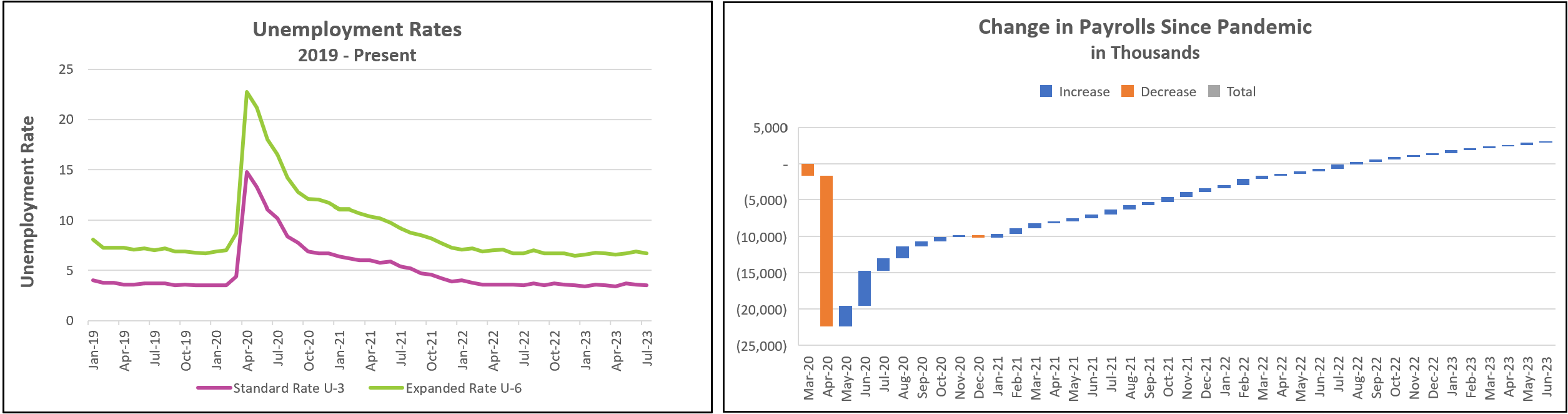

Hiring and total compensation trends indicate the labor market remains strong but is beginning to soften. Policymakers welcome the news because it should ease inflationary pressures. The unemployment rate returned to near its 50-year low as more people were hired than returned to the labor market.

The highlights from the Bureau of Labor Statistic’s report, The Employment Situation – July 2023, are listed below.

Employers continue to hire at a healthy clip, but this report showed some easing in the labor market. Indeed, 187,000 people were added to payrolls in July, up from a revised 185,000 in June. But the overall trend is lower. Since the beginning of the year, the three-month rolling average of people added to payrolls has fallen from 384,000 to 218,000. That is welcome news for policymakers at the Federal Reserve, which raised its benchmark rate last week in their efforts to lower inflation. Chairman Jerome Powell remarked, “What we’re looking for is a broad cooling in labor market conditions, and that’s what we’re seeing.” (Press conference July 26, 2023)

The gap between the supply and demand for labor narrowed in July. The unemployment rate ticked down to 3.5% because more were hired than entered the workforce, but employers have fewer job openings. In a separate report, the Bureau of Labor Statistics reported that on the last day of June, job openings decreased to 9.6 million, the fewest since April 2021. However, the worker shortage persists. Approximately 1.6 jobs are available for every unemployed worker, but that is down significantly from over a 2 to 1 ratio earlier in the year. Workers were slower to quit their jobs, indicating they were less confident they could find a new one quickly.

Despite wages increasing more than inflation, weekly compensation increased only 0.12% because the average workweek was shorter. That compares to 0.74% between May and June. A shorter workweek could be a sign of a softening of the labor market since employers usually cut hours before they lay off workers. Businesses are also cutting their temporary workers by 22,000. Temporary workers are a leading economic indicator because they are some of the first hired early in an expansion and the first to be cut when businesses need to cut back.

The lion’s share of job gains was in healthcare, which added 63,000 to payrolls. There were also small gains in social assistance, financial activities, wholesale trade, construction, leisure and hospitality, and government. Employment in the retail trade, leisure and hospitality, and leisure and hospitality industries remain below prepandemic levels. Construction payrolls increased despite the jump in mortgage rates. It is likely the result of a surge in the building of manufacturing facilities fueled by the Reduction Act and CHIPS Act passed last year to promote domestic manufacturing. Higher mortgage rates impeded residential construction, which lost 5,500 workers.

The full impact of the rate hikes can take years to filter through the economy, making it probable that the influence of the past hikes has yet to run its course. Policymakers at the Fed will likely pause its rate hikes to monitor the effect of past rate increases. But policymakers will receive another employment report and two inflation reports before it meets in September. The July consumer price index will be released on Thursday. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.