The US economy recovered nicely in 2023 from the anemic and inflationary conditions of 2022. In that year, inflation peaked at 9.1%, but by December 2023, it had significantly dropped to 3.4%. The economic growth in 2022 was a modest 1.9%, marked by two quarters of negative growth. In contrast, 2023 witnessed a more resilient economy with a growth rate of 2.5%, surpassing 2.0% in every quarter. Notably, employers continued hiring, maintaining the unemployment rate near-record lows.

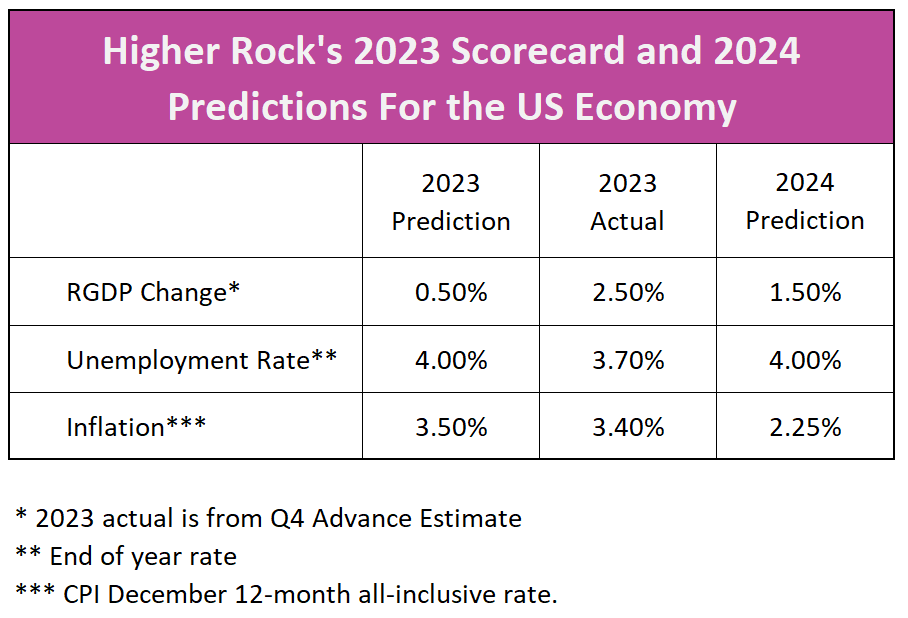

Where is the US economy headed going into 2024? Higher Rock Education predicts the following year’s growth rate, inflation rate, and unemployment rate every year. The table below provides Higher Rock’s scoreboard and our predictions for 2024.

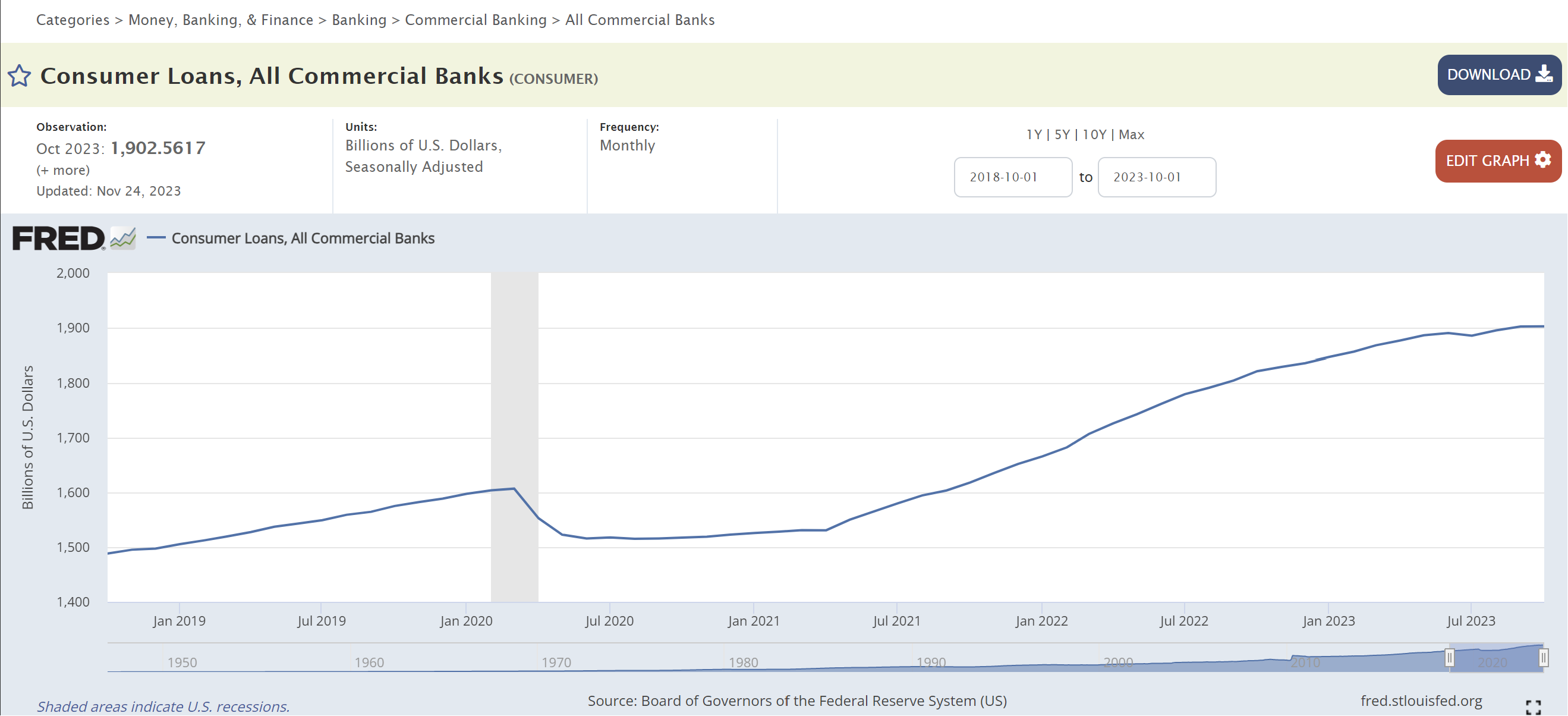

Few economists foresaw the economy maintaining its robust performance in 2023; many had predicted a recession. However, the consumer’s resilience and the labor market’s vigor proved decisive. Consumer spending exhibited consistent growth each quarter throughout the year, culminating with a 2.2% increase for the entire year. This expansion was financed by elevated wages, a growing workforce, accumulated savings, and increased borrowing.

A shortage of available workers compelled employers, particularly in the service industries with a higher proportion of lower-paid employees, to raise wages to attract and retain staff. This demographic has a higher propensity to spend, experienced a notable uptick in income. Notably, 2.5 million individuals joined the labor force, creating 2.7 million new jobs—the confluence of more workers earning higher wages translated into an augmented pool of disposable income.

Furthermore, Americans dipped into their savings to finance the purchase of goods and services, adding another dimension to the economic dynamics of the year.

They also used debt.

Private investment experienced a 1.2% decline in 2023, primarily influenced by a challenging real estate market. Mortgage rates reached their highest point in two decades, contributing to the housing market’s most difficult year since 1995. Despite this downturn, numerous businesses engaged in substantial investments, responding to incentives provided by the CHIPS Act and the Inflation Reduction Act.

Government spending increased 4.0%, nearly doubling the deficit to $1.84 trillion.

While inflation had receded from its peak of 9.1%, it remained unacceptably high, prompting policymakers at the Federal Reserve to persist in their strategy of raising the target for the federal funds rate four more times in 2023. However, the effects of such tightening measures take time to permeate the entire economy, so the tightening policy initiated in 2022 did not make its way through most of the economic landscape until 2023. This resulted in a continued trend of disinflation.

Food prices, which had surged by over ten percent in 2022, concluded the year with a more moderate increase of 2.7%. In contrast, gasoline prices experienced a decline, while housing costs stubbornly maintained their elevated levels.

Labor shortages persisted in 2023. The initial impact of the COVID-19 pandemic in early 2020 led to a substantial exodus from the labor force and widespread job losses. It wasn’t until late in 2022 that the size of the labor force and employment levels returned to pre-pandemic levels. Still, job openings exceeded the available workers by a margin of 2:1. In 2023, the participation rate of workers improved, and by the end of the year, there were 1.45 job openings for every unemployed worker. The worker shortage lifted wages. Earnings experienced an average increase of 4.1%, surpassing the 3.4% inflation rate. Unemployment reached a 50-year low of 3.4% in June and hovered near historic lows throughout the year.

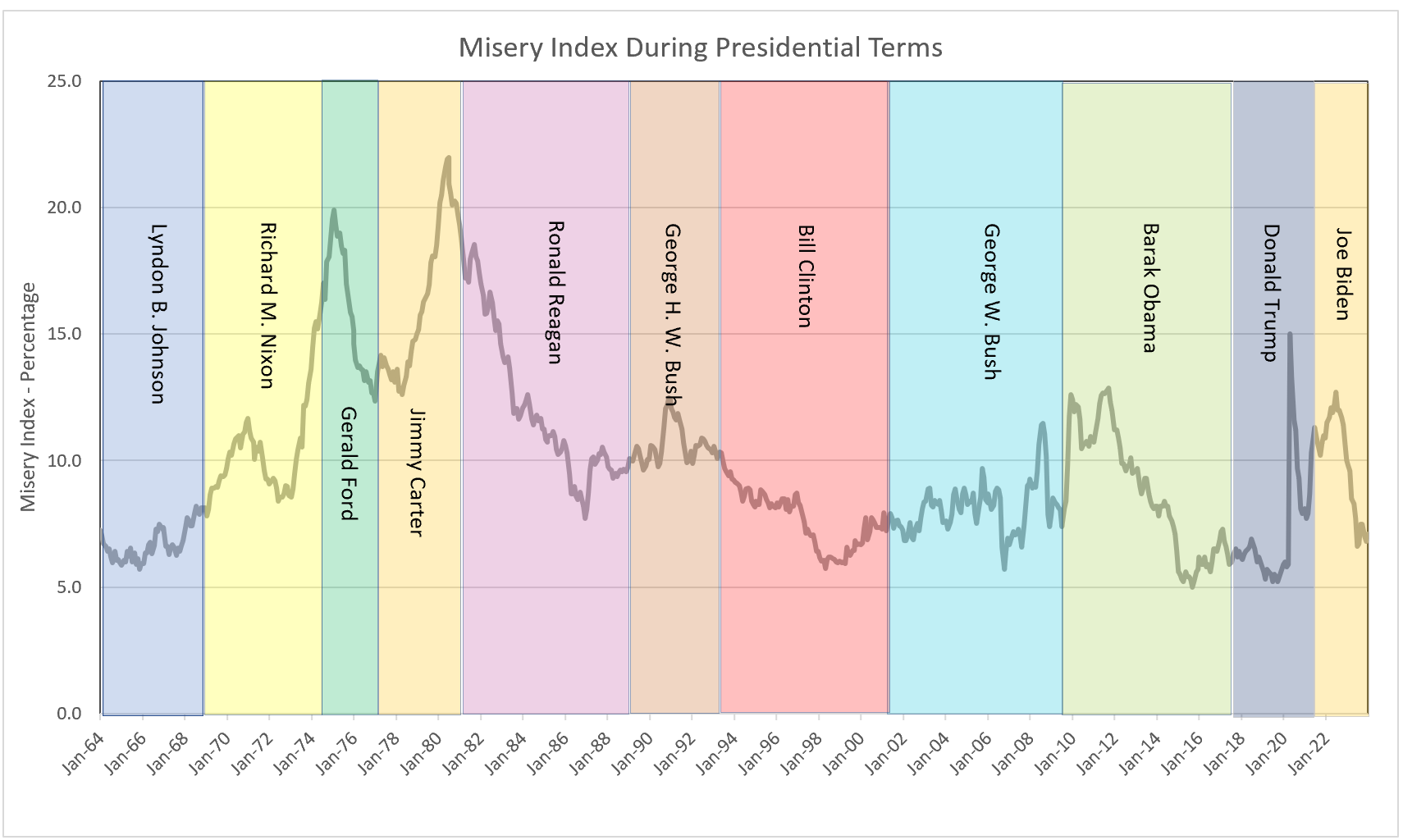

The misery index serves as a reflection of the 2023 economy. This economic indicator encapsulates the level of financial distress individuals endure within a country. It is the sum of the unemployment and inflation rates. Appropriately named, the index attains significance during periods of elevated unemployment and inflation, as individuals often grapple with challenges in their daily lives, leading to a pervasive sense of misery. The higher the index, the more pronounced the overall sense of hardship experienced by the population.

The index declined from 10 to 7.1 in 2023, reaching its lowest point since the onset of the COVID-19 pandemic. This improvement surpasses the historical average dating back to President Johnson’s presidency, signifying an improving economy and better economic well-being of its citizens.

Higher Rock predicts RGDP will grow 1.5% in 2024. The consumer has always been the driver of the US economy by contributing approximately 70% of the US GDP. Consumer spending will be less robust in 2024. Wage increases will moderate as the balance between the supply and demand for labor improves. Economists estimate that employers must add approximately 100,000 workers to monthly payrolls to account for the population growth. Despite payroll increases exceeding 200,000 monthly from January 2021 to May 2023, the three-month average has steadily trended lower throughout 2023. We anticipate that payroll additions will continue declining until reaching a more sustainable level of around 100,000 workers. The slower payroll growth and smaller wage increases will diminish available disposable income. For 22 million borrowers, disposable income will further shrink with the resumption of student loan payments deferred during the pandemic. A lower debt capacity and diminished savings will result in reduced spending capacity.

Businesses are expected to maintain spending, especially in artificial intelligence, although the high cost of borrowing may deter them. The real interest rate, which is an inflation-adjusted rate, has reached its highest point in sixteen years. Concerns about an economic slowdown may dissuade some businesses from expanding. Banks will tighten lending guidelines, particularly for commercial real estate.

A decrease in government spending during an election year is doubtful, as politicians tend to favor making promises over withdrawing funding. Despite a deficit reaching 7.4% of GDP, an unsustainable figure, Higher Rock believes government spending will increase slightly after much bipartisan bickering.

International trade will boost the RGDP because exports will grow more than imports as global economies improve.

We anticipate that inflation will reach 2.25% by the end of 2024. The cooling of consumer spending and productivity improvements will restrain price increases. Presently, the CPI likely overstates inflation because the shelter index, which comprises about one-third of the index, exhibits a lag compared to other price indexes. The Bureau of Labor Statistics employs current leases rather than market leases. Since renters typically agree to terms between six months and a year, a survey of current leases may not reflect present market conditions. Consequently, when rents decline, there is a delay in the lower shelter cost being reflected in the Consumer Price Index (CPI).

Past rate increases have yet to trickle throughout the economy. Inflation has peaked, but it will continue to trend lower. It is unlikely that policymakers at the Federal Reserve will resume rate increases, but we believe they will begin to lower them at the end of the second quarter.

As the economy cools, unemployment will increase slightly. Unemployment will equal 4.0% at the end of 2024.

Indeed, the world is in a constant state of unpredictable change. We have observed numerous revolutionary shifts, with COVID-19 significantly disrupting every economy. Global tensions have the potential to erupt, leading to widespread inflation. However, the prospect of favorable changes also exists. Technologies like artificial intelligence can enhance productivity much like the Internet has done. I hope for world peace and diminished political tensions, fostering responsible bipartisan leadership that enables the global economy to thrive.