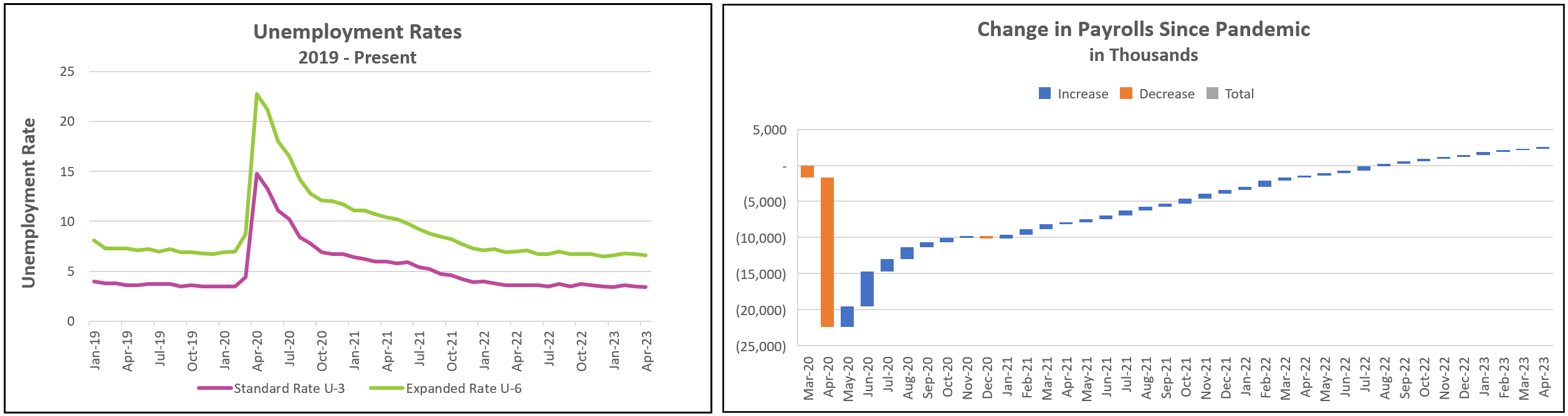

The US labor market surprised analysts by showing its resilience when economic growth slowed. April’s job growth increased, and the unemployment rate fell. Month-to-month wages increased. However, the 12-month payroll and wage readings fell, demonstrating that the weakening of the labor market will be bumpy and prolong the fight to reduce inflation. The highlights from the Bureau of Labor Statistic’s report, The Employment Situation – April 2023 are listed below.

April’s employment report showed little sign the economy is slowing. Employers added 253,000 workers to their payrolls, the most since a significant increase in January. Hiring was broad-based, with the largest gains in professional business services (43,000) and health care (40,000). A contraction in the housing market failed to deter construction companies from adding 11,000 people to their payrolls. However, the overall hiring trend remains lower, evidenced by the lowest six-month average since September 2020, when containment measures temporarily shut down thousands of businesses. The demand for workers needs to fall to reduce inflationary pressures.

Employers have increased wages to attract and retain workers because of a large surplus in job openings. The supply and demand for workers is more balanced than a year ago when there was a surplus of workers. Job openings remain high at 9.6 million, and there are approximately 1.7 available jobs for every available worker. (BLS: Job Openings and Labor Turnover – March 2023) But the gap between job openings and available workers has fallen since a year ago when there were two openings for every unemployed worker.

A 43,000 drop in the civilian labor force helped lower the unemployment rate to 3.4%. (People must be working or seeking employment to be included in the labor force.) The decrease was insufficient to change the participation rate, which measures the percentage of the population in the labor force. But people between 25 and 54 years old, the largest working group, have been returning to the labor force. The participation rate among this group rose to 83.3%, the highest since 2008. Many people who want a job remain on the sidelines. The number of marginally attached workers increased by 191.000 to 1.5 million. These people wanted and were available for work. They had looked for work during the prior 12 months, but not during the four weeks before the survey. Policymakers hope that many of these people reduce the competition for labor by returning to work. An increase in the participation rate or a slowing of the economy would lessen the shortage of workers and reduce the pressure on wages.

Wage increases rose during April, but the 12-month average decreased. The Federal Reserve monitors wages closely because reducing wage inflation is essential in lowering the economy’s inflation rate. Companies frequently increase prices to offset the higher labor cost - especially the service companies where labor is one of their highest costs. When households earn more, they can pay higher prices or purchase more, creating an inflationary spiral.

Earlier this week, the Federal Reserve increased its benchmark rate by 0.25% to a target of between 5% and 5.25%. It was the tenth increase since March 2022. The Fed’s objective is to slow the economy just enough to lower inflation to its 2% target without causing stagflation, the dreaded combination of high inflation and recession. Following his announcement, Chairman Powell hinted there will be a pause in rate hikes to evaluate the economy’s direction – especially after the collapse of Silicon Valley Bank, Signature Bank, and First Republic Bank. Their failure may prompt other banks to tighten their lending guidelines, which means they may require higher credit scores or more collateral before making a loan. Such behavior could slow the economy more than a rate hike.

Potential Congressional inaction from a prolonged battle to increase the debt ceiling could also push the economy into a recession. Default on the federal debt (which has never happened in the United States) would push interest rates higher and possibly cause a global financial crisis.

The employment report suggests that while the economy continues to slow, the fight to contain inflation will be prolonged because the labor market remains strong. We will learn more on May 10th, when the Bureau of Labor Statistics releases Consumer Price Index – April 2023. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.