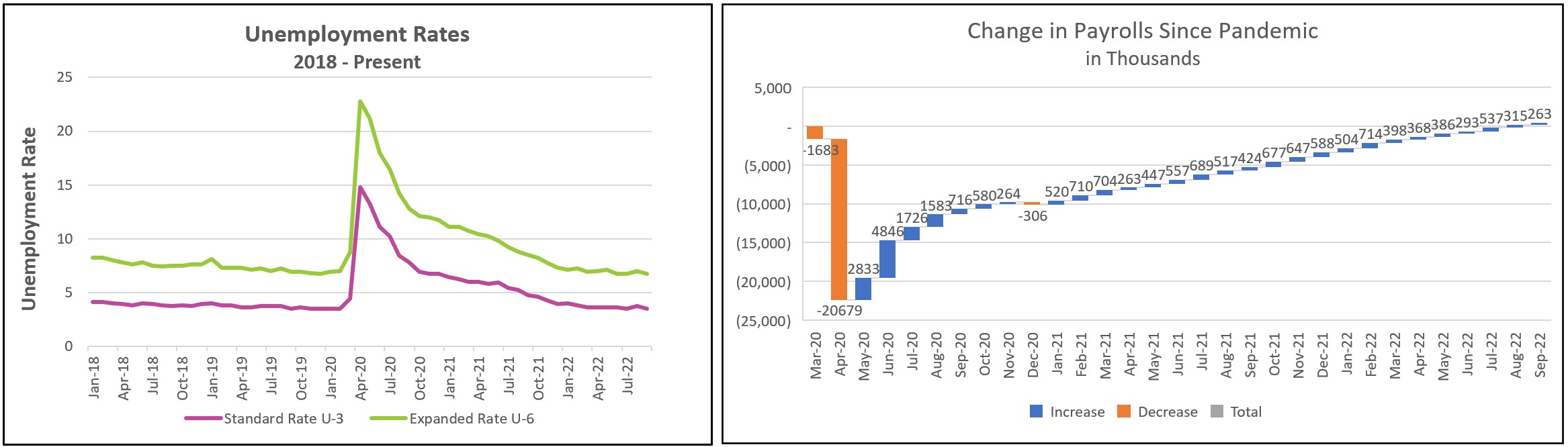

Today’s employment report provides evidence that the labor market is losing momentum while remaining resilient. The unemployment rate returned to its 50-year low of 3.5%. Payrolls increased for the 21st consecutive month. However, payroll gains decelerated to 263,000, the slowest pace since April 2021. An imbalance between the supply and demand of workers remains.

The highlights from The Employment Situation – September 2022 are listed below.

The hospitality, leisure, and healthcare industries had the most notable payroll gains. However, the leisure and hospitality industry remains one of the few that has not fully recovered to its pre-pandemic level. In September, it employed 1.1 million fewer workers. The public sector was one of the few groups that lost workers.

For months, policymakers have hoped a diminished COVID threat would entice more people to return to the workforce. But the workforce fell by 57,000 in September. Many employers remained short-staffed and continued to hire, bidding up wages and providing families with the money to support consumer spending. The combination of new hires and fewer workers combined to reduce the unemployment rate.

Inflation poses the greatest threat to the US economy, and this report provides little comfort. Policymakers were hoping for a weaker report – one where wages increased less because as long as wages continue to increase at the current rate, the central bank will struggle to cool inflation.

Employers will continue raising prices to cover the additional labor expense. Workers will use the added income to increase consumer spending. However, the purchasing power of most families will continue to fall until inflation matches or is less than wage increases. Wages rose 0.3% in August and September. The core price index rose 0.6% in August (September’s CPI will be released next week). Prices rose 6.3% in August, while wages increased 5.0%.

Fed officials worry that a tight labor market will prolong inflation, so they are trying to curb inflation by reducing the demand for labor and slowing the growth in wages. They recognize the hardship imposed by inflation and have made it clear that they intend to tame it – knowing that the likelihood of a recession increases and many workers will lose their jobs. In a separate report released on Tuesday, the Bureau of Labor Statistics reported that the number of job openings per available worker fell to 1.7 in August. Policymakers will be encouraged by the deceleration of monthly payroll increases and the narrowing gap between available workers and job openings because these trends indicate that the supply and demand for labor are more balanced than several months ago.

This report does little to dissuade the Federal Reserve policymakers from increasing its benchmark rate by three-quarters of a percent for the fourth consecutive meeting in November. However, they will also lean heavily on the September CPI report, which will be released on October 13th. A surprisingly good report may sway the Fed into being less aggressive and imposing a smaller rate increase. Check back to HigherRockEducation.org shortly after October 13th for our summary and analysis.