Key takeaways from the Bureau of Labor Statistics report The Employment Situation – June 2025 include:

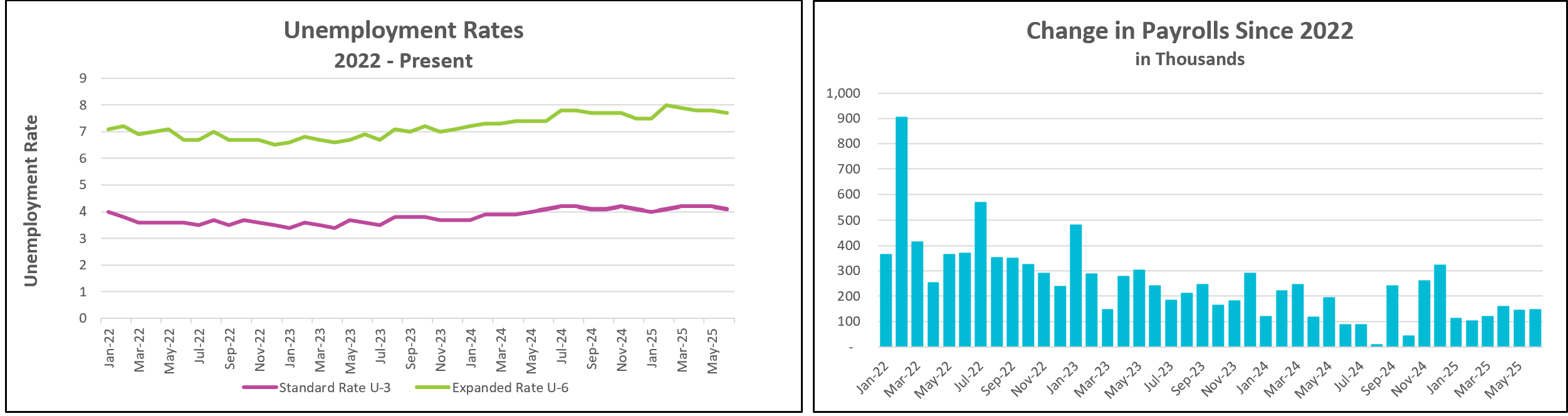

The latest employment report was stronger than expected, with total nonfarm payrolls rising by 147,000 in June and the unemployment rate falling slightly to 4.1%, continuing a year-long trend of remaining within a narrow range of 4.0% to 4.2%. While these figures provided a headline boost, the underlying data reveal a more complex and less encouraging picture of the labor market.

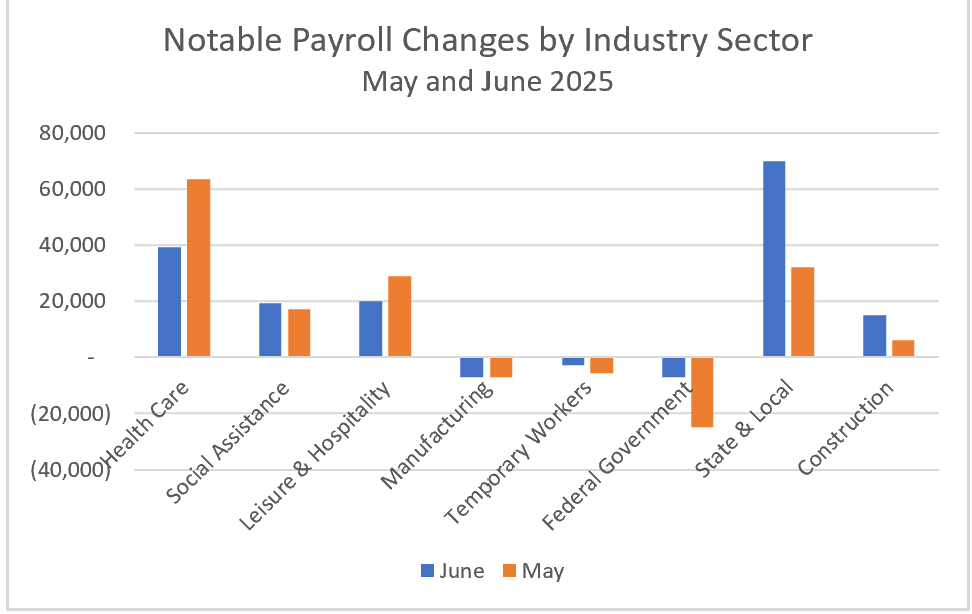

The private sector added just 74,000 jobs—down from 137,000 in May and the smallest gain since last October. Federal employment declined for the fifth consecutive month, but state and local governments accounted for nearly half of June’s payroll increase, as public schools added thousands of teaching positions. In the private sector, health care and social assistance were responsible for most of the new jobs, although even here, hiring slowed compared to May. Hiring also slowed in the leisure and hospitality sector. Manufacturing—a sector that policymakers have aimed to bolster with tariffs—shed jobs for the second straight month, with employment still lagging year-ago levels. Temporary employment also declined, a potentially troubling signal. Economists consider temporary workers a leading indicator because they are the first to be hired during expansions and the first to be let go in contractions.

The lower unemployment rate wasn’t solely due to increased hiring. Instead, 130,000 people left the labor force—more than the number added to payrolls—driving the decline. The number of foreign-born workers, in particular, has decreased for the third consecutive month, reaching its lowest level of the year. This drop may reflect a combination of discouragement, immigration concerns, and a tightening labor environment.

Wage growth in June continued to outpace inflation, offering some relief for workers as their paychecks retained some purchasing power. However, the pace of wage growth has lost momentum. Average hourly earnings rose at their slowest rate since July—a sign that the labor market may be loosening. Slower wage increases suggest that employers feel less pressure to compete for talent, possibly due to uncertainty about the broader economic outlook.

Compounding this slowdown in wage gains was a reduction in the number of hours worked. Many employers have begun trimming hours rather than cutting jobs outright, which often signals caution about future demand. As a result, even though hourly wages edged up, average weekly earnings declined. This decline in weekly pay means that workers may not feel the benefits of nominal wage growth, particularly among lower-wage earners, where reduced hours can make a significant difference in take-home income.

This dual trend—slower wage growth and fewer hours worked—raises concerns about household income stability. When both factors move in the wrong direction, consumer spending, which drives nearly 70% of U.S. economic activity, may begin to weaken. It also adds to evidence that the labor market, while not in crisis, is becoming more fragile beneath the surface. Employers appear to be adopting a wait-and-see approach as they assess the impact of recent policy changes and evolving economic conditions. It typically takes five or six months for the impact of legislation to show up in employment data.

A newly passed tax bill has lowered rates for most individuals and businesses should provide some economic lift. However, a few business sectors—especially those relying on Medicaid funding and renewable energy projects—may see adverse effects, as the bill reduces federal support in those areas.

Meanwhile, the Federal Reserve is expected to keep interest rates unchanged at their next meeting despite ongoing pressure from President Trump to implement cuts. The Fed has indicated that it is closely monitoring economic data, and while inflation remains subdued, it is above the Fed’s 2% target. Payrolls continue to grow, and wage growth exceeds inflation; all support a cautious stance on monetary policy. A decline in June’s Consumer Price Index (CPI) that would bring inflation closer to the Fed’s 2 percent target would strengthen the case for a future rate cut. HRE will publish a summary and analysis shortly after the CPI is released on July 15th.