Hiring rose from October while wages increased, and the unemployment rate fell. However, these developments do not suggest an economic resurgence or a compelling case for policymakers at the Federal Reserve to raise rates at next week’s FOMC meeting. Instead, the report affirms that the current contractionary monetary policy is effective and will likely lead to a controlled and gradual economic slowdown, indicative of a soft landing.

The highlights from the Bureau of Labor Statistics’ report, The Employment Situation – November 2023, are listed below.

Job gains continued to be the most prevalent in health care (+77,000), government (+49,000), and leisure and hospitality (40,000). Hiring was heaviest with service providers, while businesses selling goods experienced a smaller increase or drop in employment. Health care and government services are not tied to economic growth, which may partially explain why they added the most workers. Notably, manufacturing companies added 28,000 to their payrolls, but 30,000 were workers returning to their jobs following the resolution of the United Auto Workers strike. Surprisingly, the retail sector reported 30,000 fewer workers in November compared to October, a noteworthy observation given that November traditionally marks the start of the holiday shopping season.

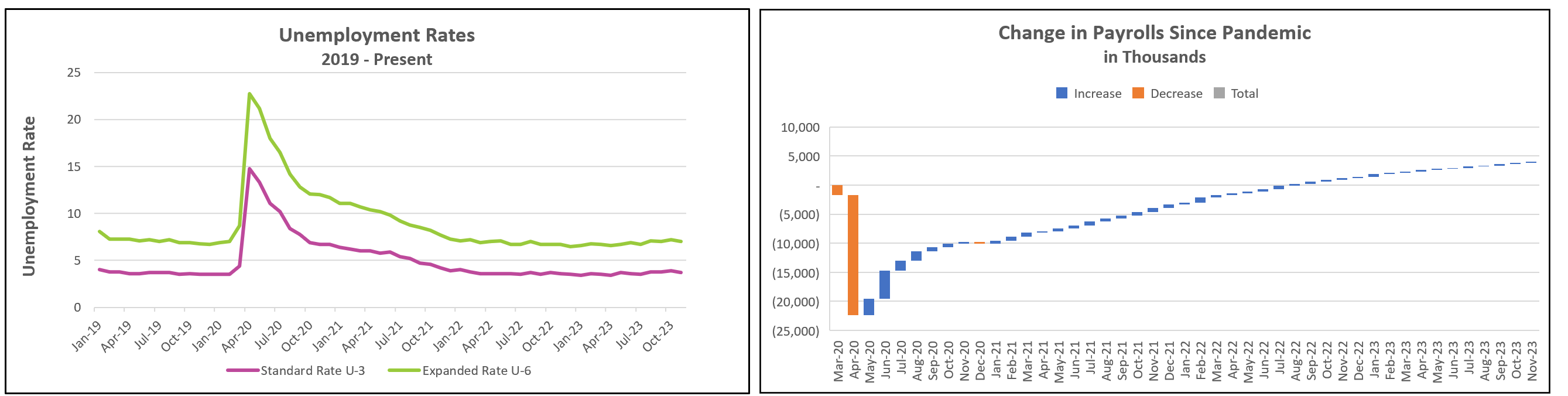

Employers are scaling back their hiring. Analysts use rolling averages to identify trends and quiet short-term volatility. The six-month moving average of payroll gains equaled 186,000, the lowest since the onset of the pandemic. Between September and October, the number of job openings fell from 9.4 to 8.7 million, according to the Job Openings and Labor Turnover Summary, published by the Bureau of Labor Statistics earlier this week. Meanwhile, more people entered the workforce. In October, there were approximately 1.3 job openings for every unemployed worker, a notable improvement from earlier in the year when the ratio was 2 to 1. Economists expect wage growth to be more restrained due to a more balanced alignment of labor supply and demand.

Most economists had expected the unemployment rate to increase as more people entered the workforce and had difficulty finding a job. Instead, it fell to near its 50-year low because of the success of those seeking employment. The combination of more people entering the workforce and finding jobs has lowered the unemployment rate to near its 50-year historical low.

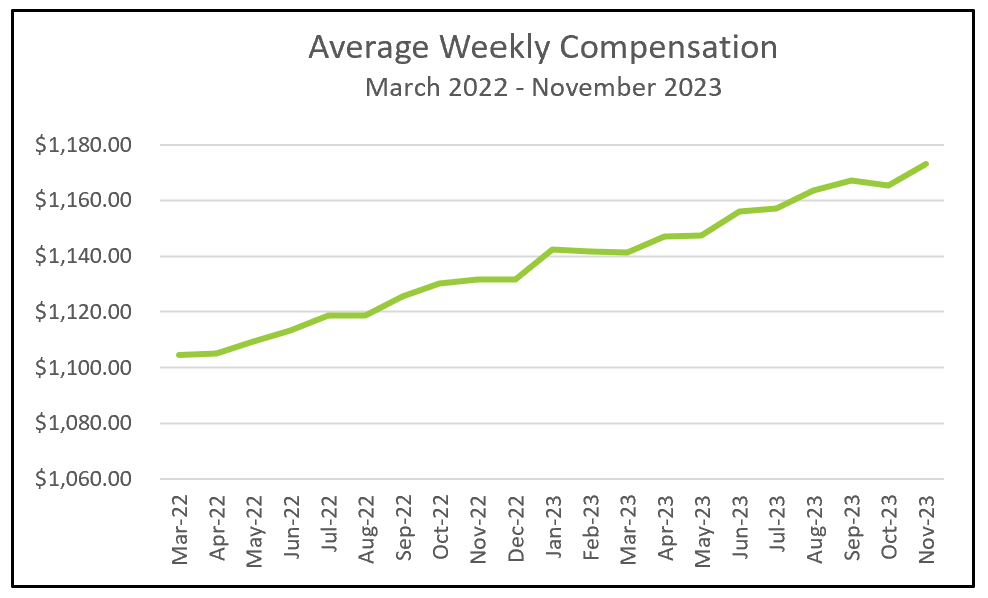

Workers continue to benefit from a tight labor market. The average weekly compensation has continued to increase throughout 2023 despite employers reducing working hours. The percentage increase observed in November was surpassed only by figures from January and June. However, November’s notable surge was partly influenced by a drop in compensation during October. Wages experienced a 0.35% increase, a substantial decrease from late 2022 and early 2023 when growth approached 0.5%.

Policymakers at the Federal Reserve could interpret this report as indicative of a resurgence in the labor market and heightened inflationary pressures. Notably, payrolls and wages increased at a faster clip than in October. Despite these concerns, I believe policymakers will be encouraged by the overall trends in hiring and wages. Their next meeting is December 12-13. It is doubtful that they will raise their benchmark rate. However, the labor market’s strength also reduces the probability Fed officials will begin reducing their benchmark rate early next year. Policymakers will pay attention to the Labor Department’s publication of the Consumer Price Index - November 2023, released the morning of the first day of their meeting. Refer to Higher Rock’s report for a comprehensive summary and analysis early next week.