index. The index fell slightly from 0.8% to 0.6%. However, rental increases remain stubbornly high. The category “rent of the primary residence” increased by 0.8% in November. It was one of the few items that increased more in November than October. Fortunately, many economists believe this overstates November’s increase because the index accounts for new and existing leases, and there is evidence that new leases are coming down in many areas. Economists monitor the shelter index because it is the largest component of the CPI and less volatile than gasoline prices.

Soon the debate will switch to whether the Federal Reserve is tightening too much. The full impact of the rate increases usually takes a year to filter throughout the economy. Some industries, such as real estate, are almost immediately affected. However, price stabilization takes more time in most industries where a sequence of events is needed. For example, it may take several quarters for business investment to fall, which would slow employment and diminish wage increases, reducing the demand for that industry’s good or service. So much of today’s tightening will be reflected in next year’s economy. Tightening too much too soon could throw the economy into a recession.

Are we closer to a recession? The BEA’s Personal Income and Outlays – November 2022 report will help answer this question by providing detailed data about income and consumer spending. Check back with HigherRockEducation.org shortly after its release on December 23rd for our summary and analysis.

However, it is the Holiday Season, so let us celebrate the good news. This report suggests that inflation is subsiding, which is good news indeed.

Happy Holidays

For a little humor, watch our video