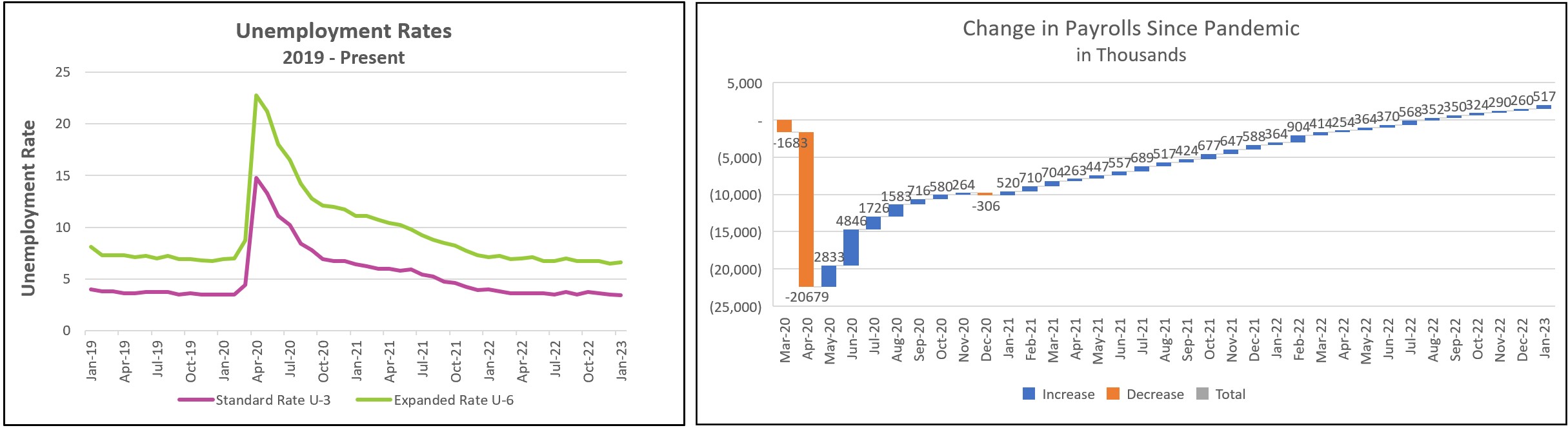

An unexpectedly large increase in payrolls and a drop in the unemployment rate stuns analysts and increases the likelihood that policymakers will extend their tight monetary policy. Payrolls increased by 517,00 workers in January, more than twice the number in December. January also snapped a streak of five straight months of slowing growth. The unemployment rate fell to 3.4%, the lowest since the second quarter of 1969. The labor market remains very strong and poses the greatest challenge to the Federal Reserve in taming inflation.

The highlights from the Bureau of Labor Statistic’s report, US Employment Situation - January 2023 are listed below.

Employment gains were widespread. Leisure and hospitality increased the most but still employ almost 500,000 workers less than before the pandemic. The public sector added 74,000 jobs, but nearly half of the added jobs resulted from ending California academic employees’ strike. (New York Times) Even construction added workers, which is surprising given the recent plunge in residential contraction.

However, recent economic data sent mixed signals about the economy’s direction. The BEA reported that the pace of economic growth decelerated from an annual rate of 3.2% in 2022’s third quarter to 2.9% in the fourth quarter. Consumer spending, which accounts for 70% of economic activity, continues to increase, but the growth rate slowed every month during the fourth quarter.

Many business owners expect a recession. So why would payrolls increase so much? Job openings have exceeded the available workers for most of 2022. In fact, the number of openings increased from 10.4 in November to 11 million in December, increasing the ratio of openings to workers from 1.7 to 1.9 in December. Many companies have lost sales because their service has deteriorated. Businesses are hiring to fill these positions. In January, 900,000 people were added to the labor force. A larger labor pool adds competition for jobs and reduces the pressure for wage increases. Increases in hourly wages, measured on a monthly and 12-month basis, slowed in January.

Policymakers have stressed that cooling the pace of wage increases is a key to slowing inflation because higher wages can finance added consumer spending and increase business costs. Wages are usually the most significant expense of service companies. Higher compensation costs frequently force businesses to increase their prices to protect their profit margins. Recent data have been encouraging. On Wednesday, the Bureau of Labor Statistics reported that the employment cost index rose only 1% during the fourth quarter, the smallest increase in 2022. This index tracks quarterly changes in employee compensation and includes paid leave, insurance, pensions, and social security.

Policymakers at the Federal Reserve increased their benchmark interest rate by 0.25% last week. This report does little to convince them to discontinue their tightening policy. In fact, the labor market’s resilience may convince the Federal Open Market Committee (FOMC) to continue its tight monetary policy longer than first anticipated. However, members of the FOMC will be very interested in the Bureau of Labor Statistics’ monthly publication, Consumer Price Index – January 2023, which will be released on February 14th. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.