Key takeaways from the Bureau of Economic Analysis Gross Domestic Product, 2nd Quarter 2025 (Advance Estimate) include:

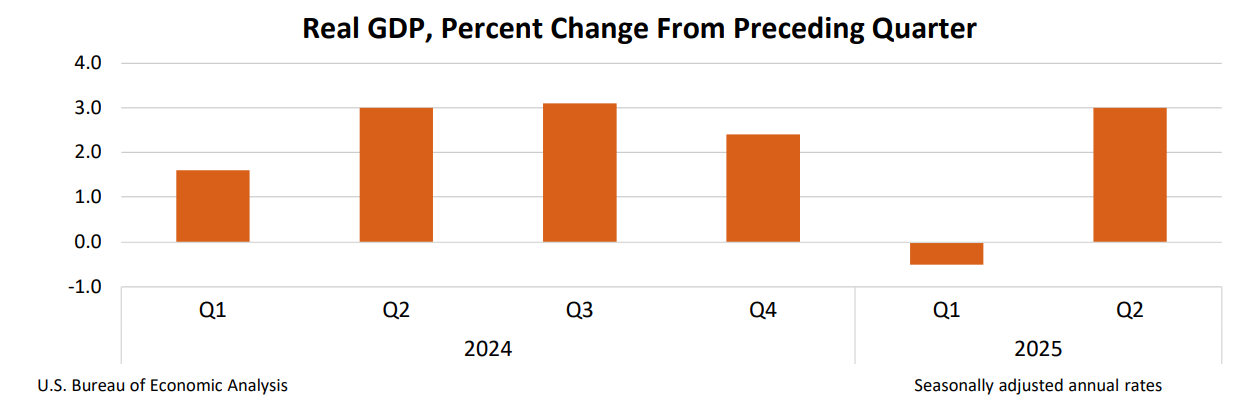

The U.S. economy posted a surprisingly strong 3.0% annualized growth rate in the second quarter of 2025, but that headline figure obscures underlying weaknesses. A sharp contraction in the first quarter dragged down the average growth rate for the first half of the year to just 1.2%, well below the 2.5% quarterly pace recorded in 2024.

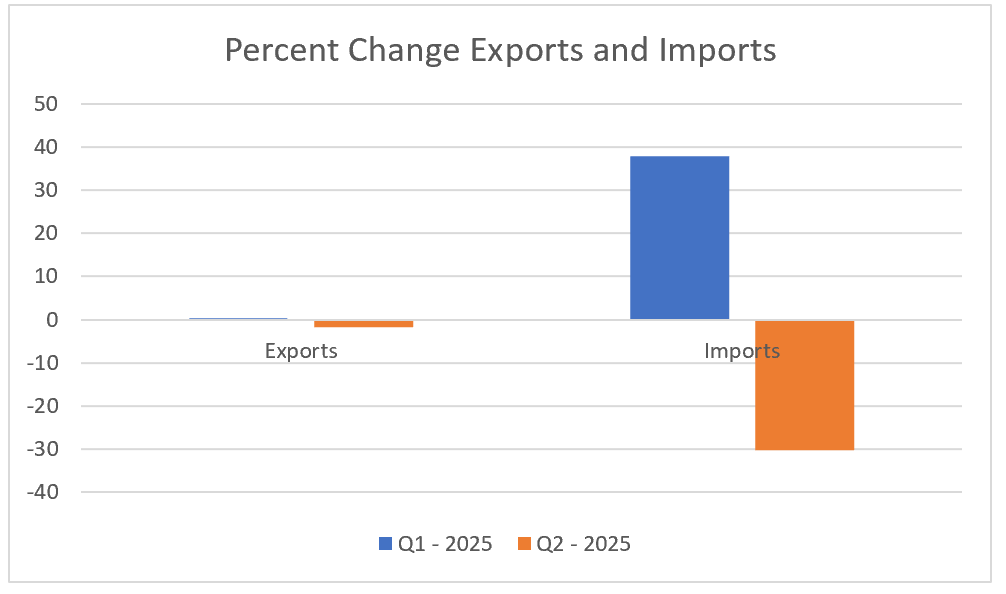

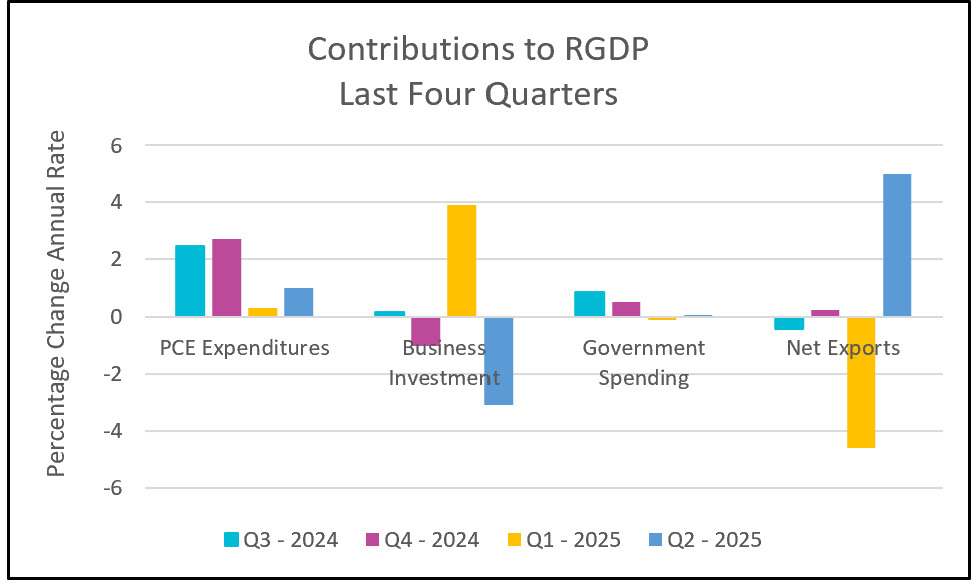

Much of the volatility in 2025 can be traced to shifting trade dynamics driven by President Trump’s renewed emphasis on tariffs. At the start of the year, businesses and consumers rushed to import goods ahead of anticipated import taxes, resulting in a temporary surge in imports. That pattern reversed in the second quarter as companies relied on existing inventories rather than placing new orders, contributing to a steep drop—over 30%—in imports.

This dramatic shift in trade flows distorted GDP data and made it difficult to gauge the economy’s true health. Because imports are subtracted from gross domestic product—since they are not domestically produced—the sharp decline in imports boosted RGDP, even though it did not signal stronger consumer or business activity. While exports fell only slightly, the steep drop in imports alone contributed over five percentage points to second-quarter GDP growth. In contrast, during the first quarter imports rose 38% and reduced the RGDP by 4.7%. Economists warn that this trade-driven boost masks more troubling underlying trends.

Inventory adjustments also played a significant role. As mentioned earlier, businesses had stockpiled goods in the first quarter in anticipation of tariffs, but much of that inventory was drawn down in the second quarter, subtracting more than three percentage points from GDP.

Beneath the headline growth figure, signs of strain are mounting. Consumer spending—typically the primary driver of U.S. economic growth—slowed markedly, posting its second-weakest quarterly increase in two years. At the same time, business investment plunged 15.6%, the largest drop since the pandemic, as uncertainty surrounding trade and broader economic policy dampened confidence. A more accurate gauge of underlying domestic demand—real final sales to private domestic purchasers, which excludes the effects of trade, inventories, and government spending—increased just 1.2% in the second quarter, down from 1.9% in the first. This further underscores the weakening momentum in the private sector.

The housing market continues to weigh on economic growth. Elevated mortgage rates have stalled both buying and selling activity, pushing residential investment down 4.6%—its weakest performance since 2022.

Government spending also declined, with federal outlays falling 3.7% in the second quarter, following a 4.6% drop in the first. However, increased spending at the state and local levels helped offset some of the decline in federal expenditures.

Inflation remains a central concern for policymakers. Although 12-month inflation moderated slightly in the second quarter, monthly data show renewed upward pressure. The PCE price index rose 0.3% in May and June, up from 0.2% in April. This recent acceleration has kept the Federal Reserve cautious. Despite mounting political pressure from President Trump to cut interest rates, most Fed officials chose to hold steady, emphasizing the need for more unmistakable evidence that tariffs and trade-related disruptions will not reignite inflation.

A separate report from the Bureau of Economic Analysis showed that disposable personal income in June barely kept pace with inflation—a concerning development, as real income growth has been a key driver of consumer spending in recent years.

The labor market, however, remains a pillar of support for the U.S. economy. Over the first six months of 2025, payrolls grew by an average of 130,000 jobs per month, with little sign of slowing. Unemployment has held steady around 4%, and employers continue to raise wages to attract and retain workers. To date, income gains have kept up with inflation, helping to sustain consumer activity.

Tomorrow, the Bureau of Labor Statistics will release its July employment report—a closely read publication. Economists and policymakers will examine the data for signs of weakening momentum that could prompt the Federal Reserve to consider cutting its benchmark interest rate. HRE will publish a summary and analysis shortly after the report’s release.