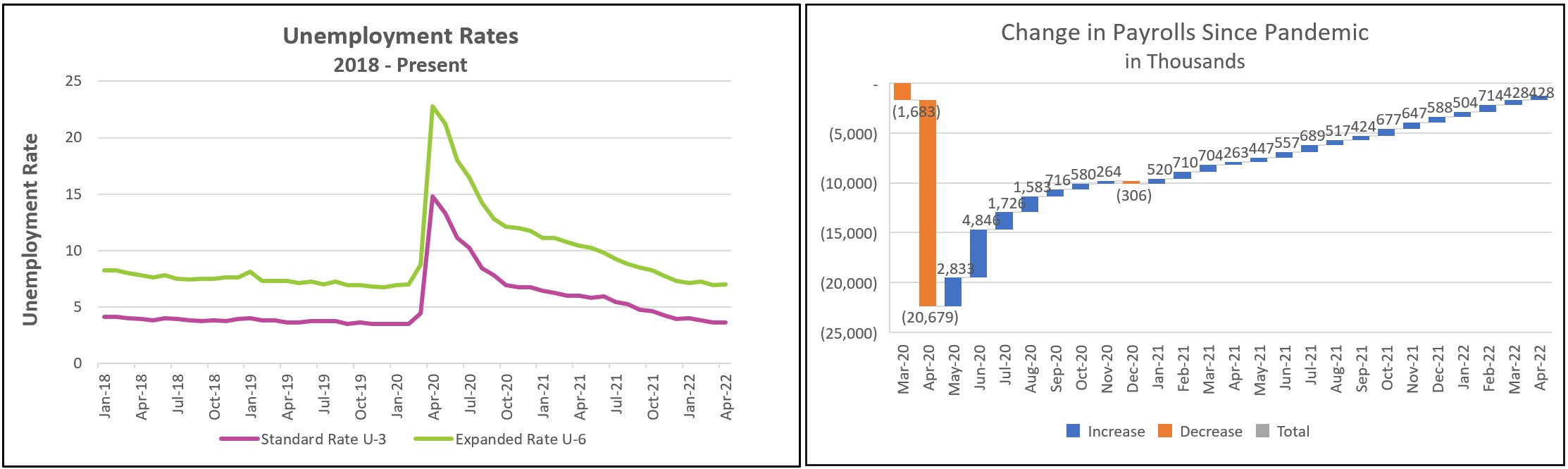

The job market remains very strong. Over 90% of the jobs lost by the pandemic have been restored. But the labor supply has not kept pace with the number of job openings. While real gross domestic product (RGDP) rebounded past pre-covid levels, payrolls remain 1.2 million less than before COVID. Employers are anxious to hire, but there are nearly twice as many job openings as people willing to fill them. Desperate, companies have increased wages and benefits to attract and retain workers. Wages are up 5.5% from a year ago. But despite the pay increase, the increase has been less than inflation, so most households have seen their buying power fall. The continued growth in payrolls is encouraging, but a fall in the participation rate is not. The labor force fell by 363,000 people in April, the first drop since September.

The highlights from The Employment Situation – April 2022 are listed below.

Chairman Jerome Powell summed up the state of the economy in a press conference last week shortly after lifting the federal funds rate by 0.5%.

Labor demand is very strong, and while labor force participation has increased somewhat, labor supply remains subdued. Employers are having difficulties filling job openings, and wages are rising at the fastest pace in many years.

Higher interest rates take time to filter through the economy and slow growth. Economists refer to this as the lag effect, which can be six months or longer. The housing market will likely be one of the first industries impacted. Higher mortgage rates will slow sales. Many buyers may compromise for a smaller home than they would have a few months ago.

Many economists predicted that workers would return to the labor force quickly after the economy reopened. Why have workers been hesitant to return to work? Why is the labor shortage so persistent?

In February 2020, 63.4% of the US population participated in the labor market. Last month 62.2% participated. If the same percentage of civilians participated in the workforce today as in February 2020, approximately three million more workers could fill most of the job vacancies. The participation rate among 25- to 54-year-olds equaled 82.4% in April. Since September, it steadily increased and had almost returned to its pre-pandemic 83% before decreasing slightly in April. Concerns related to the upsurge in COVID cases probably were a deterrent for many, especially families with young unvaccinated children who have had trouble finding good daycare. But participation will likely continue to increase among this group as this surge in COVID fades.

More troubling is that older workers have been slow to return to the workplace. Participation in this group fell by nearly two percent. Many who were nearing retirement chose to retire sooner than initially planned. It is likely that most of these workers will not return to the labor force. Finally, immigration restrictions have prevented many people from working in the US who would have participated in the labor force.

Most of Wall Street’s and the Fed’s attention will continue to be on subduing inflation. But increasing labor participation is necessary to relieve some supply bottlenecks and inflationary pressures. Check back to HigherRockEducation.org shortly after The Bureau of Labor Statistics releases its March CPI report on May 11th for our summary and analysis. It will provide valuable data and insights into whether inflation has peeked.