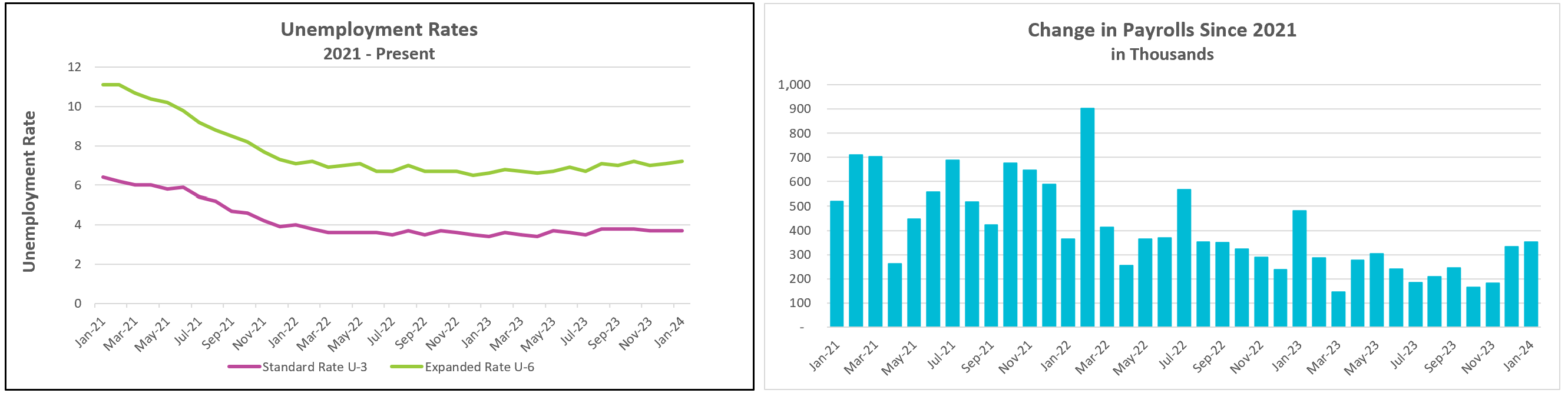

Most economists anticipated that economic growth would ease and impact the labor market. However, the surge in payroll growth, totaling 353,000—the highest since last January—defied most experts’ expectations. Moreover, the revised data for 2023 revealed that the US economy added 3.1 million jobs, surpassing the initial estimate of 2.7 million. Wage increases continued to outpace inflation. The substantial growth in payrolls and higher wages played a crucial role in sustaining consumer spending, the primary driving force of the economy. However, these positive trends have also contributed to delaying potential rate reductions by Federal Reserve policymakers. Unemployment held steady at 3.7% for the fourth consecutive month.

The key findings from the Bureau of Labor Statistics’s report, The Employment Situation – January 2024, are outlined below.

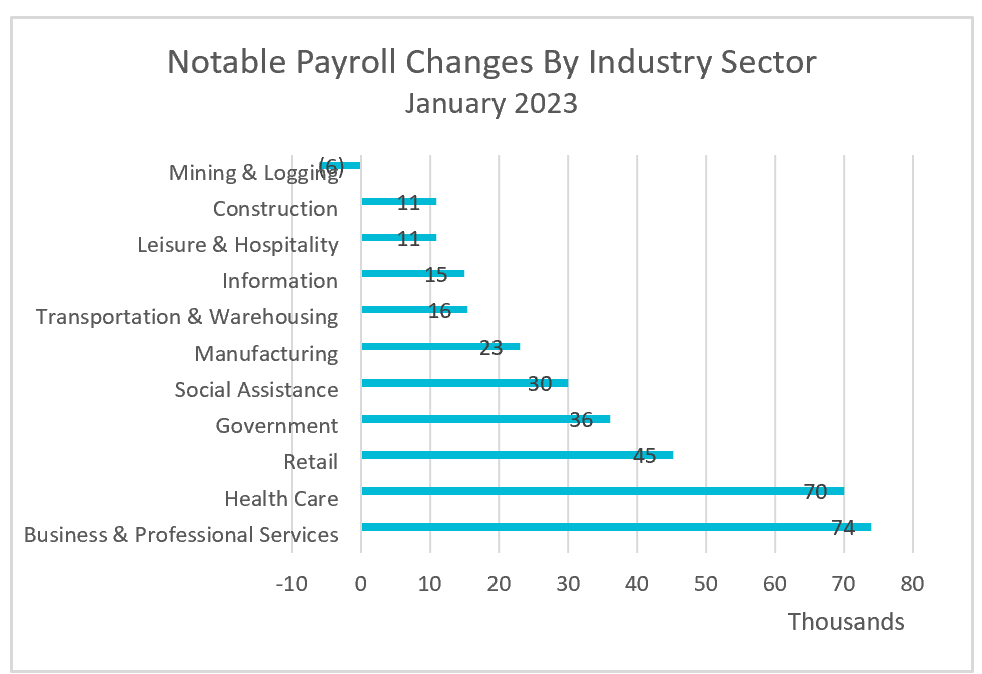

The BLS revised many of the employment figures throughout 2023. Most were higher in the latter part of 2023 which indicate that the labor market is more robust than initially estimated. January’s payroll growth was widespread, with professional business services experiencing the most significant increase, while only the mining and logging sectors reported a decline in workers. The table below summarizes January’s payroll changes by industry sector.

It is noteworthy that the unemployment rate held steady at 3.7% despite the uptick in payrolls, a slight decrease in the labor force, and no change in the participation rate. How can this be explained? The answer likely lies in the fact that the Bureau of Labor Statistics relies on two surveys: a household survey focusing on employment and demographics and an establishment survey used to assess employment by sector, hours, and compensation. The Census Bureau provides much of the population data. If population growth is underestimated due to factors like immigration, it could lead to understating the unemployment rate. A higher unemployment rate would place less pressure on businesses to raise wages.

Wage growth continues to exceed inflation; however, a notable decline in the average workweek has resulted in a slight reduction in weekly compensation. Harsh weather conditions, including bitter cold and severe storms, likely account for abbreviated workweeks and the subsequent decrease in compensation. (The average workweek was the shortest since March 2020.) Despite wages being 4.5% higher than a year ago, average weekly compensation only experienced a 3.0% growth. Policymakers find encouragement in the recent improvement in productivity over the past three quarters, as reported by the Bureau of Labor Statistics (BLS), indicating that businesses are better positioned to absorb elevated labor costs without necessitating price increases.

Federal Reserve policymakers have suggested they are done raising their benchmark rate. The current speculation revolves around the timing of their decision to initiate a rate reduction. This report reduces the probability of a rate cut soon, given the persistent strength in the labor market and consistent wage growth. It raises concerns about the labor market’s robustness, potentially exerting upward pressure on wages and subsequently contributing to inflationary trends. On a positive note, this is one report and inflation is on a downward trajectory without causing a concurrent increase in unemployment. The sustained economic growth and lower inflation enhance the outlook for achieving a soft landing.

Policymakers will closely monitor the Labor Department’s release of the Consumer Price Index – January 2024 on February 13th. The key question is whether inflation continued its moderating trend in January. Following the release, you can access our thorough summary and analysis at HigherRockEducation.org.