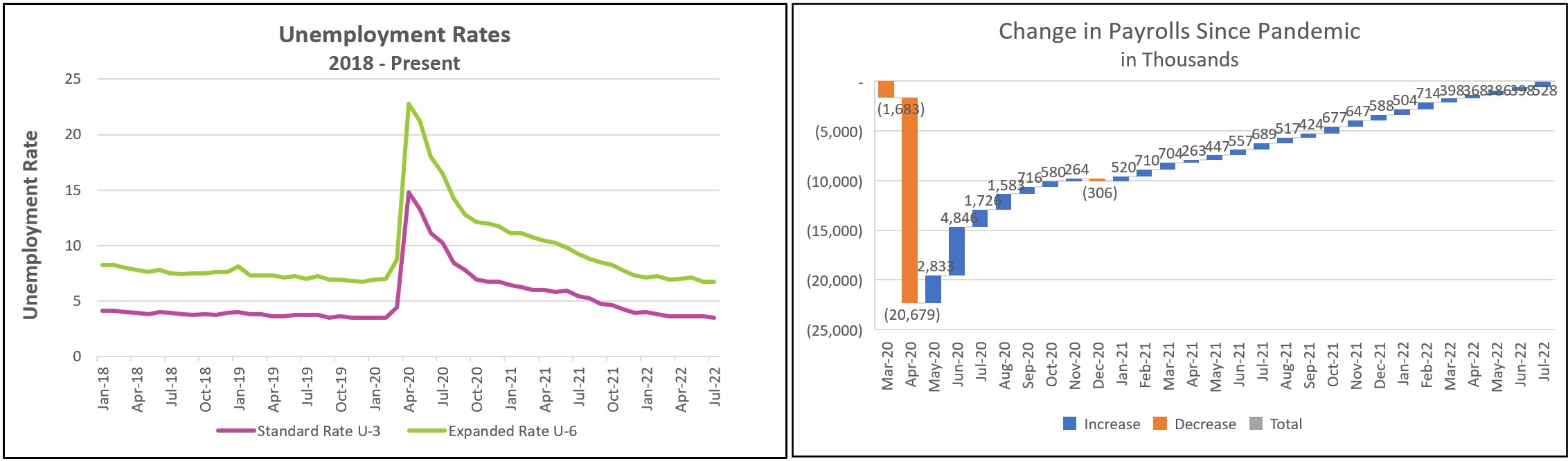

Employers hired more workers than expected in July, bringing the total employed to a level not seen since the pandemic began. The increase weakened concerns of an imminent recession but also raised the probability that the Federal Reserve policymakers will continue its aggressive strategy of increasing its benchmark rate to slow inflation.

The highlights from The Employment Situation – July 2022 are listed below.

The labor market picked up steam as more workers were added to payrolls in July than in the prior five months, lowering the unemployment rate to 3.5%. Payrolls for May and June were revised upward by 28,000 workers. Payroll gains were broad-based, with nearly every industry adding workers. Leisure and hospitality companies employed 96,000 more people but remained 1.2 million less than in February 2020, when the pandemic began. Employment in the professional business services industries rose by 89,000 and employs 986,000 more than when the pandemic began. Seventy thousand more health workers were employed, but health care remains 78,000 payrolls lower than February 2020. The government added 57,000 people to its payrolls but employed 597,000 fewer people than before the pandemic. Most of the government’s deficiency is in local government affiliated with education.

Why would employers continue hiring following two quarters of falling production and speculation that the economy is in a recession? Because, despite the contraction, there remains a shortage of workers to produce goods and provide the services demanded. Job openings have exceeded available workers since the economy began its recovery. At the end of June, there were approximately 10.7 million job openings and nearly six million unemployed people who were seeking work, according to the Department of Labor.

However, the demand for workers began to show signs of falling. At the end of June, there were 605,000 fewer job openings than at the end of May. Furthermore, several companies, including Target, Wal-Mart, Ford, Microsoft, and Netflix, have either started laying off employees or announced hiring freezes in anticipation of a slowing economy. Most economists expect the demand for labor will continue softening as the Federal Reserve continues to push up interest rates to contain inflation.

An imbalance between the supply and demand for workers has added inflationary pressures. Early in the recovery, consumers were flush with cash and purchased many goods. However, suppliers could not produce the goods fast enough because they lacked workers. They increased wages to attract workers while raising their prices. But the labor shortage persisted with the number of job openings consistently exceeding the number of available workers. Will inflationary pressures subside now that payrolls have returned to their pre-pandemic level? Not much. The average hourly wage increased 0.3% in the three preceding months but 0.5% in July. Employers will continue to bid up wages to attract and retain employees if the shortage of willing workers continues.

The labor market’s strength will probably prevent the current period from being classified as a recession despite the two consecutive quarters of reduced output. (The National Bureau of Economic Research officially identifies when a recession begins and ends.) However, the report increased the Fed’s probability of continuing its aggressive monetary policy and raising interest rates to reduce inflation. Policymakers had hoped a lower demand for workers would diminish wage increases. Containing inflation is more difficult when workers expect a pay increase. Companies respond by raising their prices to cover the added expense.

Higher interest rates will eventually reduce the demand for labor. It usually takes six months for the economy to reflect monetary policy changes. Economists expect employment will initially fall in interest-sensitive industries such as home construction, real estate, and the automotive industry and then ripple through most of the economy. As the cost of living increases, more people will return to the workforce. In time, reducing the demand for workers while increasing the supply of workers will lessen inflation.

A healthy economy depends on reducing inflation. Check back to HigherRockEducation.org shortly after The Bureau of Labor Statistics releases its July CPI report on August 10th for our summary and analysis.