January’s Employment Situation sparked concerns that inflation could reaccelerate if the economy gained momentum. However, February’s report alleviated these worries. It included a downward revision in January’s data, indicating the labor market was not as strong as previously implied. In February, unemployment rose and wage growth decelerated, yet payrolls continued to grow at an unsustainable rate. The moderate slowdown in wages and job openings will likely be welcomed by policymakers at the Federal Reserve, as it reassures them that growth and inflation are less likely to accelerate once more.

The highlights from the Bureau of Labor Statistics’s report, The Employment Situation – February 2024, are listed below.

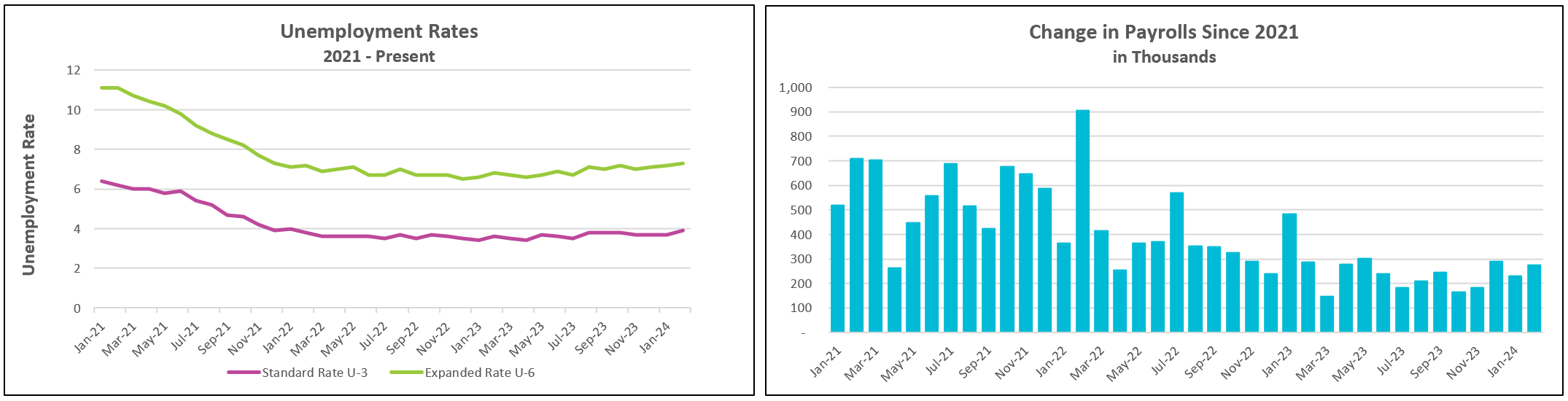

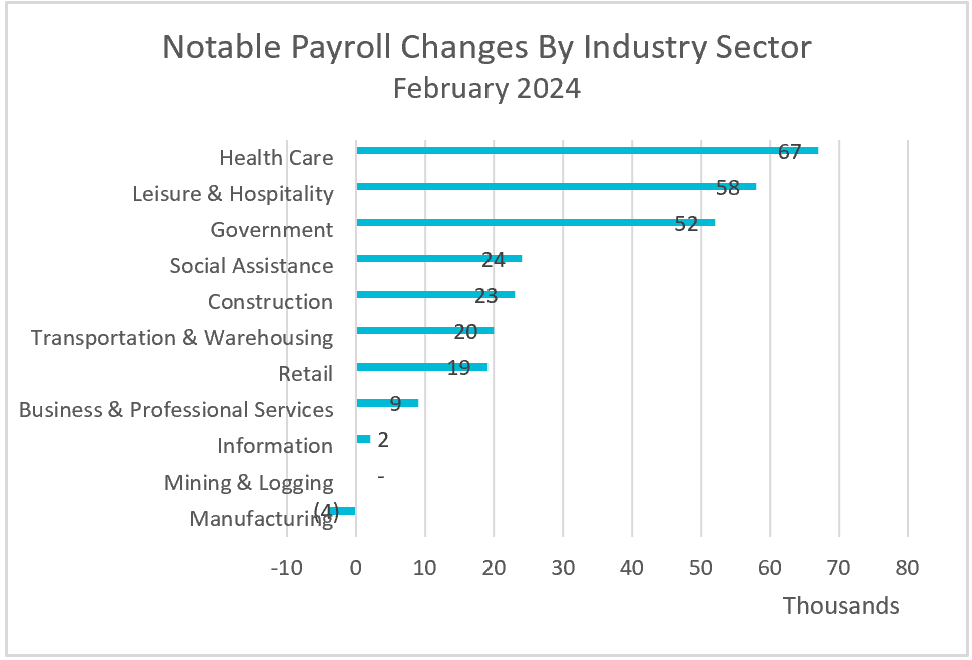

Revisions to the payroll numbers for December and January indicate that the labor market was weaker than initially reported. Both months’ payroll gains were notably lower, with January dropping from 353,000 to 229,000 and December from 333,000 to 290,000. Hiring was broad-based in February, with service industries such as healthcare, leisure and hospitality, government, and social services gaining the most workers.

The Bureau of Labor Statistics employs two surveys to compile monthly employment data: a household survey focusing on employment and demographics, and an establishment survey used to gauge employment by sector, hours, and compensation. In February, the household survey indicated a decrease of 184,000 employed workers, leading to a rise in the unemployment rate from 3.7% to 3.9%. Most economists and statisticians consider the establishment survey more reliable due to its larger sample size and less susceptibility to sampling error. Compared to a year ago, half a million more people are unemployed, primarily due to a one-million-worker increase in the labor force. The broader U6 measure of unemployment, which includes discouraged workers and part-timers, rose to its highest level in 27 months, reflecting increased economic hardship for many.

Federal Reserve policymakers have emphasized the need for wage increases in the service industry to decelerate to near or below the inflation rate to mitigate inflationary pressures. Wages inched up by 0.1%, the smallest increase in two years, sharply down from the 0.6% surge in January. The growth in the labor force and a decline in job openings have contributed to easing the shortage of available workers, thereby alleviating pressure on businesses to raise wages. Recent productivity gains have helped offset inflationary pressures stemming from higher wages as businesses become more efficient in absorbing elevated labor costs without raising prices.

Federal Reserve Chairman Jerome Powell testified before Congress that while the economy is improving, the Fed remains cautious about the risk of inflation resurgence (FRB). The Federal Reserve’s upcoming monetary policy meeting is on March 19th and 20th. Most analysts anticipate the Fed will wait until its June meeting before it begins to loosen its monetary policy. Nevertheless, policymakers will closely monitor the Labor Department’s release of the Consumer Price Index for February on March 12th, representing the final inflation report before the March meeting. Although not the preferred measure, it offers insight into February’s inflation trends. A comprehensive summary and analysis will be available at HigherRockEducation.org after its publication.