Inflation remains sticky as most of the inflation indexes rose in February. However, inflation may be easing as the labor market and consumer activity cool down.

The highlights from the Bureau of Labor Statistics press release, Consumer Price Index – February 2023, are outlined below.

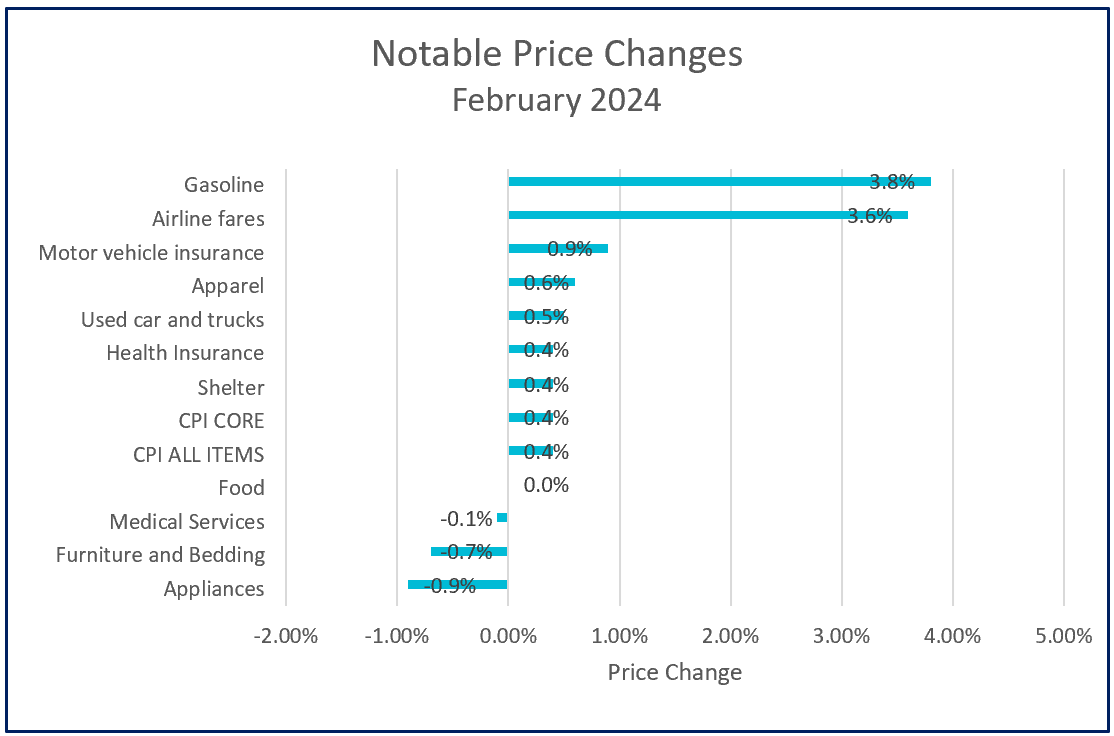

The opening months of 2024 have defied economists’ predictions of price deceleration. Both monthly and 12-month readings of the all-inclusive CPI have risen, primarily driven by higher gasoline prices and a persistently resistant shelter index. Together, these factors accounted for over 60% of the all-inclusive index. Gasoline prices surged by 3.8% in February after falling 3.3% in January, yet they remain 3.9% lower than a year ago.

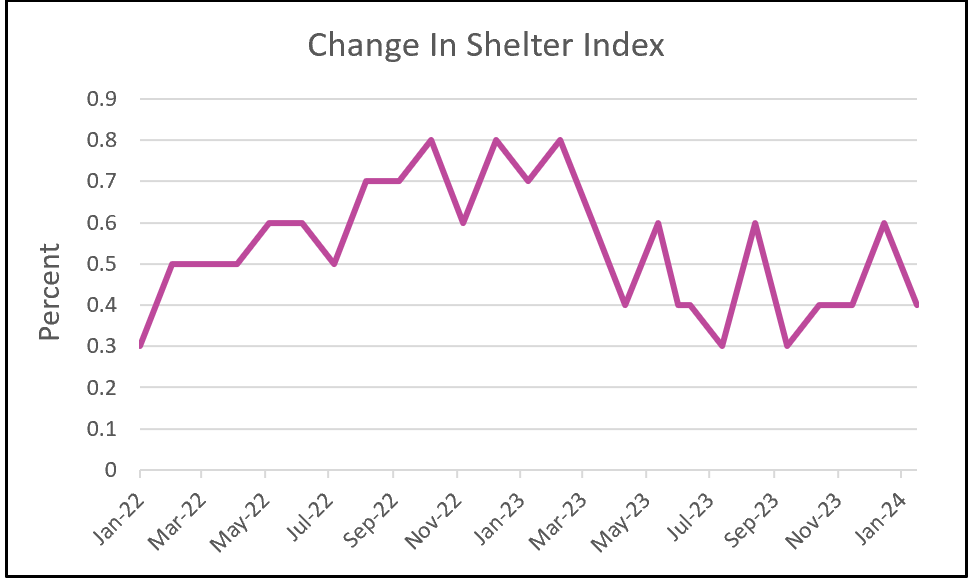

The shelter index has shown resilience, mainly because it is calculated based on existing rents rather than new ones. Economists continue to anticipate decreasing rates will reduce the shelter index and pull the inflation rate lower since it has the largest influence on the CPI. But even though new lease rates have dropped in various parts of the country, the shelter index’s decline has been slower than anticipated, which means the drop in the all-inclusive inflation rate has been less than predicted. The graph below illustrates the choppiness and slowness of the index’s decline.

Consumers are finding some relief in some vital areas of their spending. Medical expenses, grocery store prices, and dining out costs have all offered a degree of respite. The cost of medical services fell 0.1%. Grocery store prices remained stable, and dining out costs have seen only a marginal increase of 0.1%.

Two consecutive months of higher-than-expected inflation have reinforced the Federal Reserve’s resolve to exercise patience in delaying a reduction in their benchmark rate. Since July 2023, they have maintained their federal funds target steady at 5.25 – 5.5%. Higher rates are a tool the Fed uses to curb inflation because the prospect of higher rates may discourage business expansion. They also reduce the demand and sales for large items like motor vehicles and homes by increasing borrowing costs. This reduction in demand also extends to complementary goods and services such as furniture and appliances. Consequently, businesses often hesitate to raise their prices while the demand for their goods or services declines.

Policymakers have made their stance unequivocal: they will only consider reducing rates once they are confident in achieving their 2% inflation goal. Acting too soon could exacerbate inflation by spurring demand for interest-sensitive goods and services. Thus, policymakers would view further softening of the labor market and consumer spending as signs of the economy’s deceleration. They will be reassured by the recent weakening of the labor market and a decline in consumer spending. February saw the unemployment rate rise to 3.9%, while consumer spending in January saw a modest increase of 0.2% following a robust 0.7% surge in December.

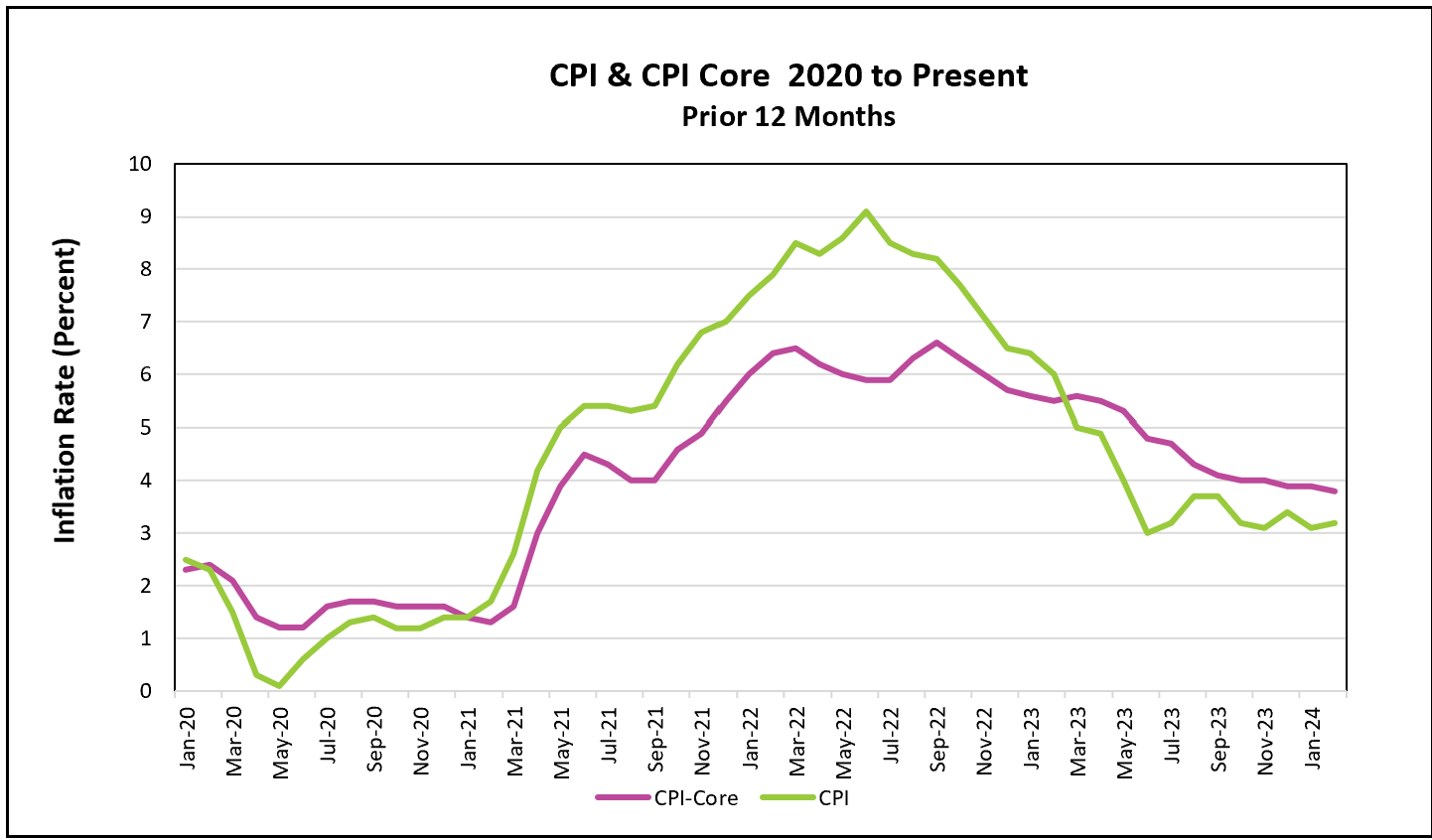

While the latest employment report might seem discouraging, economists will take solace in the steady, albeit gradual, decline in the 12-month core inflation rate, which has either remained stable or decreased for twelve consecutive months. Economists favor the core index for trend analysis because the index excludes volatile food and energy prices.

Many Americans harbor dissatisfaction with the economy, primarily due to the surge in prices since 2021. Some express a desire for prices to revert to pre-COVID levels. However, they should exercise caution in this wishful thinking. Achieving such a reversal would necessitate a severe recession, inevitably leading to high unemployment rates and lower wages.

One significant reason why inflation has remained relatively high is the prosperity of the US economy. A robust labor market has driven up real wages, while low unemployment rates have spurred consumer spending. Concurrently, the stock market has reached unprecedented highs, reflecting overall economic strength.

Fed officials meet next week. Most economists expect them to maintain current interest rates. Their report will also include their projections for the economy. Economists and investors will scrutinize the report, seeking insights into the Fed’s perspectives.

The Bureau of Economic Analysis recently reported that the PCE price index, which is preferred by the Fed, stood at 2.4% in January. February’s reading will be released on March 29th in the Personal Income and Outlays – February 2024 report. This publication will offer valuable insights into household income and spending trends. Higher Rock will promptly deliver a summary and analysis of the report following its release.