The hot labor market cooled in August as employers hired fewer workers than in July, more people entered the workforce, and wages increased at a slower pace.

The highlights from The Employment Situation - August 2022 are listed below.

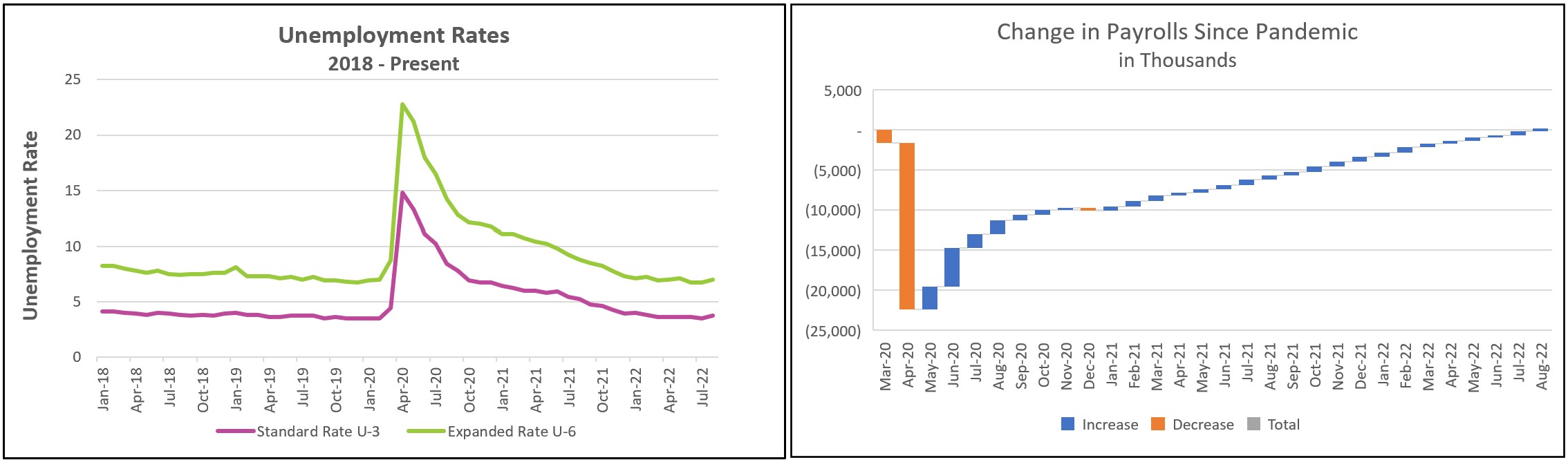

Good news. The unemployment rate increased. The unemployment rate rose because more people entered the workforce. A higher labor participation rate combined with a healthy increase in the number of people working is welcome news, even if the unemployment rate increases. Why? Because a person must be either employed or seeking employment to be included in the labor force.

Two-hundred and forty thousand more workers are employed than in February 2020, before the pandemic forced the termination of millions of jobs. Earlier this month, the Bureau of Labor Statistics reported there were 11.2 million job openings in July, approximately twice the number of available workers. The worker shortage continued to push up wages, but the added workers probably prevented August wages from increasing as much as in July. Hourly wages rose 0.3% in August, compared to 0.5% in July.

The participation rate increased by 0.3% and reached its highest point since the pandemic. Plentiful job openings, higher wages, inflation, a receding pandemic, and depleted savings drew nearly one million people into the workforce. Many found jobs. Payrolls increased by 315,000 workers: fewer than in most months during the recent recovery but more than before the pandemic. Those who could not find work were counted as unemployed.

Job gains were broad-based, but increases in professional and business services, health care, and retail trade were the most significant. Hiring in leisure and hospitality continues but is not as robust as earlier this year. The leisure and hospitality industry suffered the most job losses during the pandemic and still has not fully recovered—the leisure and hospitality industry employs approximately 1.2 million fewer people than before the pandemic began.

The Fed’s strategy may be working. A surging demand and inadequate supply combined push the economy’s price level to an unacceptable level. By increasing their benchmark rate, the Fed’s policymakers hope to slow the economy’s growing demand and provide suppliers time to catch up. Balancing the aggregate supply and demand should provide price stability. However, the policymakers hope for a soft landing, meaning their goal is to slow the economy sufficiently to reduce inflation without throwing it into a recession. A cooling of the labor market helps. More available workers and reduced wage increases lessen inflationary pressures. Containing inflation is more difficult when workers expect a pay increase. Companies respond by raising their prices to cover the added expense. Policymakers are probably encouraged that companies continue to hire amid signs of a slowing economy, higher interest rates, and inflation. The added pool of workers has decelerated wage gains – which should reduce inflationary pressures while providing households with additional income to support consumer spending. However, it is unlikely that this report will sway the policymakers from increasing its benchmark rate by 0.5% - 0.75% in their next meeting on September 20-21.

A healthy economy depends on reducing inflation. Check back to HigherRockEducation.org shortly after The Bureau of Labor Statistics releases Consumer Price Index - August 2022 on September 13th for our summary and analysis.