October’s all-inclusive inflation rate was flat, while the core rate fell significantly, probably negating any chance policymakers will raise their benchmark rate at their December meeting. Disinflation was broad-based.

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – October 2023, are summarized below.

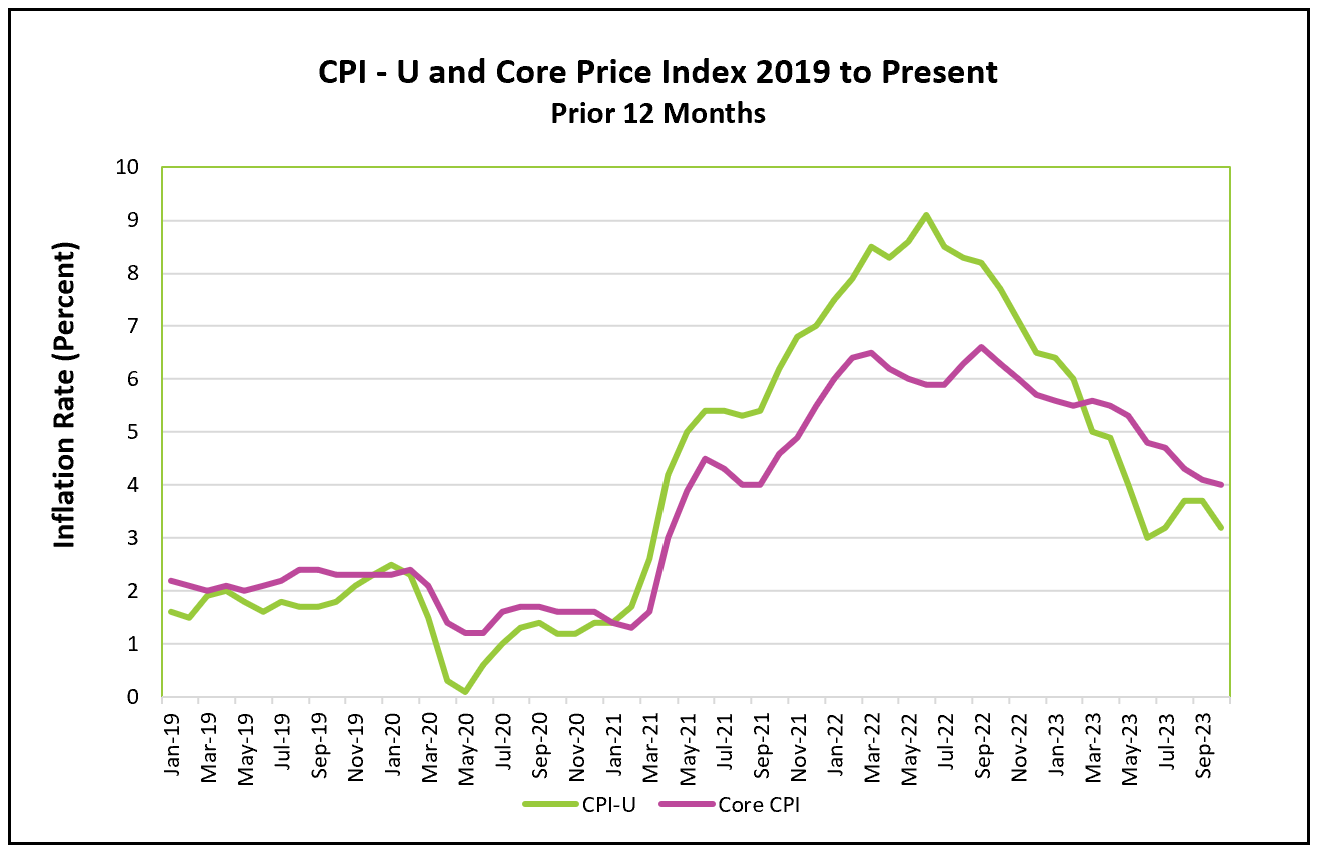

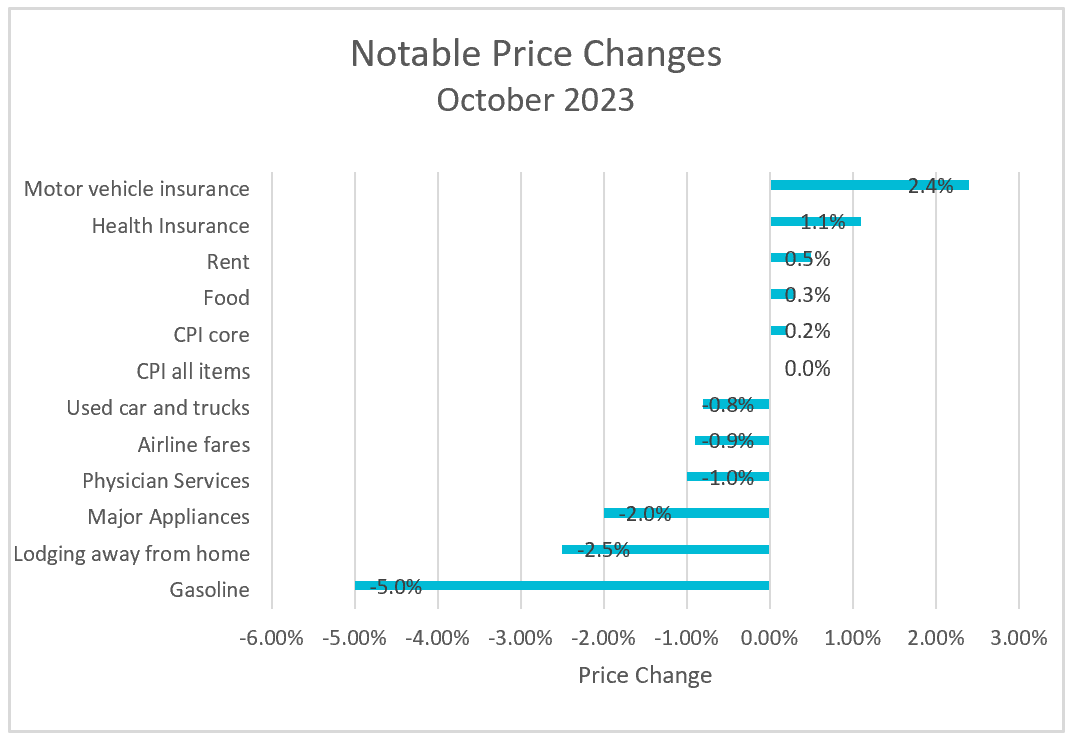

Optimism abounds as inflation continues to decelerate. The consumer price index was virtually unchanged in October and rose only 3.2% when measured over the prior year. It marked the first time the price index has stayed the same for consecutive months since July 2022. October’s drop was mainly because gasoline prices fell 5%. But the core index decelerated to 0.2% from September’s 0.3%. Economists consider the core index a more reliable gauge of trends since it excludes volatile food and energy prices. The twelve-month CPI indexes also fell. The all-inclusive index fell from 3.7% to 3.2%, while the core index reached 4.0%, its lowest reading since September 2021. Still, inflation remains above the Federal Reserve’s 2% target.

Disinflation was broad-based, indicating that the easing of inflation is sustainable. Used car and truck prices fell 0.8%, while physician services decreased 1.0%. People paid approximately 2% less for new appliances. Travel was less expensive because, in addition to gas prices, people paid 0.9% less for airfares and 2.5% less for a hotel room.

Notable price increases included health insurance, motor vehicle insurance, shelter, food, and hospital visits. A change in the Bureau of Labor’s methodology in calculating the health insurance index contributed to the significant increase in the health insurance index, so the implied 1.1% cost increase is likely overstated. As new and used vehicle prices have increased, so has the cost to insure them. However, vehicle prices have decelerated, making it likely vehicle insurance will follow.

The rent index rose at an annual rate of 8.8% in April. Since then, rent has decelerated to 7.2%. Many economists believe the rent index is overstated when rents fall since it includes all rental homes rather than just new leases. Private surveys by Zillow and others have concluded that the rental market has softened, which has slowed the rise in the cost of renting a home. Furthermore, most economists anticipate downward pressure on rent because a surge in apartment construction has created a surplus of rental units.

Owners’ equivalent rent evaluates the amount a homeowner would pay to rent a comparable home. It, like rent, has decelerated recently partly because higher mortgage rates have slowed the sale of homes. Economists expect that trend to continue.

Food inflation increased from 0.2% to 0.3% between September and October. However, the pace over the prior 12 months slowed to 3.3%.

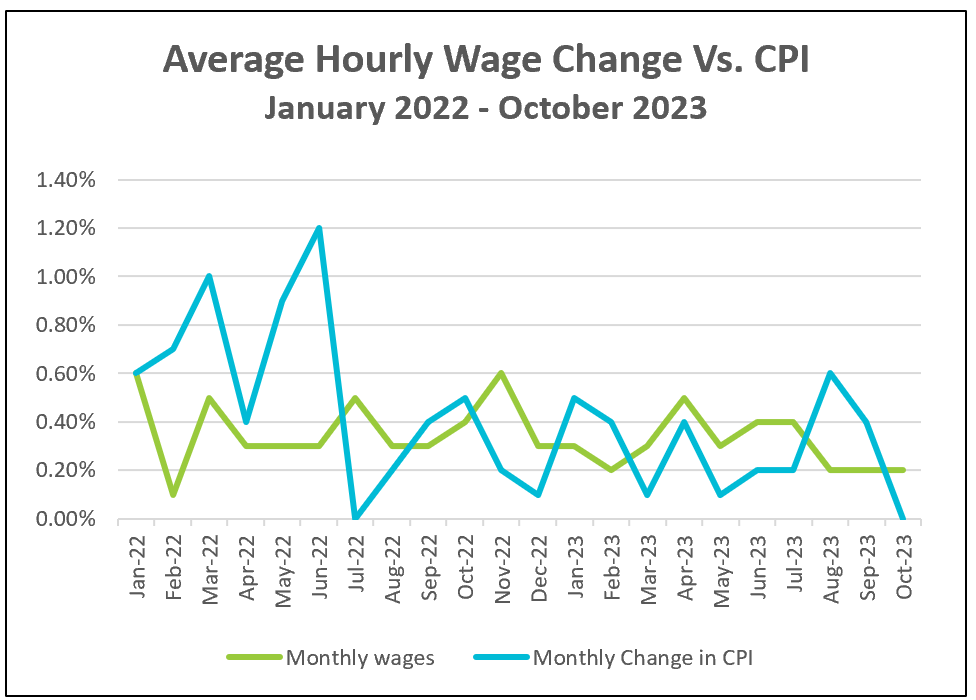

Is the average working American better off at the end of October? Inflation-adjusted hourly wages rose 0.2% in October for the first month since August 2023. Generally, that results in an increase in disposable income, but the average weekly earnings fell following a slight drop in the number of hours worked.

Policymakers at the Federal Reserve will be encouraged by the disinflation. Inflation has fallen considerably since it peaked at over 9% in June of last year. Policymakers raised their benchmark rate from near zero to a target of 5.25 to 5.5% in eleven consecutive rate increases. Their objective was to return inflation to their 2% target by slowing the growth of consumer and business demand. Higher costs caused by supply chain challenges during the pandemic pushed prices up in 2022. The price level dropped as companies successfully addressed their challenges. However, an elevated consumer demand remained, and inflation seemed stuck in the 3.5 – 4% range. But, this report and the employment report provide evidence that disinflation is broad-based. It reduces the chances of another rate hike and likely eliminates the possibility of them increasing rates at their December meeting. However, Fed officials will quickly point out that this is one report, and the core rate remains significantly above its 2% target.

The resilience of consumer spending and the growth of disposable income have supported the economy’s aggregate demand and confounded the Fed’s policymakers. On November 27th, the Bureau of Economic Analysis will release October’s Personal Income and Outlays report, which will report on consumer spending and disposable income and provide the PCE price index, the inflation measure favored by policymakers at the Federal Reserve. For a summary and analysis of this release, visit HigherRockEducation.org shortly after its publication.