I thought this video in today's Wall Street Journal addressing student attitudes towards student loans is interesting.

Wall Street Journal – Student Loans The student loan market is now second only to the mortgage market in securitized loans.

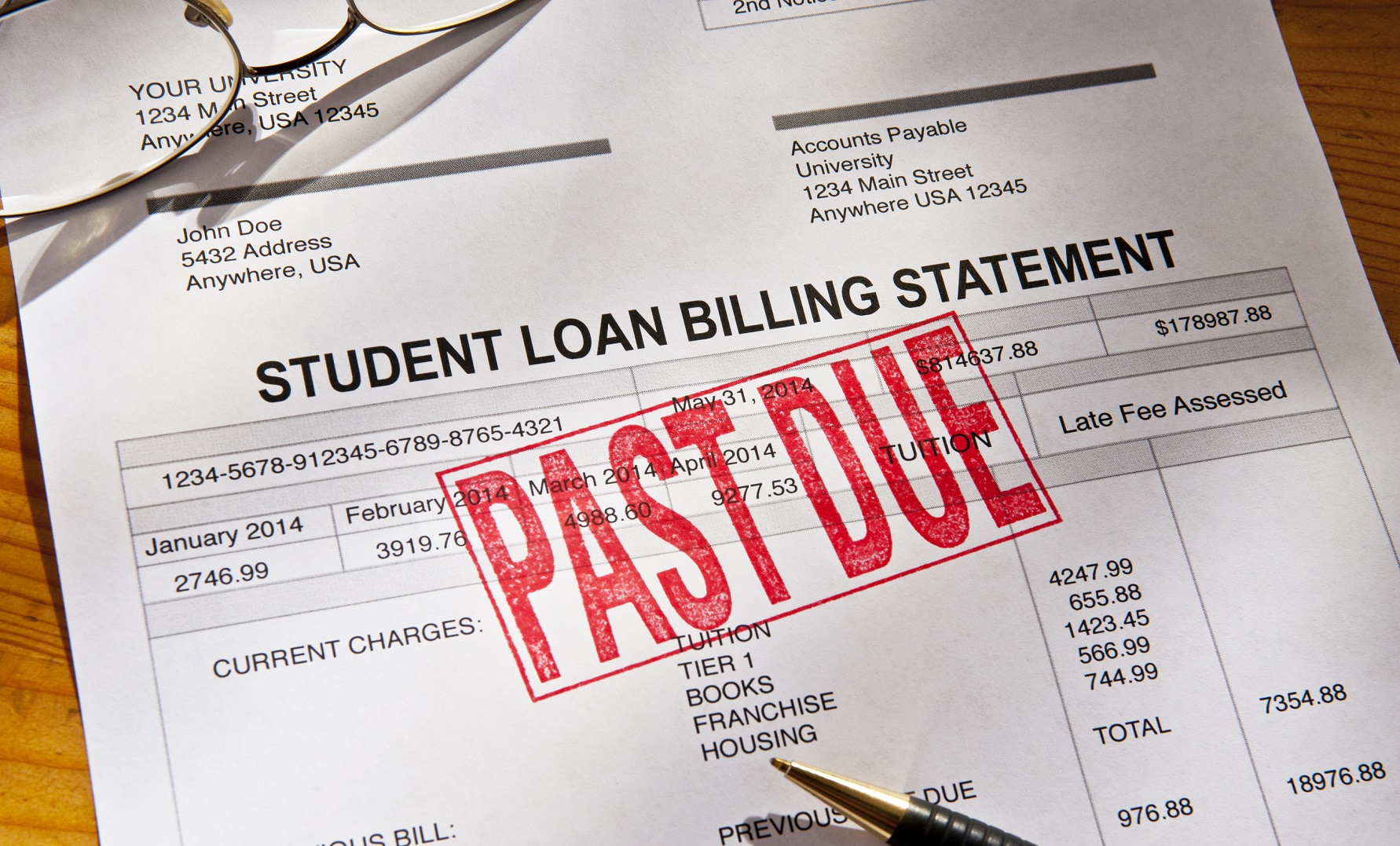

Many of those loans are in default. Specifically, $125 billion in student loans are now in long-term default, meaning payments are over 360 days past due. Many students believe they should not pay them off because they feel misled by the schools they attended. They may have been promised good paying jobs, and now find themselves in low paying jobs. The degree they paid so dearly for is not worth the price they paid. Others are willing to pay off their loans, but are victims of a slow economic recovery and struggle to make ends meet and have not taken advantage of the income based repayment options. This has enormous implications both for the individuals and the economy. Credit will suffer for the individuals. Lower credit scores will influence their ability to borrow for a car or home. If a large segment of consumers are unable to purchase large ticket items, it could hurt the growth of the economy's aggregate demand and further slow economic recovery.

If you have a student loan and would like to review your options I encourage you to visit the

US Department of Education web site.

If you strongly believe you should not repay your loan, please consider the long-term consequences of poor credit. You may be hurting yourself more than you think. Good luck.