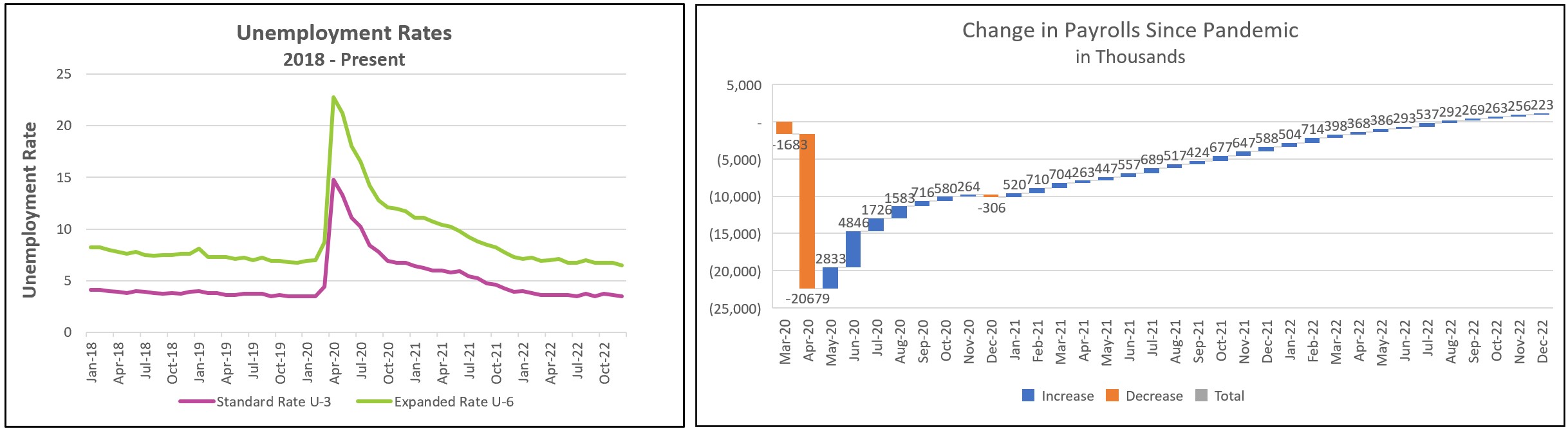

In 2022, payrolls grew by 4.5 million workers, exceeded only by last year’s gain of 6.7 million. The economy regained more than the 22 million jobs lost during the pandemic. However, shortages of workers persist, and the gains remain insufficient given the population growth.

In December, hiring remained robust but less so than in prior months. Unemployment fell while wage gains moderated, providing the Fed with some encouraging news.

The highlights from the Bureau of Labor Statistic’s report, The Employment Situation – December 2022 are listed below.

The growth of nonfarm payrolls decelerated for the fifth straight month to its smallest increase since December 2020. In December, new hires increased by 223,000. However, the labor market remains strong. Job openings continue to exceed the number of willing workers. Last week the Bureau of Labor Statistics reported that a shortage of workers persists. There were 10.5 million openings in November compared to 5.7 million unemployed workers in December. While payrolls now exceed the prepandemic level, they remain far less than what they would have been had prepandemic trends continued. An increase in the participation rate would help balance the supply and demand for workers. A 717,000 increase in the number of people employed combined with a 439,000 increase in the labor force lowered the unemployment rate to 3.5% from 3.6%.

Leisure and hospitality (+67,000), health care (+55,000), and social assistance (+20,000) added the most workers. Construction companies surprisingly continued hiring (+28,000) despite the surge in interest rates. However, several large tech companies, including Amazon, Salesforce, and Meta, are beginning to lay off employees.

Most of December’s new hires were part-time workers. Between August and October, the number of part-time workers fell. The trend reversed in November when 24,000 were hired. But in December, a whopping 190,000 part-time workers were added to payrolls. The implication is that many people took part-time jobs to supplement their income as inflation stretched their budgets.

The growth in part-time employment partially explains December’s smaller increase in wages. Wages were up 0.3% in the month, the smallest gain in 16 months. Wages are 4.6% higher than a year ago. Even with the higher wages, the average weekly earnings fell slightly in December as employers cut hours. The average workweek fell to 34.3 hours, the shortest fewest since early 2020.

The Fed increased its benchmark rate seven times in 2022 to reduce the economy’s aggregate demand and curb inflation. Between April 2021 and June 2022, when inflation peaked at 9.1%, supply constraints, a strong labor market, and escalating wages fueled consumer spending and prevented the inflation rate from decreasing. However, supply constraints are fewer and current trends of a continued easing of wages and slowing of payroll increases have helped lessen inflation.

Federal Reserve Chairman Jerome Powell has stated several times that slowing the growth of wages was essential in slowing inflation. Wages are the highest cost of most service companies, so lower wages should reduce inflationary pressures because businesses will be less compelled to increase prices to maintain their profit margins. The combination of lower wages and adding fewer people to payrolls may induce the Federal Open Market Committee (FOMC) to scale back its rate hikes in its February meeting. However, members of the FOMC will be very interested in the Bureau of Labor Statistics’ monthly publication, Consumer Price Index – December 2022, which will be released on January 12th. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.