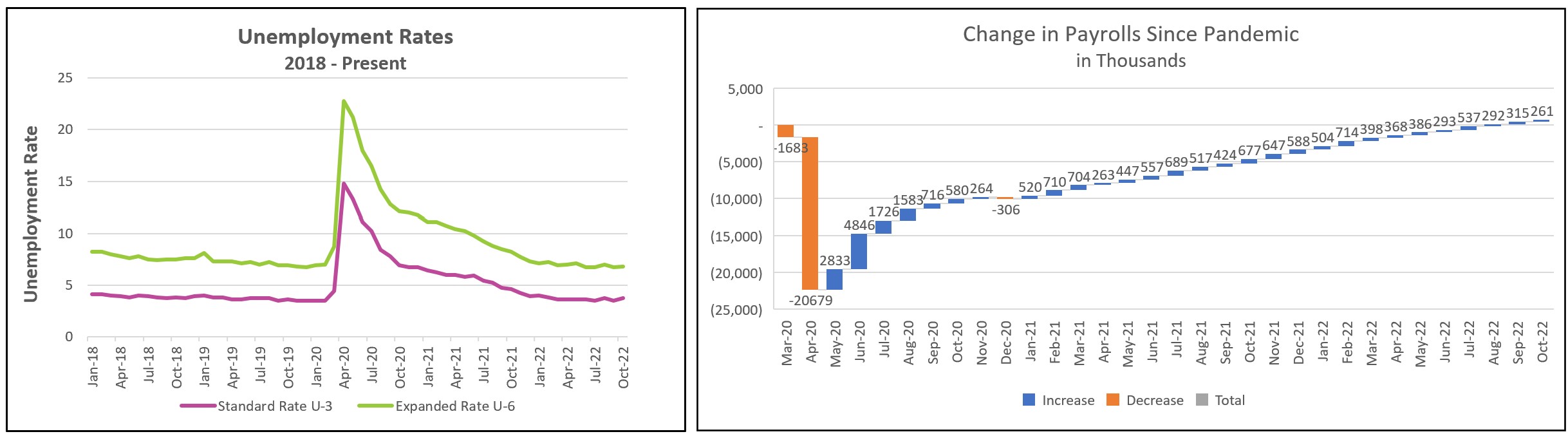

Businesses continue to compete for labor, pushing up wages and hampering the Federal Reserve’s policymakers’ efforts to lower inflation. Payrolls increased for the 22nd consecutive month, but growth has slowed from its 400,000+ pace earlier in the year, suggesting that the labor market is moderating. Hiring was widespread, with healthcare leading the way. A reduction in the labor force and an increase in job openings widened the gap between willing workers and available jobs to 1.9. Wages increased, but inflation has exceeded pay raises for the past year, adding hardship to many Americans. The strong labor report is good for workers. However, it increases the challenge to tame inflation for the policymakers at the Federal Reserve.

The highlights from The Employment Situation – October 2022 are listed below.

Earlier this month, the Bureau of Economic Analysis reported continued growth in consumer spending. An increasing aggregate demand causes inflation, especially if the labor supply remains unchanged. Most companies will strive to increase production to meet the added demand, which, in most cases, will require more workers. Management will need to increase wages to attract the additional workers. The added labor cost and increase in demand will support raising their prices. In time, workers may pressure their employers to increase their compensation to offset the increase in their cost of living. Employers may acquiesce, knowing plentiful job openings make it easier for workers to quit. This scenario describes a dreaded wage-price spiral, which is a perpetual loop where higher wages result in price increases, followed by more wage increases.

Continued inflation will likely reduce employment. The Federal Reserve has increased interest rates six times since the beginning of the year to slow consumer spending and try to tame inflation. Higher rates have probably slowed monthly payroll gains from an average exceeding 400,000 earlier in the year to less than 300,000 in the last three months. The rate hikes have also pushed mortgage rates from approximately 3.25% to 7.00% since the beginning of the year, dramatically increasing the cost of homeownership for potential buyers. For example, a $250,000 30-year mortgage has a payment of $1,088.02 at a 3.25% mortgage rate. The payment would jump to $1,663.26 at 7.00%, yielding a 53% increase in the cost. According to the National Association of Realtors, in September, higher mortgage rates helped lower existing home sales to the lowest point in 10 years.

FreddieMac reported on November 3rd,

Mortgage rates continue to hover around seven percent, as the dynamics of a once-hot housing market have faded considerably. Unsure buyers navigating an unpredictable landscape keeps demand declining while other potential buyers remain sidelined from an affordability standpoint. Yesterday’s interest rate hike by the Federal Reserve will certainly inject additional lead into the heels of the housing market.

Approximately 10% of jobs are tied directly or indirectly to real estate. Some jobs include builders, trade contractors, real estate brokers, appraisers, inspectors, insurance companies, mortgage companies and lenders, title companies, and furniture manufacturers and sellers. So, if the housing market contracts, it will reduce the demand for labor in each of these professions and slow economic growth.

Fed officials worry that a tight labor market will prolong inflation. Their objective in increasing their benchmark rate is to reduce the economy’s aggregate demand. Doing so would reduce the economy’s labor demand and relieve some pressure on companies to increase wages. Chairman Jerome Powell has been clear that the Fed will continue to raise interest rates until the labor shortage is reduced. He recognizes the hardship higher rates bring – but inflation causes more pain in the long run.

Policymakers hoped that more people would enter the labor market. Unfortunately, that has not materialized. The participation rate dropped slightly, and the labor force shrunk by 22,000 workers. In a separate report, the Bureau of Labor Statistics reported that there were approximately 10.7 million job openings in October, which equaled about 1.9 openings for every available worker. (BLS) The higher number of job openings relative to available workers suggests employers are having trouble filling positions, which pressures them to increase wages. Many business owners are calling for lifting some immigration restrictions to increase the labor force. Recent job shortages have been prominent in the leisure and hospitality industries, where immigrants are frequently employed. Advocates for reducing immigration barriers reason that if the current labor market is unwilling to fill so many jobs, allow people who are willing to fill them into the country. More workers would reduce the labor shortage and lessen the pressure on wages. Eventually, the hardship wrought by inflation will induce people to return to work or work a second job. That is already happening among older workers, where those willing to work increased by 141,000, and the participation rate increased from 38.8% to 38.9%.

In September, wages increased by 0.3%, while the prices rose by 0.4%, reducing consumers’ buying power. Will that trend continue? It will if October’s consumer price index exceeds 0.4%. Are the recent rate increases beginning to reduce inflation? The Bureau of Labor Statistics’ monthly publication, Consumer Price Index – October 202, will help answer these questions. Check back to Higherrockeducation.org shortly after its release on November 10th for our summary and analysis.