The US job market is healthy. Employers continue to hire. But the economy shows a few signs that the Federal Reserve’s campaign of raising interest rates to slow growth is working. However, the report sends mixed signals on how the Federal Reserve should respond at its next meeting. Employers continue to hire despite higher interest rates and expectations of an impending recession, while wage inflation subsided moderately because more people entered the labor pool.

The highlights from the Bureau of Labor Statistic’s report, The Employment Situation – February 2023 are listed below.

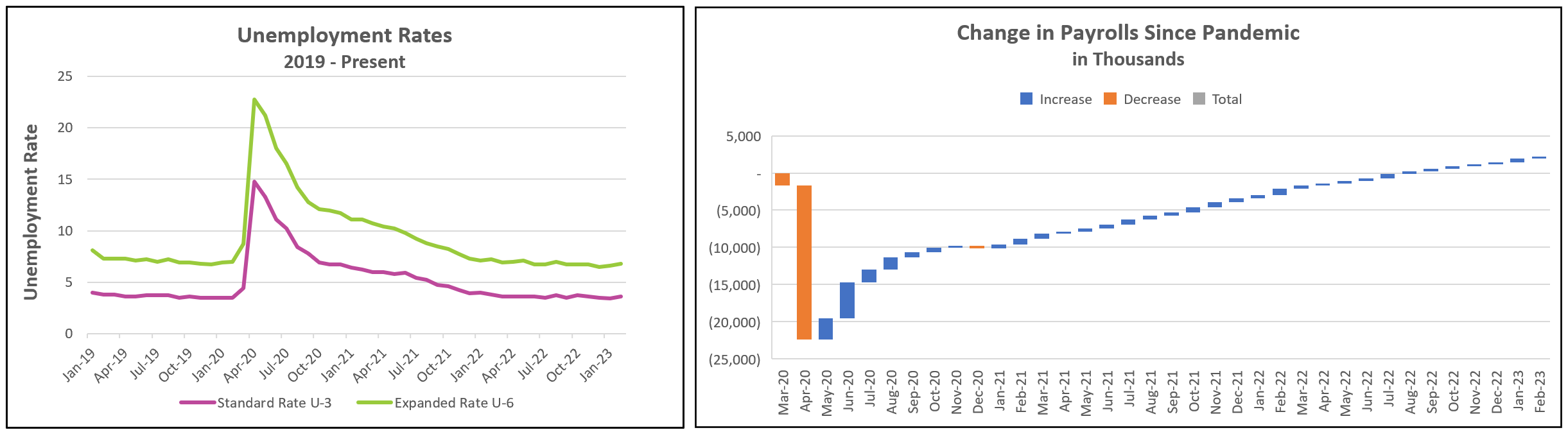

Four hundred and nineteen thousand people returned to the workforce in February. The increase contributed to raising the unemployment rate to 3.6%. (The unemployment rate equals the number of people employed divided by the number of people in the workforce.) Hiring remains robust, so most of the new entrants found jobs. Payrolls increased by 311,000, slightly lower than the 343,000 average over the prior six months but well above 100,000, the number of workers most economists believe need to be added to the workforce each month to replace retiring workers and accommodate the increase in population. Available job openings continue to exceed willing workers by almost two to one. The BLS reported on Wednesday that there were 10.8 million job openings at the end of January, while the number of unemployed rose slightly to 5.9 million people. Job openings fell by 410,000 from December.

The largest payroll gains were in leisure and hospitality (+105,000), retail (+50,000), government (+46,000), professional and business services (+45,000), and health care (+44,000). Most of the job growth has been in smaller service companies that suffered from shutdowns and social distancing requirements during the pandemic. These gains have exceeded the recent layoffs among larger and more prominent tech companies, including Alphabet, Inc. (Google), Walt Disney Co, and Amazon.com, Inc.

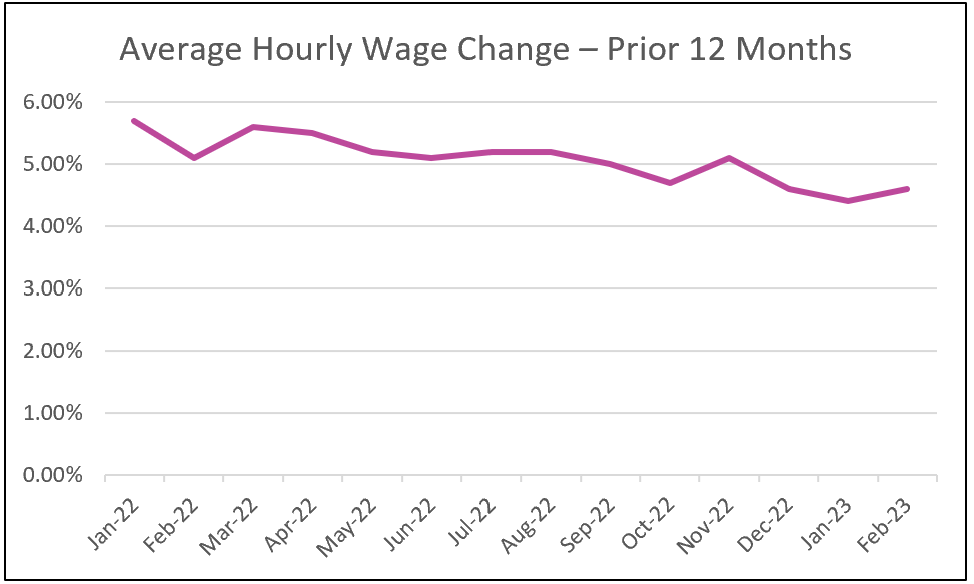

The economy’s greatest threat remains inflation, and a strong labor market poses challenges for the Federal Reserve in its resolve to tame inflation. Higher wages have fueled demand-pull inflation by providing families additional funds to purchase goods and services. Higher labor costs have exacerbated inflation because businesses raise prices to recoup some of their added costs. Fortunately, wage increases slowed in February. The 0.2% increase was the lowest in a year, and the prior twelve-month reading has fallen from 5.7% to 4.6% since January 2022.

January’s reports sparked concern that the economy was heating up, which would hamper efforts to subdue inflation. Payrolls increased by 507,000 (revised from 514,000). The unemployment rate dipped to a 53-year low of 3.4%, and consumer spending reversed course and soared the most in a year after falling for three straight months. January’s PCE price index, the inflation measure favored by policymakers at the Federal Reserve, tripled. Many economists questioned the Fed’s wisdom of only raising its benchmark rate by 0.25%, rather than 0.5%, at their last meeting. Chairman Powell warned the Senate banking committee (see Chairman Powell’s testimony) that policymakers could opt for a larger rate hike at its next meeting if the data shows the economy is not slowing sufficiently to slow inflation. Fortunately, February’s employment report concluded that payroll increases remain too high, but they are moderating. The higher unemployment rate was healthy because it was caused by people entering the labor force, slowing wage increases.

Policymakers at the Federal Reserve will meet on March 21st and 22nd to monitor and adjust its monetary policy. This report does little to dissuade them from increasing its benchmark rate, but the increase will likely be only 0.25%. Beforehand, they will be very interested in the Bureau of Labor Statistics’ monthly publication, Consumer Price Index – February 2023, which is scheduled to be released on March 14th. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.