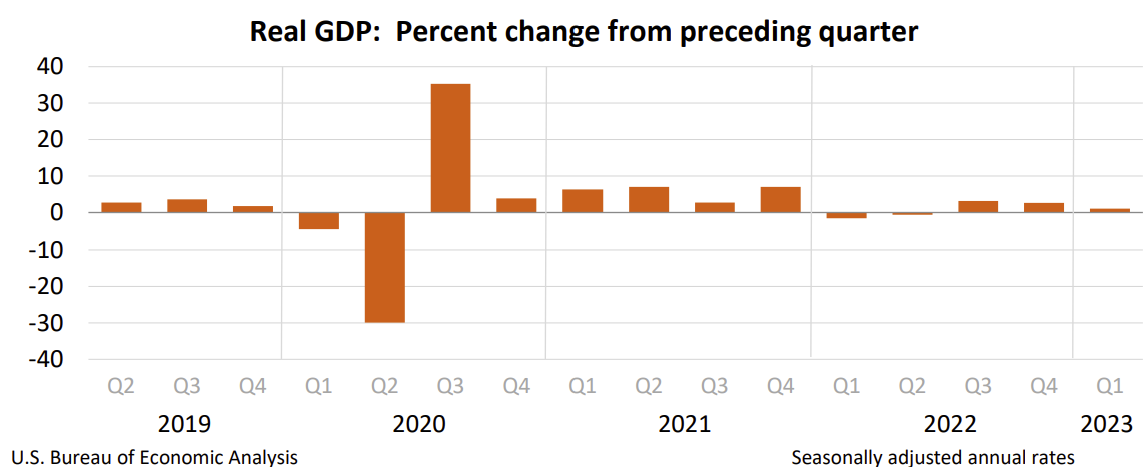

Real gross domestic product (RGDP) increased at an annual rate of 1.5% after rising 2.5% in the last quarter of 2022. The increase in consumer spending was the largest since the second quarter of 2021, while the fall in business investments was the greatest since the second quarter of 2022. The surge in consumer demand contributed to accelerating inflation in the first quarter after falling in the fourth quarter of last year. The 12-month PCE price index, the inflation index favored by policymakers at the Federal Reserve, rose 0.5% during the first quarter. However, the PCE price index remains 3.3% lower than a year ago. While inflation has subsided since last year, the Fed will likely raise its benchmark rate when it meets next week because inflation remains significantly above the Fed’s 2% target.

Access the Bureau of Economic Analysis’s news release and report at Gross Domestic Product, First Quarter 2023 (Advance Estimate). Here are the report’s highlights.

Policymakers at the Federal Reserve will likely be disappointed in the surge in consumer spending. An escalating aggregate demand has helped propel inflation to an unacceptable level. Policymakers have increased their benchmark rate nine times since March 2022 to ease demand. Businesses have cut investments, and higher interest rates have slowed the production of interest-sensitive investments such as homes. However, rising wages have provided the funds and the confidence to continue spending on many goods and services.

Consumer spending accounts for over two-thirds of economic activity. While it surged in the first quarter, most economists expect consumer spending to wane in the second and third quarters. An annual cost-of-living adjustment in Social Security drove disposable income and consumer spending significantly higher in January, only to slow substantially in February and March.

A strong labor market has contributed to higher wages, which have fueled the added spending. Americans will continue to spend if companies continue to hire and raise wages. But since January, increases in compensation have barely kept pace with inflation. Food and shelter were among the categories with the greatest price increases. The Consumer Confidence Board reported, “The Expectations Index has now remained below 80—the level associated with a recession within the next year—every month since February 2022, with the exception of a brief uptick in December 2022. A drop in consumer sentiment partially explains the increase in the savings rate because people tend to save more when they are concerned about their future.

Higher interest rates have contributed to eight straight quarters of lower residential production. The good news is that the decrease was only 4.2% in 2023’s first quarter, up from over 25% in the third and fourth quarters. Business managers are also less optimistic. They reduced inventories during the first quarter after a significant increase in the last quarter of 2022. Managers probably increased inventories at the end of last year fearing supply chain challenges would resurface. They did not feel the urgency since most supply chain constraints have improved since the beginning of the year. Higher interest rates also discouraged investing in equipment.

Most economists expect business investment to continue to slow in the second quarter. Data compiled in this release preceded the collapse of the Silicon Valley and Signature banks. The Wall Street Journal reported that the FDIC will likely seize First Republic Bank after losing over $100 billion in deposits in the aftermath of Silicon Valley Bank’s failure. The banking community’s response will influence economic growth in the second and third quarters. If banks retain more reserves and cut back on lending, the economy will slow. The hardest hit will be smaller companies that rely on banks for loans and do not have access to the capital markets.

Policymakers welcome a slower pace of growth as the Fed tries to rein in inflation. Recent trends have been promising. Consumer spending will likely continue decelerating, and business investment will remain low. But inflation increased to 4.2% in the first quarter and remains well above the Fed’s 2% target. Expect policymakers to raise their benchmark rate for the tenth time since March 2022 when they meet next week. A short recession is more likely – but necessary to lower the inflation rate.

The BEA’s report, Personal Income and Outlays - March 2023, was released earlier today. March’s income and spending were lower. Read Higher Rock’s summary and analysis of the report in Monday’s blog.