Key takeaways from the Bureau of Labor Statistics (BLS) report, The Employment Situation – September 2025, include:

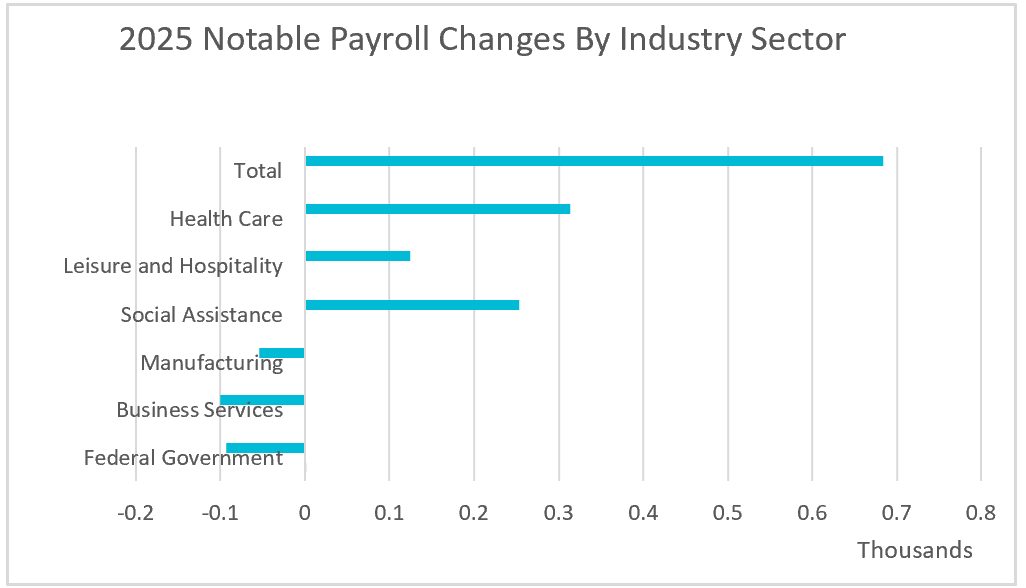

The September employment report painted a mixed and somewhat contradictory picture of the U.S. labor market. On the surface, the economy added a better-than-expected 119,000 jobs, with nearly all of the growth concentrated in health care, social assistance, and leisure and hospitality. More than 87% of new positions came from these sectors, which have driven almost all payroll expansion in 2025. Without them, overall employment would have fallen by about 6,000 jobs, underscoring how narrowly based current job growth has become.

Several major industries moved in the opposite direction. Manufacturing, transportation and warehousing, as well as business services, and the federal government all shed workers in September. The continued decline in manufacturing employment is especially noteworthy given President Trump’s claim that tariffs would revitalize the sector. Another warning signal came from the drop in temporary hiring—a measure economists often view as a leading economic indicator. Companies tend to bring on temporary workers when they expect rising demand, and they are typically the first employees released when firms anticipate a slowdown.

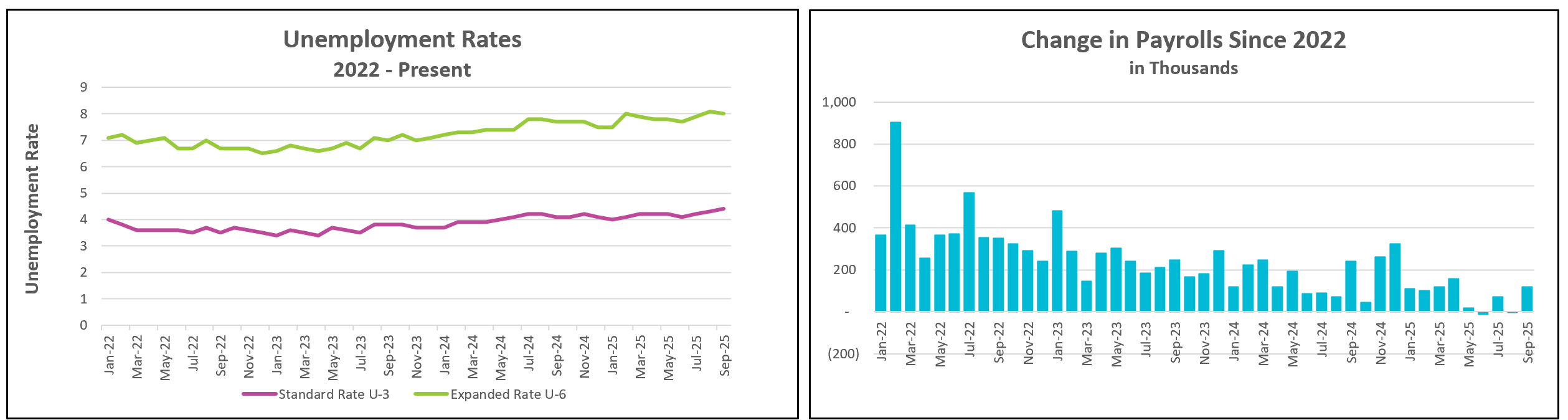

Although payrolls increased, the unemployment rate rose to 4.4%, the highest in four years. This jump was driven not by layoffs, but by 470,000 people entering the labor force—far more than could find jobs. While employers seem reluctant to cut existing staff, workers who are newly unemployed or newly seeking work are finding it harder to secure positions. Wage growth also softened, rising just 0.2% in September. With inflation trending higher, slower wage gains are putting additional strain on household budgets. In a separate release, the government reported that real earnings were flat in September (BLS Real Earnings - September).

Revisions to earlier data also dampened the headline job gain. Payroll figures for July and August were marked down, with August showing a decline of 4,000 jobs—the second monthly drop since June and the first time in several years that payrolls have contracted twice in the same calendar year. Looking ahead, October’s report is expected to show a further decline in federal employment as voluntary resignations submitted earlier in the Trump administration officially take effect.

The delayed release of this report—postponed nearly seven weeks by the federal government closure—is particularly important because it arrives just as the Federal Reserve weighs its next move on interest rates. Policymakers who support lowering rates argue that the rising unemployment rate and weakening labor indicators point to a fragile economy in need of support. Those favoring a pause emphasize the surprisingly strong payroll growth and worry that additional stimulus, combined with tariff pressures, could reignite inflation. As a result, the report highlights a labor market that is neither clearly strong nor clearly deteriorating, but instead caught in a tenuous balance between modest job creation and growing signs of underlying weakness.

October’s data will either be unavailable or incorporated into November’s reports for both the Employment Situation and the Consumer Price Index. The BLS will not publish an October Employment Situation report because the government shutdown prevented the household survey from being conducted. Data from the establishment survey will be included in the November Employment Situation, scheduled for release on December 16th.

Similarly, the BLS did not collect price information in October due to the shutdown. As a result, the November Consumer Price Index report—covering price changes since September—will be released on December 18th.

HRE will provide a summary and analysis of both releases shortly after they are published.