Slower Growth and Lower Inflation – Will We Have a Soft Landing, or Are We In The Beginning of a Recession

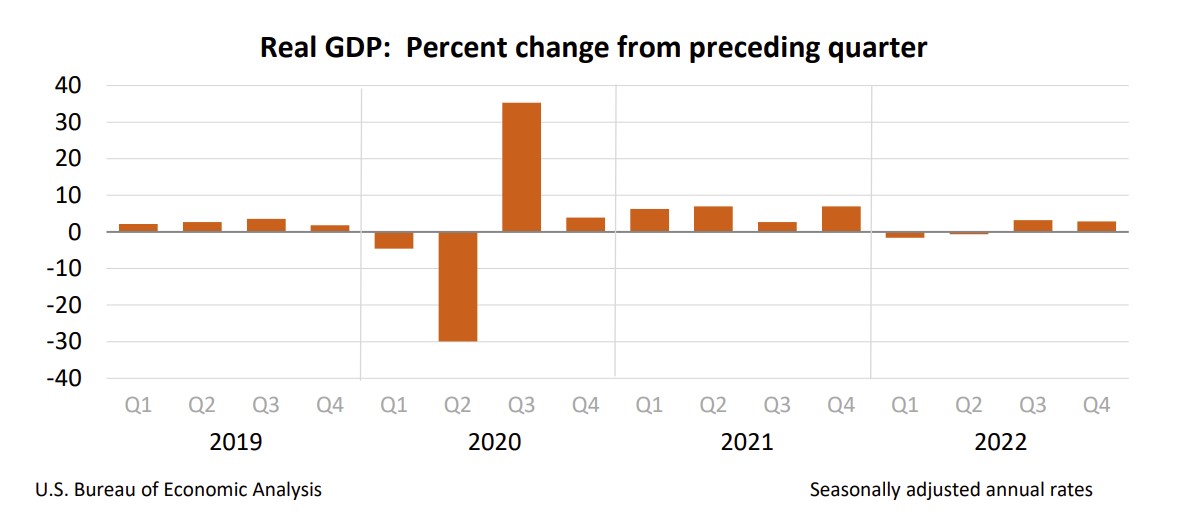

Policymakers at the Federal Reserve increased its benchmark rate seven times during 2022 to slow the economy and reduce inflation. Their strategy worked. The US economy lost momentum in the fourth quarter, and the inflation rate fell. The economy’s growth decelerated from an annual rate of 3.2% in the third quarter to 2.9%. For the year, the economy grew by 2.1%. That compares to 5.9% in 2021.

Nevertheless, the US economy has remained remarkably resilient given the increase in interest rates and the weakness in European and Chinese economies. While inflation has subsided, it remains significantly above the Fed’s 2% target, and additional increases in interest rates are likely. However, the Federal Reserve will not be as aggressive in increasing interest rates when they meet later this week.

The Bureau of Economic Analysis’s news release and report can be accessed at Gross Domestic Product, Fourth Quarter 2022 (Advance Estimate). Here are the report’s highlights.

Increases in consumer spending, private investment, net exports, and government spending contributed to the fourth quarter’s growth. However, digging deeper uncovers trends that suggest the economy will continue to lose momentum and begin to contract late in the first quarter or early in the second quarter of 2023.

Aside from housing, higher interest rates did not hold consumers back for most of the quarter. Households have benefited from boosts in disposable personal income that exceed inflation. However, consumer attitudes may be changing. The domestic aggregate demand is not increasing as much as the rest of the economy. When stripping out government spending, inventory, and exports, economists have a better measure of the domestic aggregate demand. The ratio of final sales to private domestic purchases only increased by 0.2% in the fourth quarter, the smallest rise since the second quarter of 2020. A recent increase in the savings rate may be indicative of consumers becoming more cautious. In addition, retail sales fell 1.1% in December, marking the largest monthly decrease in 2022.

Higher mortgage rates thrashed the housing industry. Builders delayed or canceled projects. Residential investment fell 26.7% in the fourth quarter after plummeting over 27% in the third quarter. Its most recent decrease slashed 1.29% off GDP growth. Falling home sales also impact companies offering complementary goods and services such as mortgages, furniture, and appliances. Higher rates also affected business investment. Fixed investments fell 6.7%, which included a 3.7% drop in equipment sales.

Growth in private inventories contributed half of the fourth quarter’s growth, indicating producers anticipated more in sales. Swings in inventories are volatile and are not good indicators of future trends. In fact, they may indicate the economy is slowing since businesses anticipated more sales last quarter and will now cut back. (It is unlikely businesses are building up their inventories because they anticipate a surge in demand.)

Net exports contributed .56% to the change in RGDP during the fourth quarter. Exports fell, but imports fell even more, yielding a positive net export figure. Weaker global economies limited the growth in exports.

Government spending contributed 0.64% to the change in RGDP during the fourth quarter. The majority of the increase was from nondefense spending.

Inflation may have peaked, but it is still slowing the economy. Some of the most significant price increases have been for necessities such as food, shelter, and gasoline. Rising prices have forced families to make difficult decisions on which goods or services to cut. Spending cuts could continue to mount as many families deplete their savings.

Policymakers at the Federal Reserve are correct in focusing on inflation. Inflation becomes harder to control as it becomes more entrenched in the economy. But taming inflation requires lifting interest rates and cooling the economy, and the slowing effect of higher rates takes six months to a year to trickle throughout the economy. Many economists contend that the rate hikes during the latter half of 2022 have been too large and too frequent. They suggest more time is needed to ascertain the impact of recent rate increases and fear the eventual impact of the current monetary policy will propel the economy into a severe recession.

A combination of higher rates, consumers cutting discretionary spending, businesses cutting investments, and weak global economies will jeopardize continued growth. However, the greatest threat to the recovery is the government’s failure to raise the debt ceiling. Economists believe a delayed response would throw the economy into a deep recession. Interest rates would rise. Businesses would cut production, and millions would lose their jobs.

Tomorrow Higher Rock will publish its analysis of Personal Income and Outlays, December 2022, which will take a closer look at income and spending in December. It will also provide the most recent reading of the PCE price index, the measure of inflation preferred by policymakers at the Federal Reserve.