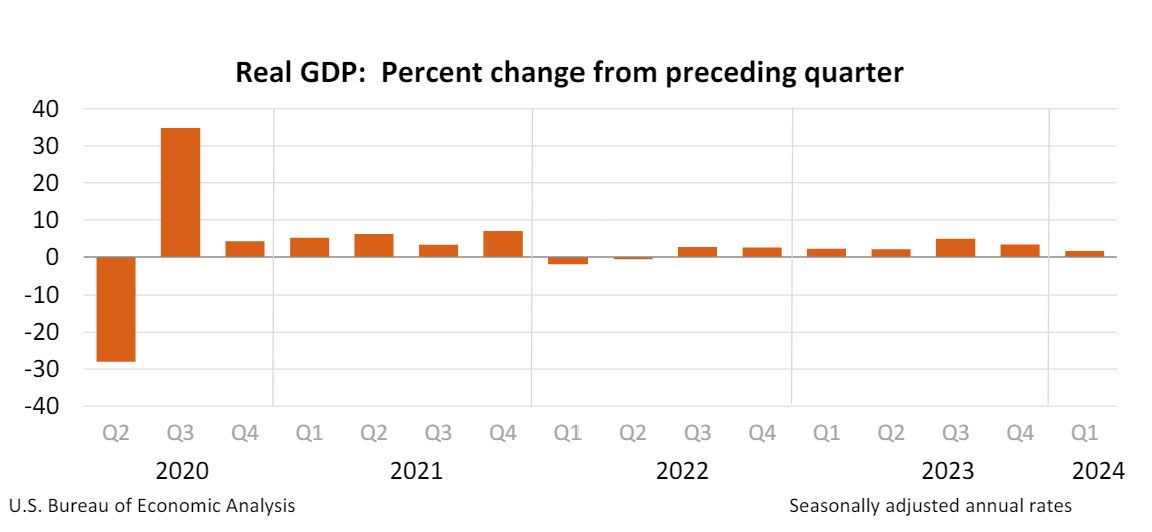

The Bureau of Economic Analysis’s news release Gross Domestic Product, First Quarter 2024 (Advance Estimate) highlights are summarized below.

The substantial drop in the economy’s growth might misleadingly indicate a cooling trend and a potential easing of inflationary pressures. However, consumers persist in spending at a heightened rate, and prices continue to escalate at an unacceptable pace. Without a significant surge in imports and a reduction in inventories, growth would have been nearly equal to last quarter’s performance.

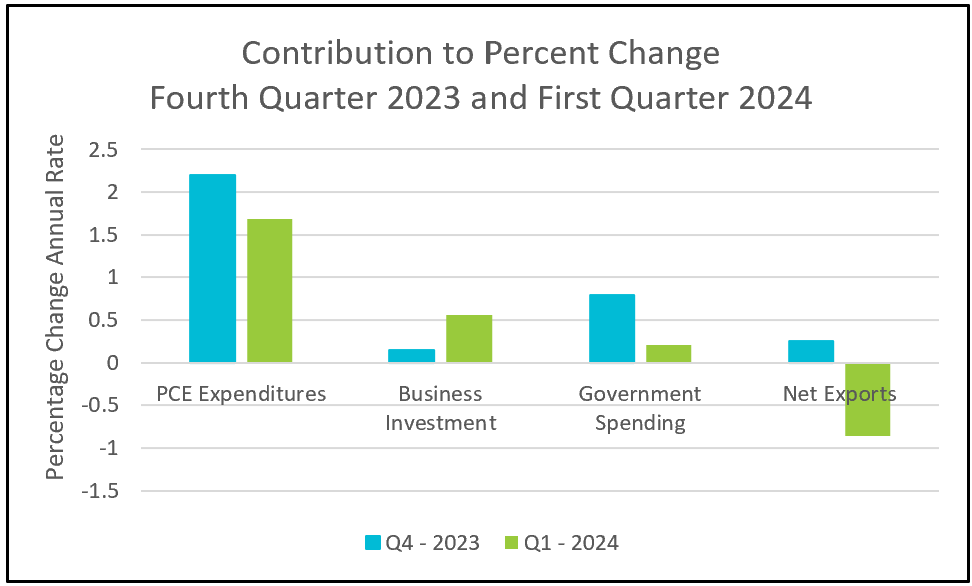

Spending patterns shifted from goods to services during the first quarter. While spending on goods rose by 3% in the previous quarter, it dipped by 0.4% in the first quarter. Higher interest rates contributed to a nearly $14 billion decline in motor vehicle sales. Falling gasoline prices also helped reduce spending on goods. However, buoyed by higher incomes, consumers continued to increase their spending on services. A robust labor market supported much of the growth from the previous quarter, with payrolls expanding and increases in disposable income outpacing inflation. Real disposable personal income increased by 1.1% in the first quarter, compared to a 2.0% increase in the final quarter of 2023. Consumers continue to be optimistic, according to the sentiment index published by the University of Michigan.

A 1.2% increase in government spending contributed less than a quarter percent to the quarter’s growth. The federal government cut spending for national defense, and state and local governments decelerated their spending.

Residential spending surged by 13.9% in the first quarter, although activity in residential investment, measured in real dollars, has yet to fully recover since its decline began in the third quarter of 2022. This significant increase in residential activity helped boost business investment by 3.2%—however, a substantial reduction in inventories restrained business growth. Nevertheless, falling inventories may signal future growth, as businesses eventually need to invest to replenish their stocks.

Exports slowed while imports surged, both contributing to a reduction in net exports. This reduction in net exports decreased RGDP growth by nearly one percent. Economists anticipate the balance of exports and imports will improve as the recovery of world economies aligns with that of the US.

Despite the modest 1.6% overall growth, economists monitor final sales to private domestic purchasers to gauge domestic demand, as it excludes inventory changes, trade, and government spending. These sales, which increased by 3.1%, fail to reflect a slowdown, helping to explain the resilience of inflation. The PCE price index, favored by most economists as a measure of inflation, rose by 3.4% in the first quarter, compared to a 1.8% increase in the fourth quarter. The core index also accelerated from 2.0% to 3.7%, marking the first rise in both measures in a year.

The sharp increases in the PCE price indexes will draw the attention of policymakers at the Federal Reserve during their upcoming meeting. With inflation remaining unchecked, the anticipated reduction in interest rates will likely be delayed. While a healthy labor market, increased business profits, and a growing economy are positive indicators, they also postpone the return of inflation to the Fed’s 2% target. The BEA’s Personal Income and Outlays - March 2024 report was released earlier today. Stay tuned for Higher Rock’s summary and analysis of the news early next week.