The inflation figures from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index (CPI) – September 2025.

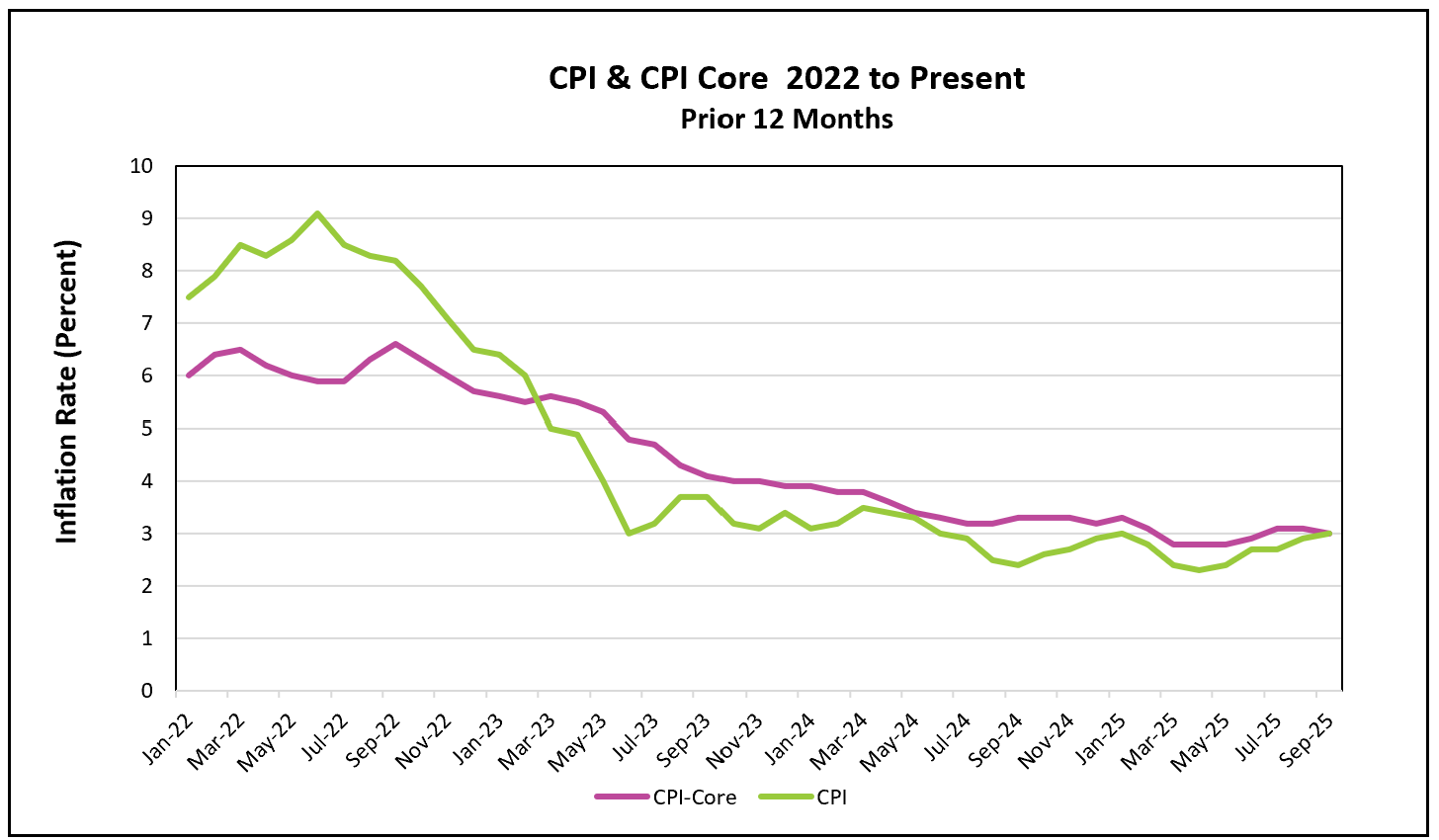

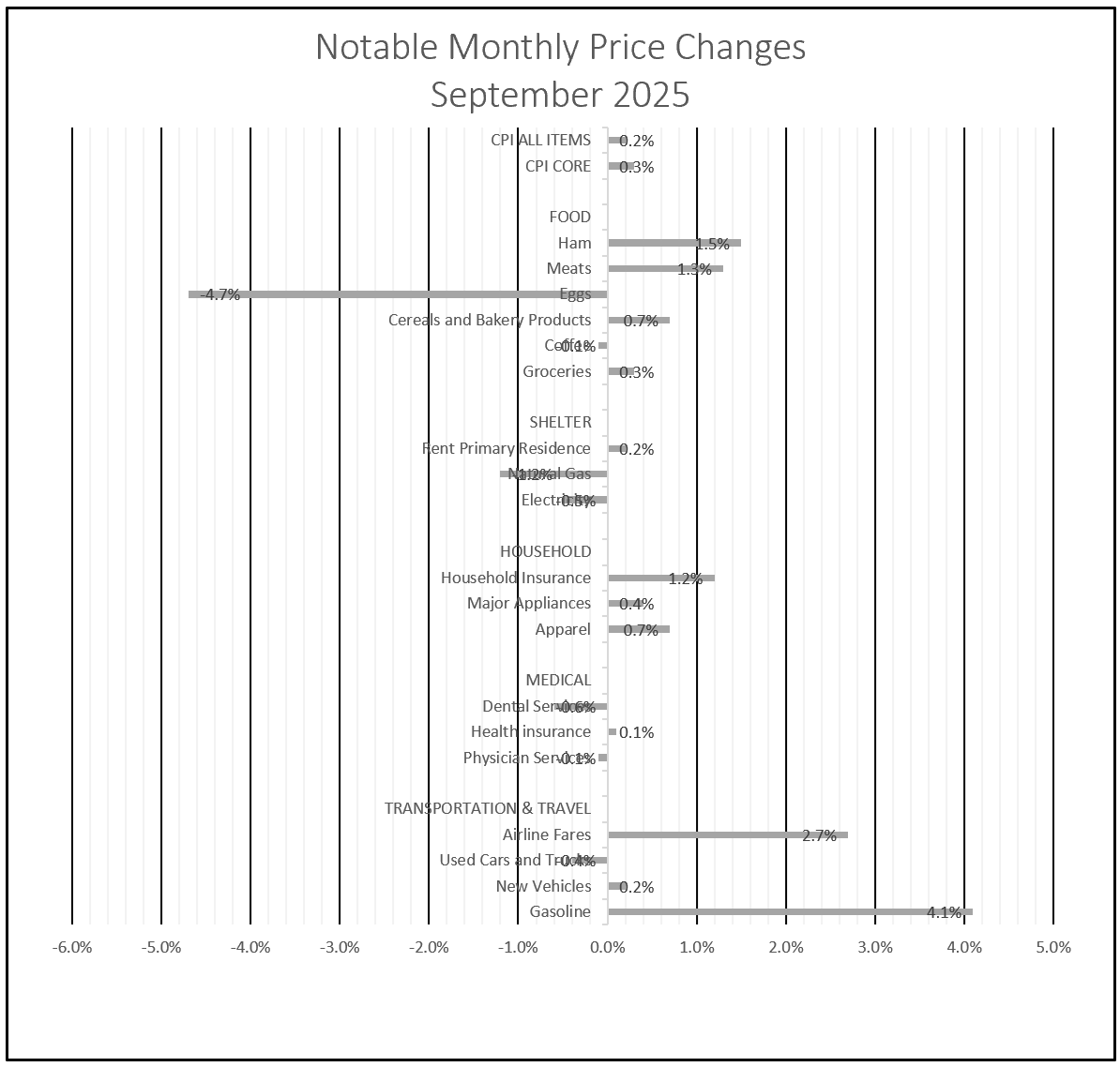

The all-inclusive consumer price index increased 3.0%, the most since January, primarily due to rising gasoline prices. However, other inflation indexes provided more encouraging news. The monthly CPI and the core CPI both declined slightly. While inflation is still above the Federal Reserve’s 2% target, the overall slowdown suggests that the trend may be stabilizing.

The recent government shutdown delayed the release of September’s inflation report. The report, originally due October 15, was published after the government recalled many furloughed workers to provide data needed by the Social Security Administration to calculate the 2026 cost-of-living adjustment, which will increase benefits by 2.8%.

The softening in inflation data strengthens the case for the Federal Reserve to continue lowering its benchmark interest rate when it meets on Tuesday. Most economists anticipate another rate cut in December, as the Fed increasingly prioritizes concerns about a weakening labor market over lingering inflationary pressures. The central bank’s challenge remains balancing its dual mandate—keeping inflation under control while supporting employment. Policymakers are seeking a rate level that encourages steady growth without reigniting price surges. The Fed will also rely heavily on September’s data in December, if, as predicted by the White House, the October inflation report is not released.

However, other key government data, including the monthly employment summary, remains unavailable. These reports are crucial for policymakers at the Fed and businesses to evaluate the health of the labor market and the broader economy.

Typically, September payrolls rise as schools rehire teachers and support staff for the new academic year, and as retailers and manufacturers prepare for the holiday season. While most economists believe payrolls increased in September, they believe the gain was far smaller than the 240,000 jobs added in September 2024. Private-sector data from ADP supports that view, showing a surprising loss of 32,000 jobs in September. Most economists believe unemployment remained essentially unchanged, as fewer people found jobs, but some dropped out of the labor force entirely. Declining immigration and increased deportations have reduced the labor supply, contributing to both wage pressures and higher costs in service industries that rely heavily on immigrant workers. For instance, in September, the cost of lawn care services rose 13.9% over the past year, while home care for the elderly and infirm increased 11.6%. At the same time, lower immigration has reduced housing demand and eased pressure on shelter costs.

Policymakers are also increasingly worried about widening income disparities. While average wages have generally kept pace with inflation, lower-income workers are falling behind. According to the Atlanta Federal Reserve, these workers are struggling to meet basic expenses. Fortunately, price gains for many necessities slowed in September. Grocery prices rose just 0.2%, down from 0.5% in August. Beef prices, however, surged 1.2% for the month and are up nearly 15% from a year earlier. Consumers benefited from a 4.7% decline in egg prices after earlier spikes, while rental increases moderated, and the cost of electricity fell. The index for owners’ equivalent rent increased only 0.1%, its smallest monthly gain since early 2021.

Finally, tariffs continued to influence prices, though their impact was less pronounced than many economists had feared. President Trump reduced some tariffs after trade negotiations, but uncertainty remains. Many companies have so far absorbed higher import costs rather than passing them to consumers, though that may change if tariffs persist. In some sectors, such as household furnishings and apparel, prices rose as businesses passed some of the import duty to their customers.

Higher Rock Education will continue to monitor the U.S. economy and will resume its summaries and analyses once the federal government resumes releasing its reports.