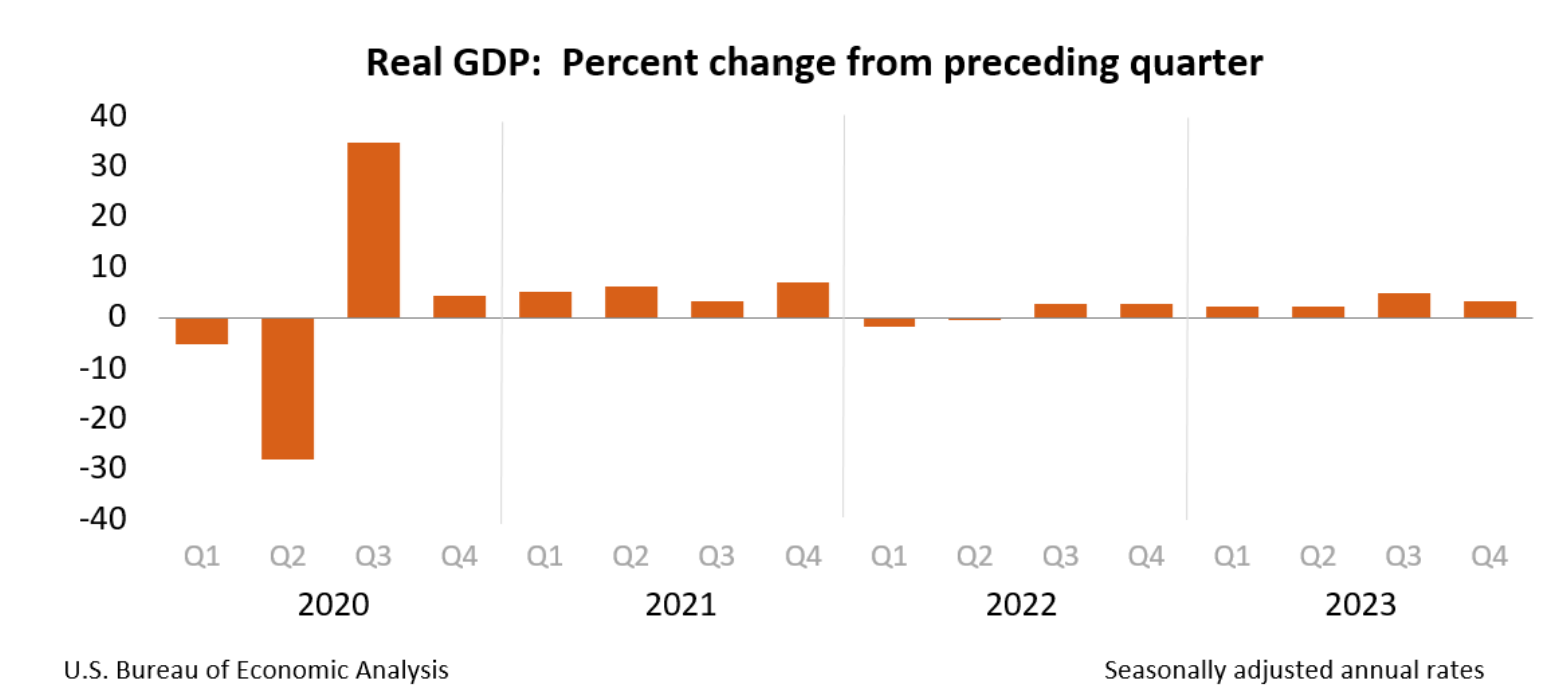

The US economy’s growth consistently exceeded two percent in every quarter since the second quarter in 2022, when it rebounded from two consecutive contractions. Fueled by an increase in disposable income, consumers continue to drive the recovery.

This post will focus primarily on the shifts observed between the third and fourth quarters. In the coming week, we will release a blog that delves into an analysis of the US economy throughout 2023 and offers predictions for 2024.

The Bureau of Economic Analysis’s news release can be accessed at Gross Domestic Product, Fourth Quarter and Year 2023 (Advance Estimate). Here are the report’s highlights.

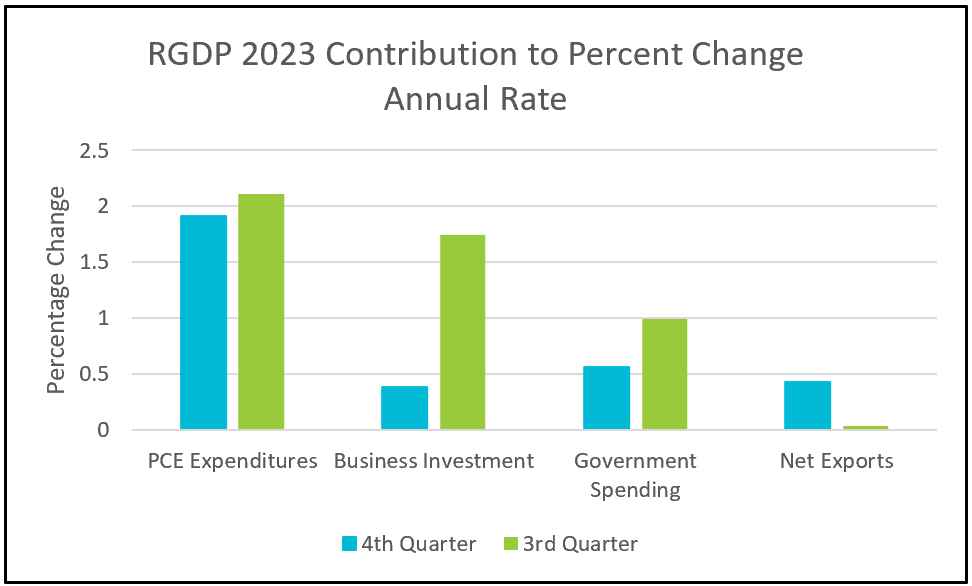

Despite a deceleration in consumer spending, it surpassed most predictions and remained the primary driver of this quarter’s growth. Contributions from business investment and government, on the other hand, experienced declines. However, a reduced trade balance gap contributed to an enhanced growth rate. The table below reflects the changes in the contributions of RGDP’s components between the third and fourth quarters.

In the fourth quarter, consumer spending on goods increased by 3.8%. While this figure is a slight decline from the 4.9% observed in the third quarter, it remains well above the average increase since the second half of 2021. Spending on services grew by 2.4%, surpassing the year’s 2.2% average. The robust labor market and improved consumer sentiment played pivotal roles in supporting much of last quarter’s growth, with payrolls continuing to expand and increases in disposable income outpacing inflation. Real disposable personal income saw a notable increase of 2.5% in the fourth quarter, in contrast to the 0.3% increase in the third. Confidence in the economy’s strength improved, so why not spend more? After all, workers feel secure in their jobs because the unemployment rate hovered near record lows. According to the sentiment index published by the University of Michigan, consumer confidence has risen to its highest level since July 2021.

Government spending contributed half a percent to the fourth quarter’s RGDP increase, down from nearly a one percent rise in the third quarter. The bulk of the increase was at the state level, involving employee compensation and investment in structures.

Businesses increased their investment by 2.1%, a significant deceleration from the 10% increase in the third quarter. This slowdown is not surprising given the substantial increase in inventories last quarter, where inventory growth accounted for 1.3% of the quarter’s growth rate—an unsustainable rate that could slow future growth if businesses reduce production to deplete their inventories.

Residential investment decelerated, following a surge in the previous quarter, which had decreased every quarter since the second quarter of 2021. However, when measured in real dollars, residential investment has not fully recovered from its drop in 2023.

Inflationary pressures continue to soften. The PCE price index, the inflation measure favored by most economists, rose 2.7% from the fourth quarter a year ago, down from a 3.3% increase between the third quarter of 2022 and 2023. Core prices also decelerated during the same period, from a rate of 3.8% to 3.2%.

Policymakers at the Federal Reserve meet next week. They will be encouraged by the economy’s current trends, which fit the definition of a soft landing where inflation dips without triggering a recession. Economists expect policymakers to maintain their pause because prematurely lowering rates could reignite inflation. However, waiting too long could push the economy into a recession. The BEA will release their report Personal Income and Outlays - December 2023 on Friday. Read Higher Rock’s summary and analysis of the news early next week. Additionally, stay tuned for our analysis summarizing the economy in 2023 and predictions for 2024 later next week.