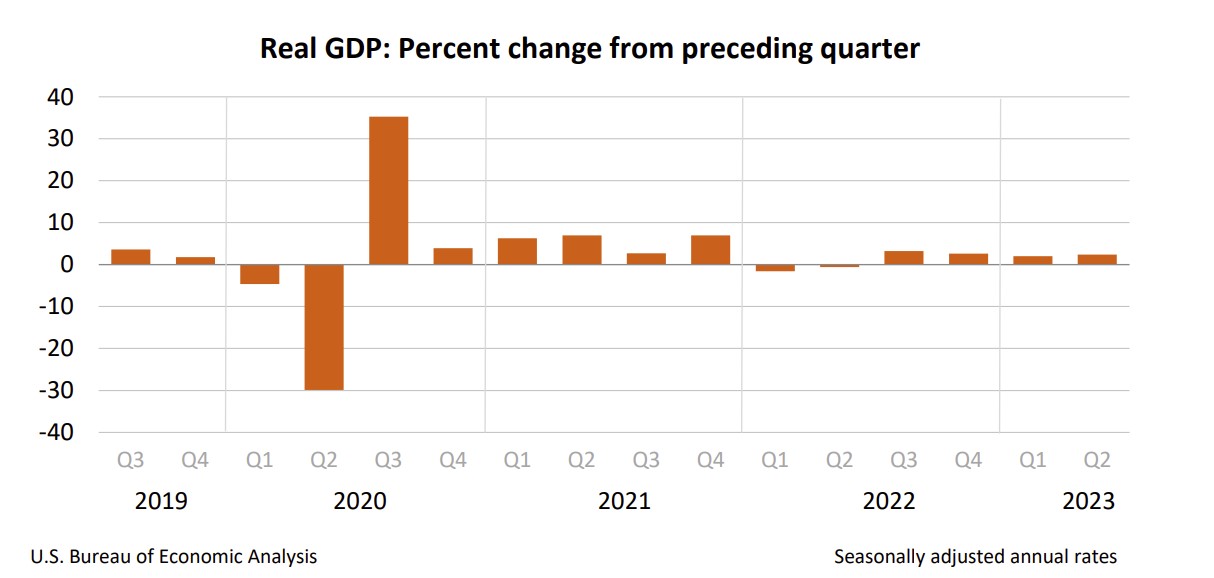

The US economy’s real gross domestic product grew at an annual rate of 2.4% during the second quarter, following a 2.0% gain in the first quarter, according to the Bureau of Economic Analysis’s (BEA) advance estimate. The upswing can be attributed to the sustained strength in consumer spending and a significant surge in business investment. Many economists feared the economy would contract following eleven interest rate increases to combat inflation by policymakers at the Federal Reserve. However, it now appears that the policymakers may have skillfully managed a “soft landing” by effectively curbing inflation without pushing the economy into a recession.

The BEA’s news release and report can be accessed at Gross Domestic Product, Second Quarter 2023 (Advance Estimate). Here are the report’s highlights.

Consumer spending decelerated in the second quarter but still grew at a healthy clip and contributed 1.12 percent to the rise in RGDP because consumer spending accounts for approximately 70 percent of GDP. However, economic growth would have decelerated without the 5.7 percent increase in gross private domestic investment.

Businesses have responded positively to incentives introduced through the Reduction Act and the CHIPS Act, both of which were passed last year to promote domestic manufacturing. As a result of these measures, there has been a remarkable surge in investment in manufacturing facilities, reaching the highest levels seen in over 50 years. However, residential construction has faced significant challenges, where higher mortgage rates have stifled construction, leading to a fall for nine consecutive quarters.

GDP includes consumer spending, business investment, government spending, and exports. Imports are excluded because they are not produced domestically. But when consumers purchase an imported item, it is added to consumer spending. If left unadjusted, GDP would be inaccurately inflated. Thus, imports are deducted from exports to calculate net exports to obtain a more precise measure. When exports surpass imports, GDP is positively impacted. In the case of June, both exports and imports declined, but the reduction in exports was greater, leading to an overall negative effect on GDP.

Government spending also decelerated, so the modest increase had little influence on the second quarter’s GDP.

The PCE price index remains higher than the Fed’s 2% target. It increased only 2.6%, compared to 4.1% in the first quarter – reaching its lowest rate since the end of 2020. The core index, which economists favor because it provides a better gauge of price trends, was up 3.8% compared to 4.9% in the first quarter. On Wednesday, policymakers at the Federal Reserve raised their target benchmark rate to between 5.25 and 5.5 percent. Chairman Powell stated that the rate hikes are working, and the Fed’s economists no longer anticipate a slight recession. Policymakers at the Federal Reserve favor the PCE price index, so the significant decrease lessens the likelihood of increases in the near future. However, Chairman Powell emphasized that the Fed’s work is not finished. Inflation remains above its 2% target. He asserted that data will drive future actions, particularly regarding the labor market’s strength.

Income gains continue to outpace inflation, making it easier for households to absorb the higher prices and continue spending more. Unemployment is low, and a shortage of workers persists. Furthermore, people are feeling better about the future. The Conference Board reported that July’s index increased to a two-year high. Growing confidence, higher pay, and job security should support continued growth in consumer spending. But policymakers at the Fed are concerned that current optimism could also empower workers to demand higher wages, which could perpetuate inflation if companies respond by raising prices to protect their margins.

The likelihood of a recession has lessened. The US economy has been remarkably resilient. Higher interest rates have done little to slow the labor market. Consumer spending remains strong. However, economists remain uncertain about the full impact of the rate increases. It takes months, even years, for the effects of rate hikes to sift through an economy. In 2007, it appeared the Fed had engineered a soft landing, but the real estate bubble burst, sending the economy into a deep recession.

Several events may threaten the recovery. Economists do not know the full impact of the resumption of student loan payments. They have been on pause since March 2020. Interest will begin accruing in September, and payments will restart in October. Student loan payments will have a similar effect as a reduction in disposable income. Delinquency rates have been steadily increasing since the third quarter of 2021. They will probably increase more. The housing market remains soft, and high interest rates may push it down further. Policymakers will likely pause before raising interest rates again to gauge how rate hikes have influenced the economy.

The BEA’s Personal Income and Outlays - June 2023 report was released Friday. June’s income fell while spending rose. Read Higher Rock’s summary and analysis of the news in Monday’s blog.