Key takeaways from the Bureau of Labor Statistics (BLS) report, The Employment Situation – January 2026, include:

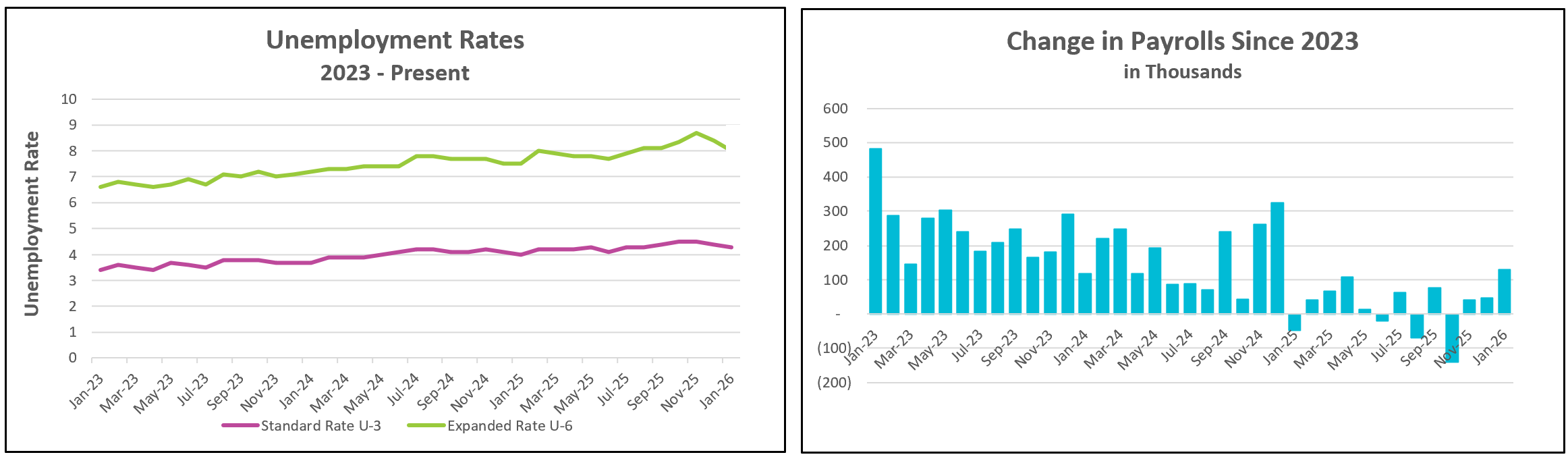

The labor market showed renewed strength in January, with total nonfarm payrolls increasing by 130,000, marking the largest monthly gain in two years. The unemployment rate also edged down to 4.3% as more people entered the workforce and found jobs. However, revisions indicated that job growth in 2025 was significantly weaker than previously reported, with only 181,000 jobs added throughout the year and an average monthly gain of just 15,000. This is a substantial decrease from the initially reported figure of 584,000. Over the past year, the unemployment rate has risen from 4.0% to 4.3%, and job growth remains concentrated in a few industries.

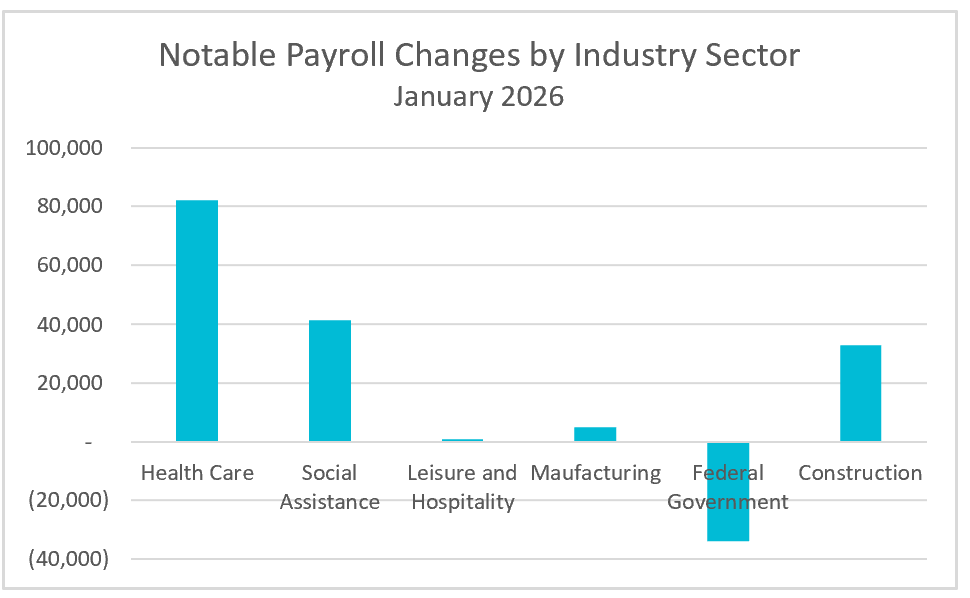

In January, health care was the leading sector for job growth, adding 88,000 positions. Employment in the health care industry is driven by population growth and an aging demographic, making it more resilient to a slowing economy. Meanwhile, construction added 33,000 jobs in January, but only 11,000 jobs in 2025.

On the other hand, federal government payrolls continued to decline, with a 34,000-job reduction in January. These cutbacks began shortly after President Trump took office. His Department of Government Efficiency (DODGE), led by Elon Musk, initiated efforts to reduce government spending and eliminate nearly 300,000 positions.

In addition, the demand for workers has shown some signs of weakening. According to a recent government report (JOLT), job openings fell to 6.5 million in December, the lowest level since September 2020. This decline indicates a softer overall labor demand.

Wage growth has shown some improvement, with average hourly earnings rising by 0.4% in January and 3.7% over the past year, surpassing inflation rates. Additionally, an increase in the length of the workweek has boosted average weekly pay by nearly 0.7%. However, these gains have been uneven, benefiting higher-income workers more than lower-income households, many of whom continue to feel the strain of rising prices. This is reflected in weak consumer sentiment readings, which have improved slightly in recent months but remain historically low, according to the University of Michigan Consumer Sentiment Index.

What should we expect when the FOMC meets in March? Policymakers have been implementing a series of interest rate hikes since March 2022 to combat increasing prices. Their strategy was effective in reducing inflation, although inflation never reached their 2% target. By late 2025, the Fed became increasingly concerned about a softening labor market and reduced its benchmark interest rate multiple times to support the economy. However, given the current strength of the labor market and recent increases in inflation, policymakers have paused further rate reductions. This stronger-than-expected economic report decreases the likelihood that the Federal Reserve will cut interest rates at its next meeting.

Still, President Trump and many economists, including his National Economic Council Director, Kevin Hassett, disagree. They believe the Federal Reserve should cut its benchmark rate at its next meeting. They contend that productivity gains from artificial intelligence could allow rate cuts without reigniting inflation.