Key takeaways from the Bureau of Labor Statistics report The Employment Situation – May 2025 include:

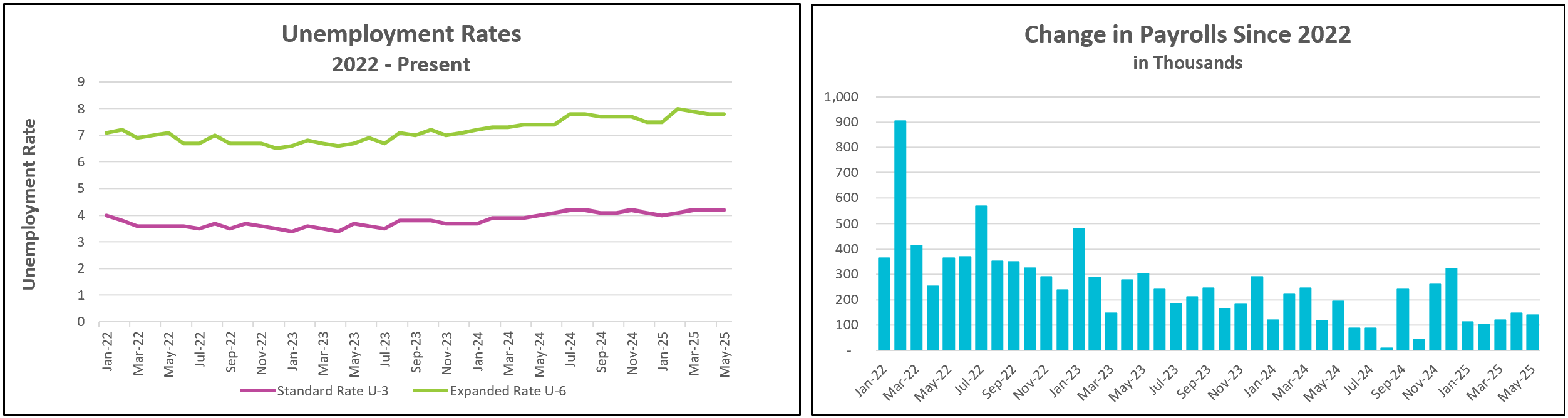

The latest labor market report highlights the resilience of the U.S. job market, surpassing most economists’ expectations. Despite widespread concerns about economic challenges, businesses, especially in service-related sectors, continued to hire. However, there is a noticeable trend of slowing job growth. So far this year, employers have added fewer than 124,000 jobs per month on average, a significant decrease from 168,000 in 2024, 216,000 in 2023, and a strong 380,000 in 2022. This moderation indicates that while the labor market remains solid but, the pace of hiring is slowing down.

The strength in recent hiring has largely been concentrated in the service sector, led by health care, leisure, and hospitality. Gains in health care and social services are more reflective of an aging population than of widespread economic. In contrast, employment in manufacturing declined by 8,000. This trend persists despite ongoing tariff measures aimed at bolstering domestic production, though it remains too soon to assess their full impact.

Employment in the public sector presented a mixed picture. Federal government jobs decreased by 22,000, marking the fourth consecutive month of job cuts, which reflects ongoing austerity measures and program reductions. This figure does not include workers on paid leave or those receiving severance, suggesting that the actual cutbacks may be more significant. Furthermore, it does not fully capture the job challenges and funding cuts affecting the private sector, as many private sector jobs linked to government funding are likely to be lost when funding is reduced. Conversely, state government employment increased, particularly in education-related positions.

Employment rates are less encouraging than what the stable unemployment rate suggests. Although the unemployment rate remained steady at 4.2%, the number of employed individuals actually declined, and the labor force participation rate dropped as 625,000 people exited the workforce. It’s important to note that only those who are employed or actively seeking employment are counted in the workforce. Furthermore, the administration’s aggressive approach to deportation is putting pressure on industries that rely heavily on migrant labor, such as agriculture, hospitality, and healthcare. As the pool of foreign-born workers shrinks, employers may be forced to raise wages to fill positions, ironically tightening the labor market even as hiring slows.

A significant reduction in temporary employment could signal that employers are bracing for an economic slowdown. Economists view trends in temporary jobs as a leading indicator of the economy’s health. When economic uncertainty increases, or demand softens, companies often cut temporary or contract positions before resorting to layoffs of permanent employees. This approach allows them to quickly reduce costs without making long-term cuts to their core workforce.

Still, wages increased by 0.4% last month and are up 3.9% over the past year, outpacing inflation. The Federal Reserve will closely monitor this sustained wage growth and recent economic strength, as higher wages could stoke demand and put upward pressure on prices. This recent strength will likely lead the Fed to resist President Trump’s calls to lower interest rates.