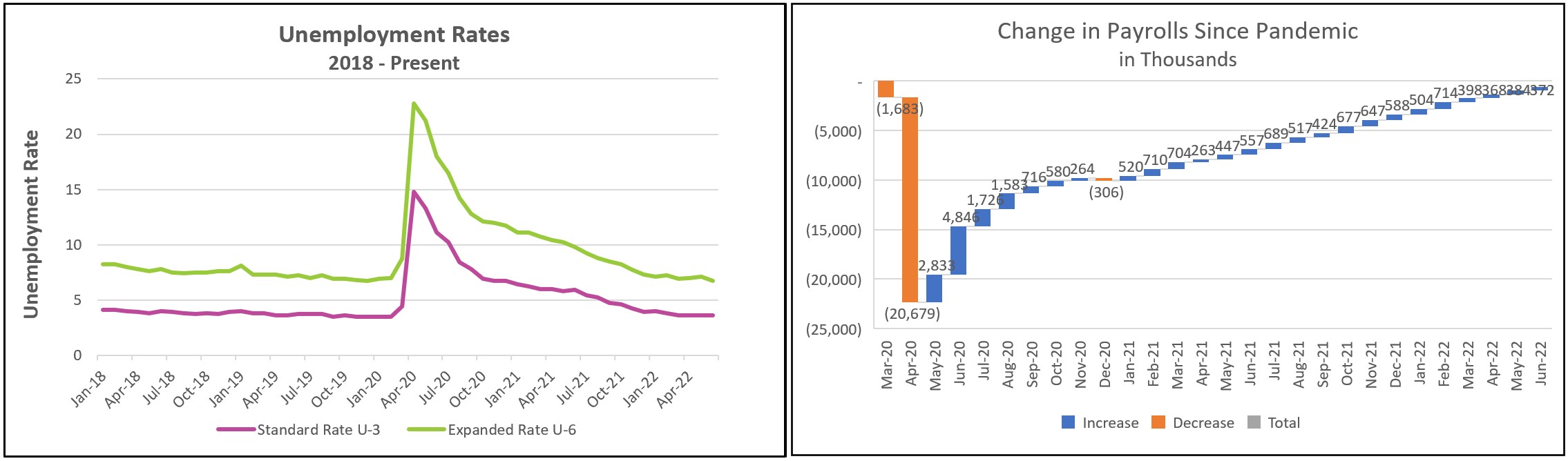

Employers continue to hire at a robust rate, and the economy only remains half a million jobs shy from just before the pandemic. The unemployment rate remains near its historical low, and approximately two jobs are available for every person willing to work. Employers continue to bid up wages. These trends are not indicative of a recession. Yet, many economists believe the economy is already in or on the precipice of a contraction. In fact, the strong labor market may increase the likelihood of a recession by encouraging the Fed to raise interest rates further to combat inflation when what is really needed is for more people to return to work.

The highlights from The Employment Situation – June 2022 are listed below.

Employers continue to hire at elevated levels despite signs of a weakening economy caused by high inflation, thereby putting the Federal Reserve’s policymakers in a bind. June’s employment report implies that the economy is not in a recession and complicates the Fed’s challenge of reducing inflation. Recently policymakers at the Fed have remained focused on reducing inflation, which remains near its 40-year high. Inflation has diminished most consumers buying power and lowered their quality of life, mainly because the cost of housing, food, and energy prices have been among the largest. Yet many economists worry that the Fed’s measures to curb inflation could push the economy into a recession.

Presently aggregate supply and aggregate demand are out of balance. Decreasing the economy’s aggregate demand, increasing its aggregate supply, or a combination of both would reduce inflationary pressures. Those who believe in reducing the aggregate demand hoped for a weaker jobs report, with a moderate payroll increase that would add less pressure on wages. Proponents of increasing the aggregate supply hoped more people would have returned to work to fill job vacancies.

Payrolls increased in every major sector except the government. Payrolls now exceed February 2020 levels in the private sector but remain lower in the public sector. The service industries continue to add the most workers. While the number of workers has almost rebounded to where it was before the pandemic, it is far short of where it should be when considering the population growth. If today’s participation rate equaled February 2020’s 63.4%, then today’s labor force would include approximately three million more people. But unfortunately, COVID continues to impact the workforce. In June, 2.1 million people could not work or worked fewer hours because COVID caused their employers to close or lose business. That is up from 1.8 million in May. Adding three million more workers would relieve some of the wage pressures and increase the supply of goods and services while reducing inflation.

The low participation rate also explains the low unemployment rate. Unemployment would approach 5.5% if it matched February 2020. A decrease in available workers prevented the unemployment rate from rising. (A person must actively seek employment during the prior four weeks to be considered unemployed.) COVID prevented many people from seeking employment. In June, 610,000 people wanted to work but were not included in the labor force. That is up from 455,000 in May.

The Federal Reserve cannot force people to work, so its policymakers have focused on reducing the economy’s aggregate demand. They hope to reduce the demand for many goods and services by increasing interest rates. Slowing the economy will also slow worker demand and ease pressure on wages. But it is hard to visualize a significant easing of wages before the ratio of job openings to workers improves. The BLS reported that there were 11.3 job openings last week, nearly twice the number of unemployed people. Indeed, wages gained 0.3% in June. Companies may be more reticent to lay off workers if they fear they will have difficulty replacing them when the economy begins to prosper. Higher wages fuel inflation because employers often increase prices to cover their added labor costs. However, wages are presently not keeping pace with inflation, and families are losing buying power. Higher prices are the primary reason consumer confidence fell to a record low. Lower consumer sentiment and disposable income explain last month’s fall in consumer spending. Continued inflation and a strong labor report will push the Fed to act more aggressively in containing inflation by reducing the economy’s aggregate demand.

There is some evidence that the Fed’s strategy is working. Tesla, Netflix, Carvana, and Redfin are among the companies that have recently announced laying off workers. Other signs of a slowing economy include: a drop in consumer spending, higher mortgage rates and residential prices have reduced the demand for housing and slowed construction of new homes, and the stock market tumbled into bear territory.

A healthy economy depends on reducing inflation. Check back to HigherRockEducation.org shortly after The Bureau of Labor Statistics releases its June CPI report on July 13th for our summary and analysis. It will provide valuable data and insights into whether inflation has peeked.