Tuesday’s inflation report confirmed a continued cooling of inflation, albeit with a few bumps along the way. Price increases remained moderate, providing support for the Federal Reserve’s likely decision at this week’s meeting to maintain its pause on raising interest rates. The central bank appears poised to wait until next year before considering a reduction in its benchmark rate.

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – November 2023, are summarized below.

Inflation rose moderately in November, but the overarching trend remains downward. Let’s consider November’s figure as a mere “bump” on the journey toward lower prices. The consumer price index showed no change in October and only a 0.1% increase in November. This rise proved insufficient to impact the 12-month reading, which decreased from 3.2% to 3.1% during November. The decline in gasoline prices countered increases in shelter costs. However, there is a prevailing belief among most economists that shelter inflation is overstated and will continue to decelerate in the upcoming months. The index incorporates rental figures for all homes, not exclusively new leases, and the rental market has recently softened.

The prices of many goods, particularly large items that are financed, have fallen. Early in the pandemic, the cost of many goods surged due to widespread shortages because supply chain challenges limited production. However, suppliers have overcome most of the challenges. Meanwhile, higher rates have slowed the growth in demand and contributed to a 0.5% drop in the prices of many durable goods since last year.

The demand for most services is less responsive to a rate increase than for durable goods. Many service businesses lost a significant portion of their workforce during the pandemic, leading business owners to raise wages to attract replacements. Consequently, many of these business owners increased their prices to maintain their profit margins, and they found that their customer base was willing to pay the higher prices. As a result, service prices have been slower to decelerate than the price of goods. In November, they increased 0.5%. Policymakers at the Federal Reserve would like to see service prices decelerate further.

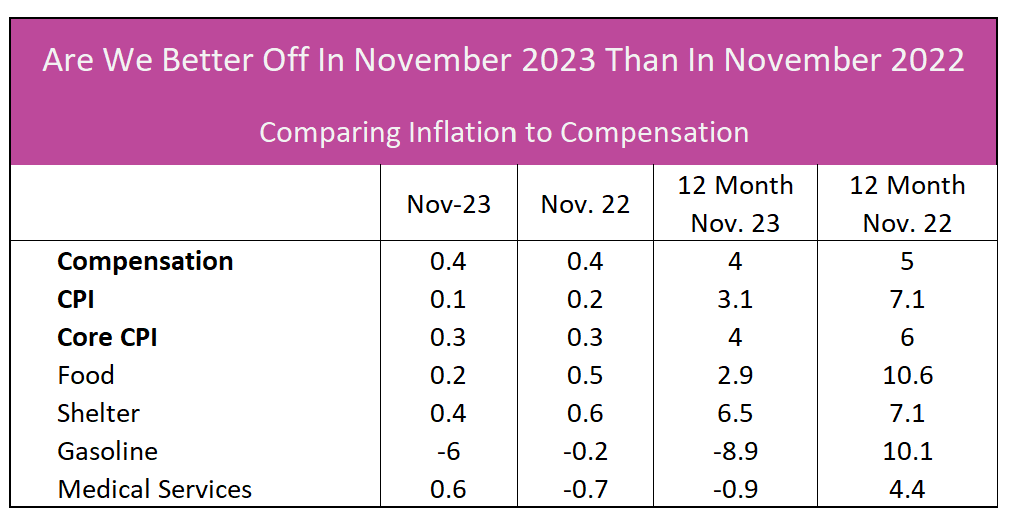

So, are most Americans financially better off now than a year ago? Last November, essential expenses such as food, shelter, and medical care increased at a faster clip than inflation. However, the average American retained more of their paycheck this November because weekly compensation outpaced the inflation rate. In addition, food and medical care costs rose less than inflation, while gasoline prices fell. Only the cost of housing increased more than wages, although the spread between the inflation rate and housing inflation was narrower than last November. So, yes, most Americans are indeed better off than they were a year ago. The table below compares growth in compensation to the CPI and price changes in these essential items.

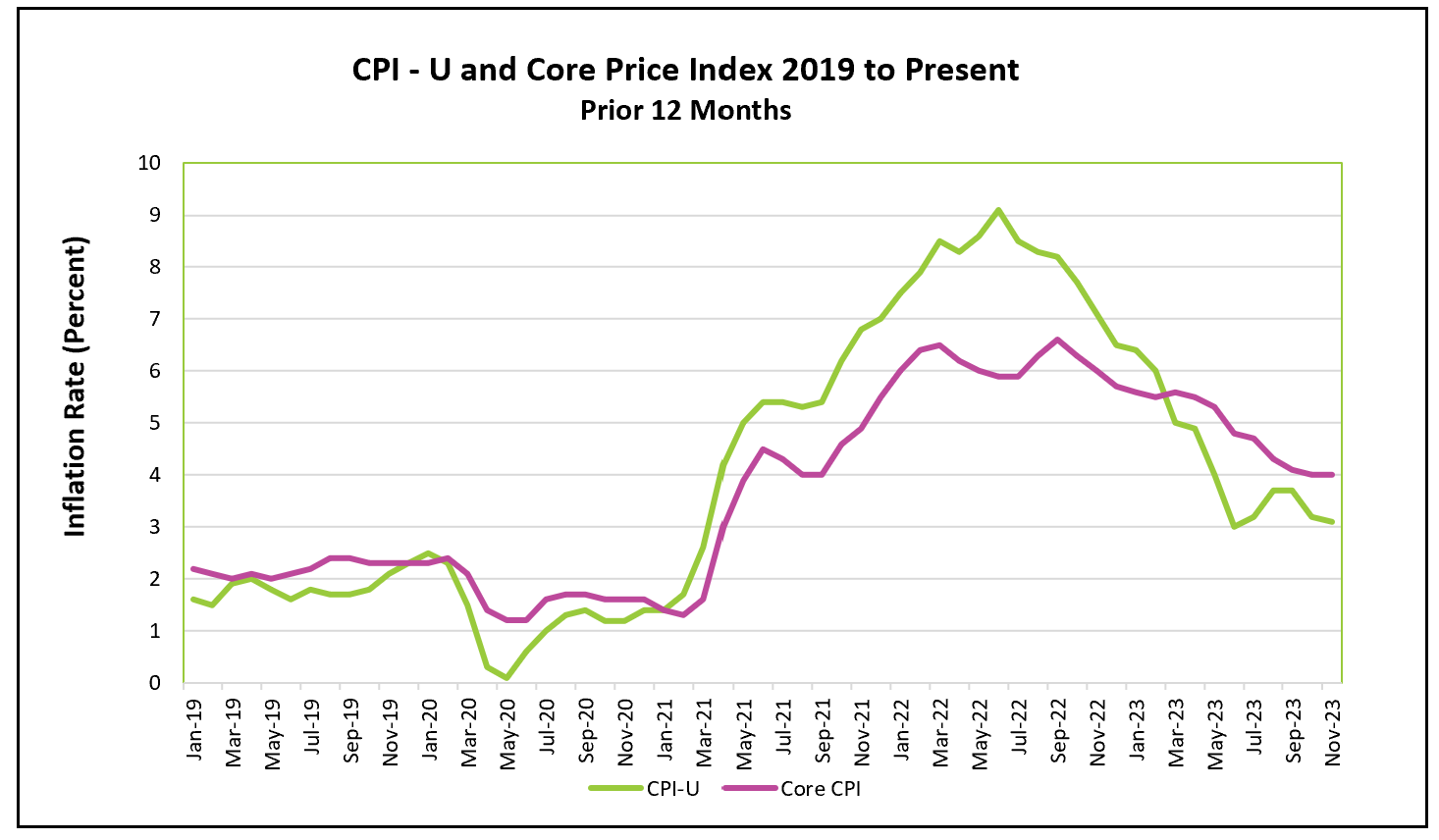

Policymakers at the Federal Reserve will conclude their last meeting in 2023 this afternoon. It would shock the financial community if they deviated from their current stance and did not continue their pause of rate hikes. Various reports, including this one, affirm that their strategy is working. Inflation, which reached a high of 9% in June 2022, has significantly decreased and is showing a downward trend. The three-month rolling average of the 12-month core rate has consistently dropped each month in 2023. Economists favor the core rate as it excludes volatile food and energy prices. Taming inflation will continue to be bumpy, so economists use a rolling average to smooth out the bumps and identify trends. However, despite positive developments, inflation still exceeds the Fed’s 2% target, making a rate cut unlikely before the end of the first quarter of 2024.

The resilience of consumer spending and the growth of disposable income have bolstered the economy’s aggregate demand, confounding the Fed’s policymakers. On December 22nd, the Bureau of Economic Analysis will release November’s Personal Income and Outlays report, offering new data on consumer spending and disposable income, along with the PCE price index—the inflation measure favored by policymakers at the Federal Reserve. For a concise summary and analysis of this release, visit HigherRockEducation.org shortly after its publication.