Key takeaways from the Bureau of Labor Statistics (BLS) report, The Employment Situation – July 2025, include:

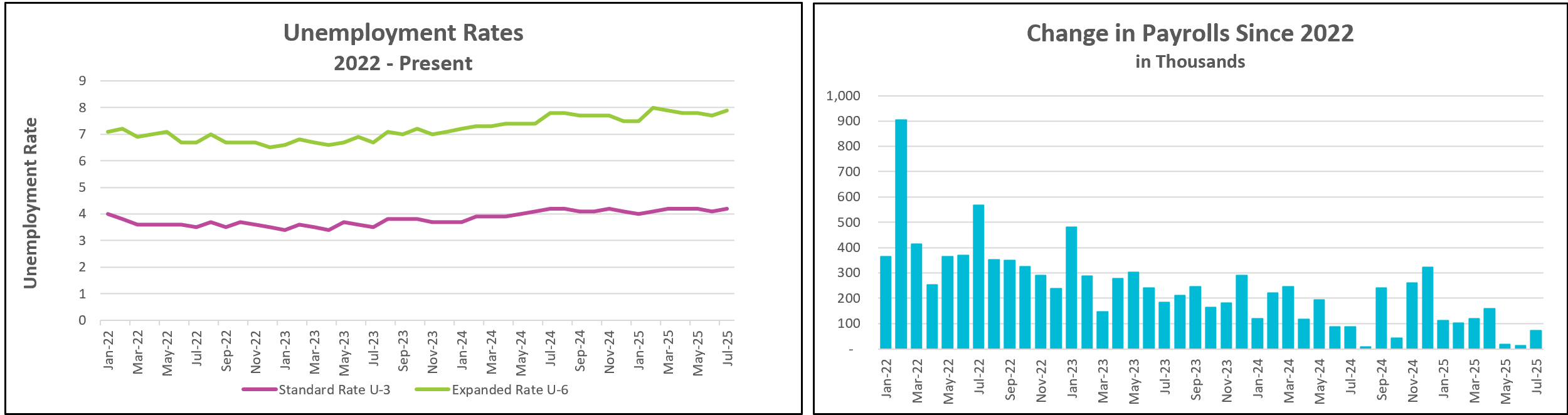

The July employment report delivered a sobering assessment of the U.S. labor market, highlighting not just a large dip in monthly job gains but also significant downward revisions to previous months. April and May’s revised payroll numbers were by a combined 258,000 jobs less than earlier estimates, underscoring a broader weakening in the labor market that had previously gone unnoticed. These adjustments suggest that the economy is not as resilient as once believed. Over the past three months, average monthly job gains have fallen to just 35,000—the weakest since the height of the pandemic—marking a sharp contrast to last year’s monthly average of 168,000.

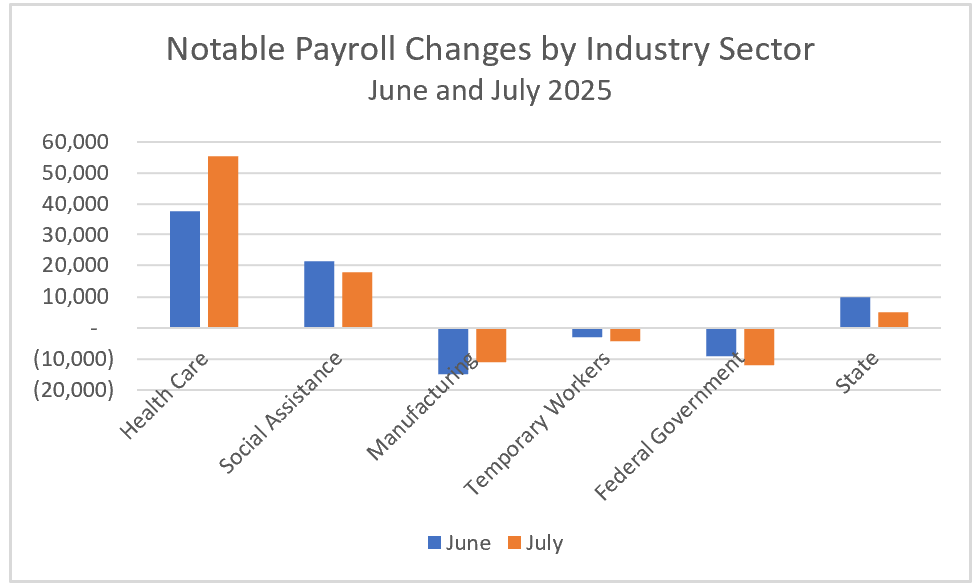

Job growth has become increasingly concentrated in a narrow range of sectors. In July, healthcare alone added 55,400 jobs, accounting for over three-quarters of total payroll gains. Social services also contributed, highlighting the continued strength of these recession-resistant sectors. However, this concentration raises red flags about the health of the broader economy. Manufacturing employment has declined steadily since March, now down 28,000 jobs from January. Temporary help services—a leading indicator of labor demand—also saw losses, reinforcing signs of a broader economic slowdown. Federal employment dropped by 12,000 jobs in July, and while state and local hiring appeared to offset these losses initially, revised data now reveal the state numbers were overstated.

Meanwhile, the unemployment rate increased slightly from 4.1% to 4.2%. It would have risen further had the labor force not continued shrinking—a trend possibly linked to the administration’s immigration crackdowns. A person is only considered unemployed if they are actively seeking employment.

Further complicating the labor picture is the political turmoil surrounding the BLS. President Trump’s decision to fire BLS Commissioner Erika McEntarfer, based on unsubstantiated claims that the data was “phony,” raises serious concerns about the integrity of government economic statistics. While revisions to labor data are normal—due to the lag in employer reporting—they are crucial for accurate decision-making. The BLS’s evolving estimates are necessary to understand a vast, complex economy. Politicizing that process threatens to erode public trust in one of the most essential tools for policymaking.

For the Federal Reserve, the timing of these revisions could not be worse. Fed Chair Jerome Powell described the labor market as “strong” just a day before the July employment report was published. The Fed delayed cutting interest rates partly because of perceived labor market strength, hoping to see additional evidence that inflation is under control. That assumption may now be in question. If the job market is weakening more than previously thought, the case for reducing interest rates may strengthen sooner than expected. Yet the Fed must base its decisions on credible, unmanipulated data, reinforcing why the independence of institutions like the BLS is so essential.

Beyond government and central bank dynamics, businesses have been cautious. Companies seem hesitant to hire or lay off workers, possibly reflecting uncertainty about the economy’s direction in light of tariffs, reduced federal spending, tightened immigration policies, and lower corporate taxes. While wages rose 0.3% and the average workweek increased slightly, boosting take-home pay in line with inflation, a weakening labor market could soon undermine consumer spending—the key engine of the U.S. economy.

The BLS will release July’s Consumer Price Index (CPI) on August 12th. Concerns about stagflation—a combination of slowing economic growth and rising prices—are growing among economists. While many have been surprised by the economy’s resilience and the relatively modest rise in prices so far, recent trends suggest potential shifts. Consumer spending decelerated in the second quarter, possibly signaling a softening aggregate demand. At the same time, the effects of tariffs often take several months to filter through to consumer prices. Categories such as apparel, household furnishings, and recreational goods—many of which are produced abroad—have already seen price increases. A noticeable rise in prices would support the Federal Reserve’s decision to keep interest rates steady. At the same time, a more muted inflation reading could strengthen the case for lowering rates to prevent the economy from stalling. HRE will provide a summary and analysis shortly after the CPI is released.