US Labor Market Remains Strong But Shows Signs of Weakening. Is That Bad?

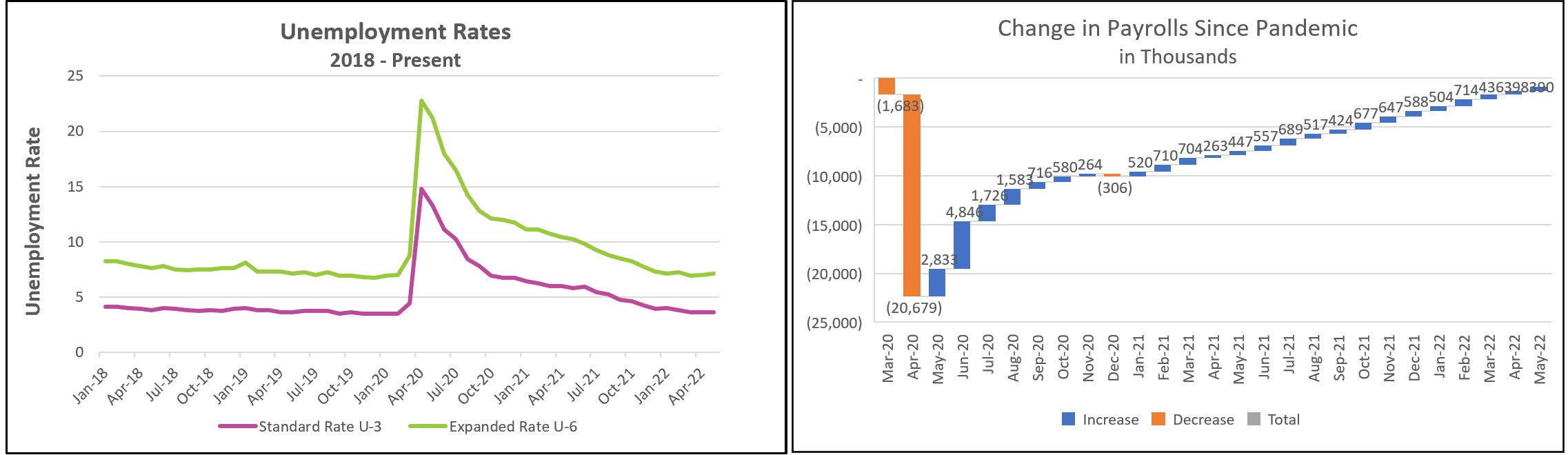

May’s employment report describes a strong labor market. Wall Street’s initial reaction was a 1.4% selloff of the S&P 500. Why? Usually, a significant increase in payrolls, a steady and low unemployment rate, and increasing wages are welcome news. But this report points to a very resilient labor market that could fuel higher inflation. Policymakers hope that while employment and wages continue to grow at an unsustainable pace, each decreased in May, providing signs that the economy is cooling, confirming their belief that they can raise interest rates to reduce inflation without sending the economy into a recession.

The highlights from The Employment Situation – May 2022 are listed below.

The balance of the supply and demand for labor improved in May. Businesses hired fewer people than in any month since April 2021. Meanwhile, more people entered the labor force. But a labor shortage remains, with almost two openings for every unemployed person. This imbalance is particularly true in the service sector. Consumers have shifted their spending away from goods toward services as the economy emerges from the pandemic. The leisure and hospitality industries added 84,000 jobs. Meanwhile, retail lost 61,000 jobs. Earlier this week, the Bureau of Economic Analysis reported that consumer spending increased 0.9% in April, confirming that the demand for goods and services remains strong. Businesses have tried to meet the demand, but finding the needed workers has been challenging. Companies have raised wages and benefits to attract workers while increasing their prices to offset their higher labor costs. Economists fear an inflationary spiral of continuous wage increases followed by price increases.

Wages are 5.2% higher than a year ago, but the increase in income remains less than inflation. Last month the consumer price index rose 8.3%. Necessities such as food and gasoline rose more than 5.2%, which means that income gains for the average household were insufficient to meet the higher cost of living. Yet most economists are encouraged that wages increased less in May than in April when measured over the prior 12 months. Policymakers and Wall Street fear that continued high inflation levels will trigger a recession if consumer purchasing power drops significantly. Higher prices would discourage sales, which eventually would lessen labor demand. This group is encouraged that payrolls fell, and wage increases cooled slightly. Most would like to see the economy cool a bit more. They believe that moderate wage growth is essential in curbing inflation.

Economists are also pleased by the increase in the labor participation rate from 62.2% in April to 62.3% in May. Higher wages, inflation, and the depletion of household savings have probably enticed many people to return to the labor market. However, participation remains less than before the pandemic, when the labor participation rate equaled 63.4%. If 63.4% of the population were either working or seeking employment, it would increase the labor force by 2.8 million. Continued improvements in labor participation would help slow the inflationary spiral by restraining wage growth.

The Fed has the challenging charge of controlling inflation while maintaining low unemployment. Policymakers have increased its benchmark rate twice and intend to raise it at least another full percentage point before the end of the year. Their objective is to dampen aggregate demand, especially for interest-rate sensitive goods. The housing market has cooled. According to the National Association of Realtors, existing-home sales fell 2.4% from March and 5.9% from a year ago April. Sales have decreased for three straight months. Higher rates should reduce the demand for labor in other industries as well because some businesses may curtail expanding operations, either because the cost of borrowing money is too high or because they expect growth in the demand for the good or service they offer will subside.

Economists expect the Fed to increase the federal funds rate by half a percent when it meets on June 14th and 15th. Policymakers hope this report points to a trend where the participation rate continues to climb, the gap between the number of job openings (demand for workers) and the labor force (supply) continues to narrow, and wage increases subside.

Check back to HigherRockEducation.org shortly after The Bureau of Labor Statistics releases its May CPI report on June 10th for our summary and analysis. It will provide valuable data and insights into whether inflation has peeked.