The consumer price index (CPI) fell slightly. However, the core price index rose to a 40-year high, revealing that inflation is entrenched and will be more challenging to tame. Policymakers at the Federal Reserve are likely to increase its benchmark rate substantially for the fifth straight meeting. Their action will increase the risk of propelling the US and world economies into recessions.

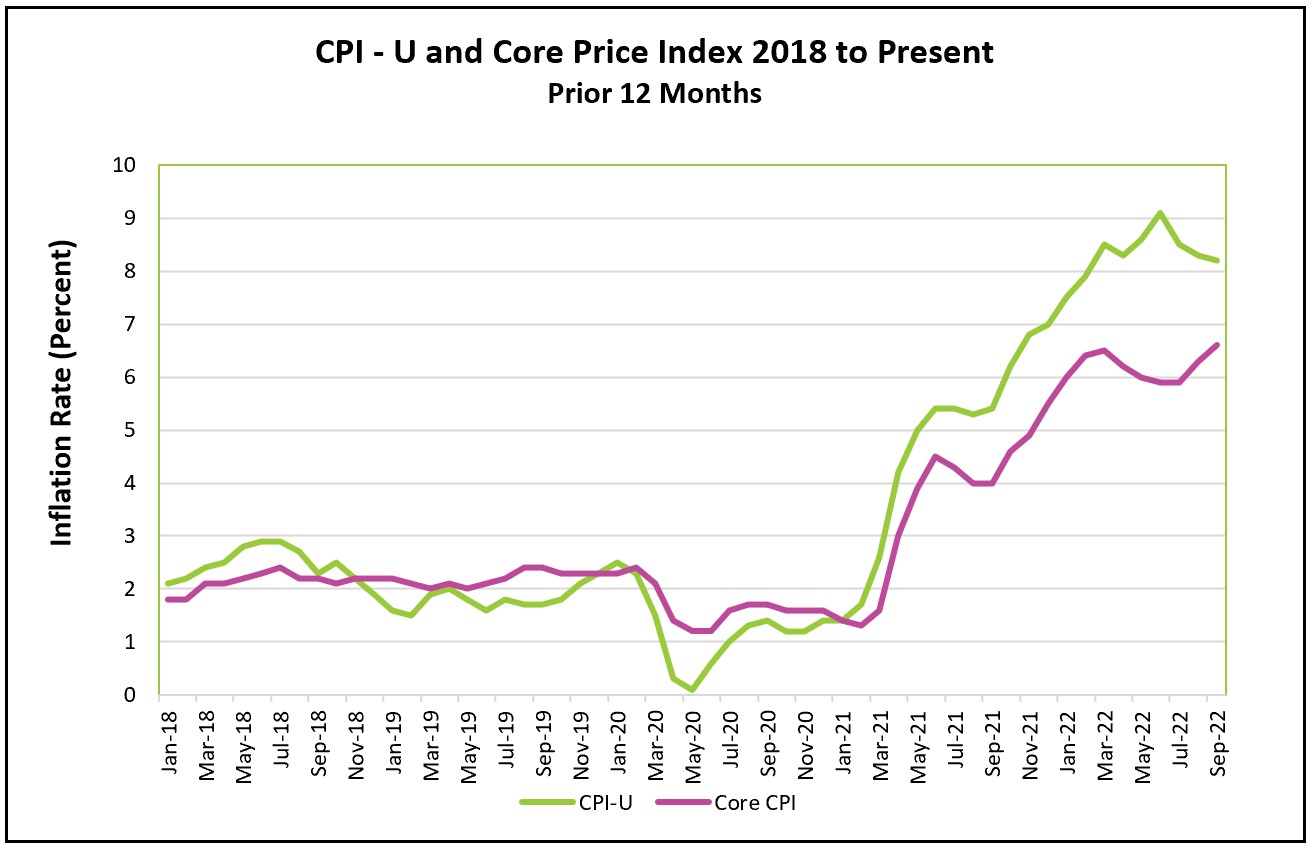

Before the pandemic, inflation was just shy of 2%. Today, it exceeds 8%, well above the Federal Reserve’s target of 2%. The highlights of today’s Bureau of Labor Statistics press release are summarized below. You can access the full report at Consumer Price Index - September 2022.

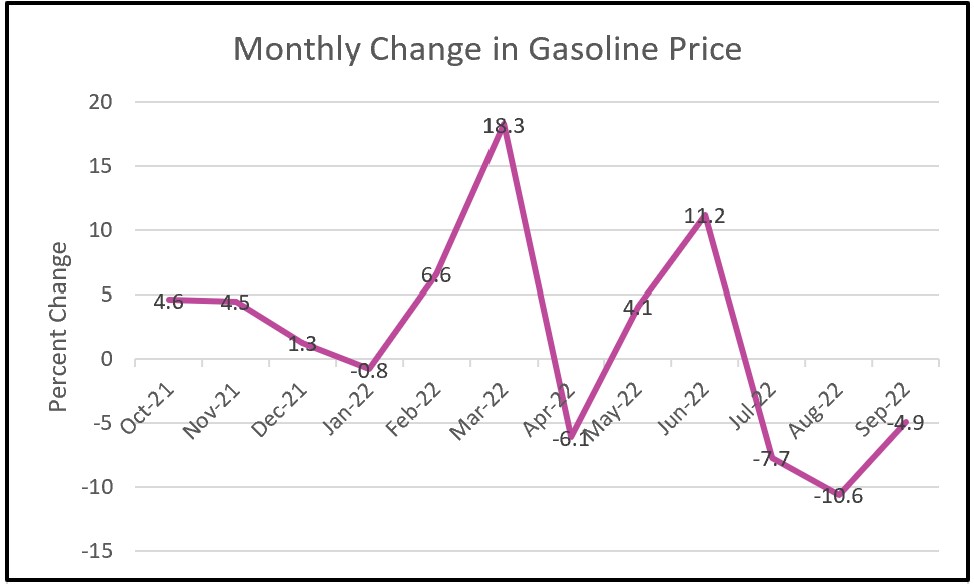

The 12-month consumer price index fell for four consecutive months. Inflation peaked at 9.1% in June and decreased from 8.2% because gasoline prices have trended lower since their summer peak in July. September’s inflation would have increased if gasoline prices were not considered. During the same four months, the core index increased from 5.9% to 6.6%, a forty-year high. Unfortunately, the monthly figures paint an even uglier picture, with core prices rising from 0.3% in July to 0.6% in September. Economists and the Federal Reserve prefer the core index when evaluating trends because the index strips out volatile food and energy prices. The graph below illustrates the recent decline and how volatile gasoline prices have been since August 2021. However, gasoline prices have recently increased (AAA) since OPEC and Russia announced they were cutting production.

Rising rents and the price of services indicate that inflation will be hard to tame. Rents are 7.2% higher than a year ago, marking the largest yearly increase since 1982. The shelter index comprises one-third of the CPI, and rising rents are slow to decrease, suggesting higher shelter prices will influence the CPI for many months.

Not counting energy prices, service prices have risen the most since 1990. Service prices have likely been pushed higher by rising wages. A tight labor market has forced employers to increase wages to attract and retain workers. Policymakers are concerned that higher wages will prolong unacceptable inflation by initiating a wage-price spiral, where employers increase their prices to offset their higher labor costs. Workers, in turn, demand higher wages following each round of price increases.

The Bureau of Labor Statistics reported that wages rose 0.3% in September and 5.0% during the prior year. Both measures are significantly below the cost of living, which reduces a family’s buying power. Real wages (wages after adjusting for inflation) have fallen every month since April 2021. Nevertheless, consumers continue to spend. According to the BEA’s latest Personal Income and Outlay’s report, consumer spending increased by 0.4% in August. Many households are dipping into their savings or increasing their credit card debt.

Escalating food prices continue to outpace inflation. They rose 0.8% in September and 11.2% during the prior 12 months. Lower-income households are hit hardest by rising food prices because they spend a larger portion of their disposable income on food than middle-income households. Many economists expect food prices to continue to outpace inflation. The Russia-Ukraine war has elevated the cost of fertilizer and gasoline. Severe weather in the west and southeast has hampered crop yields.

The Federal Reserve, Open Market Committee, has little choice but to significantly increase its benchmark rate when they meet next week because of the high core rate, a strong labor market, and continued consumer spending. The increase would be the fourth straight large increase and the sixth since the beginning of the year. Their objective is to slow the economy by increasing the cost of borrowing. Home sales have suffered because mortgage rates have climbed to their highest level in two decades.

A rapid increase in rates risks pushing the economy into a recession. Such actions usually take several months to manifest themselves in an economy. Furthermore, rate increases are much less effective when dealing with inflation caused by supply constraints such as chip and labor shortages. Economists refer to this as the lag effect.

Social Security recipients are getting a pay raise. The Social Security Administration announced an 8.7% increase in monthly benefits – the most in forty years. Beginning in January 2023, approximately 70 million people will benefit from an average $140 increase in monthly income. The income increase will increase recipients’ buying power and contribute to inflation.

American consumers have shown remarkable resilience to higher prices. They have continued to spend. However, the current trend is unsustainable if real wages continue to be negative. Ultimately untamed inflation causes a recession. When inflation limits buying power, consumers eventually cut back, increasing inventories, reducing production, and bringing down prices. The BEA’s Personal Income and Outlays – September 2022 report will detail income and consumer spending. Check back with HigherRockEducation.org shortly after its release on October 28th for our summary and analysis.