The Federal Reserve had hoped wage and inflation pressures would ease after implementing ten rate hikes aimed at reducing inflationary pressures by slowing the economy. But the employment report provides a mixed picture, putting policymakers in a dilemma. Unemployment rose because fewer people were employed while more people entered the workforce. Wage increases failed to keep up with inflation. However, employers stepped up their hiring to the highest level since January. Should policymakers at the Fed increase rates again? Many economists believe more time is needed for the impact of past rate increases to filter through the economy. Continuing to increase rates increases the risk of triggering a recession. But other economists believe that not raising them prolongs inflation.

The highlights from the Bureau of Labor Statistic’s report, The Employment Situation – May 2023 are listed below.

The Bureau of Labor Statistics (BLS) most recent employment situation report provides valuable insights into the state of the job market. The information is compiled using two surveys: one that polls households and another that polls businesses. However, these surveys send mixed messages, creating a complex picture of the current employment landscape.

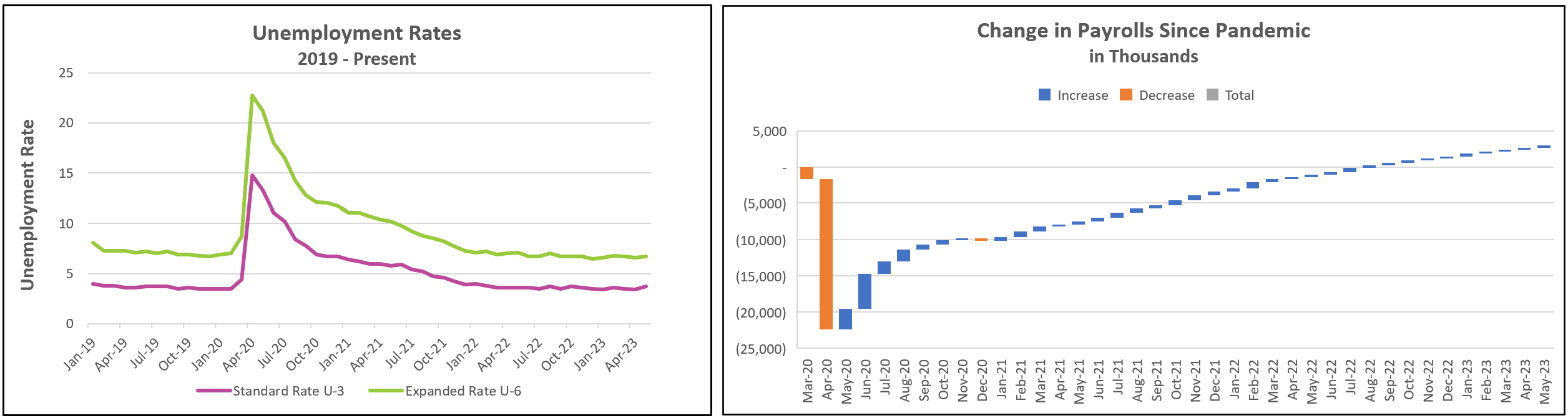

Let's start with the household survey, which gauges unemployment, and the size and demographics of the labor force. Surprisingly, this survey reveals higher unemployment rates and fewer employed individuals. On the other hand, the business survey, which focuses on payrolls, continues to show significant job growth. This contrast raises some questions about the overall health of the labor market.

One factor contributing to this disparity is the inclusion of self-employed workers in the household survey. They are not in the payroll survey. The number of self-employed fell by 369,000, which would increase the unemployment rate if they did not find alternative employment.

Another noteworthy observation is the influx of individuals between the ages of 25 and 54 into the workforce. The participation rate of this prime-age group has risen to 83.4%, reaching a level not seen since 2007. This surge has led to a 130,000 increase in the labor force. However, 310,000 fewer people had jobs, resulting in 440,000 more unemployed individuals. (A person must either be employed or actively seeking employment to be included in the labor force.)

Despite these mixed signals, an upward revision of payrolls in previous months indicates the durability and strength of the job market, particularly in the service industries, such as professional and business services (+64,000), government (+56,000), healthcare (+52,000), and leisure and hospitality (+48,000). In contrast, the goods-producing industries only added a modest 26,000 workers.

The employment situation report leaves the Federal Reserve in a quandary. On the one hand, the significant increase in payrolls showcases the continued strength of the labor market, potentially prompting the Fed to consider raising its benchmark rate at the next meeting. However, a higher unemployment rate and signs of a cooling economy may lead policymakers to pause rate hikes. Wage increases were lower in the recent period, and the average workweek shrunk to 34.3 hours, the lowest since April 2020. Consequently, workers experienced only a minimal increase in weekly compensation, falling significantly short of inflation. Although a cut in the workweek often precedes layoffs and hiring freezes, the extent of this cutback remains relatively minor. Most economists believe the Fed will adopt a wait-and-see approach, monitoring the effects of previous rate increases. The upcoming release of May’s consumer price index could influence the Fed’s decision during their June meeting.

Despite these uncertainties, the overall economy remains resilient. Consumer spending remains robust, employers continue hiring, and nominal wages are gradually increasing. Additionally, the sales of new homes (but not existing homes) have experienced an uptick, reflecting consumer confidence in the housing market. However, it’s important to note that the ratio of job openings to available workers, although slightly decreased, still indicates the likelihood of wage pressures persisting.

The employment report provides a complex and nuanced view of the job market, but the fight to contain inflation will be prolonged because companies continue to hire. We will learn more on June 13th, when the Bureau of Labor Statistics releases Consumer Price Index – May 2023. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.