Here are the key highlights from the Bureau of Economic Analysis’s Personal Income and Outlays report for August 2025:

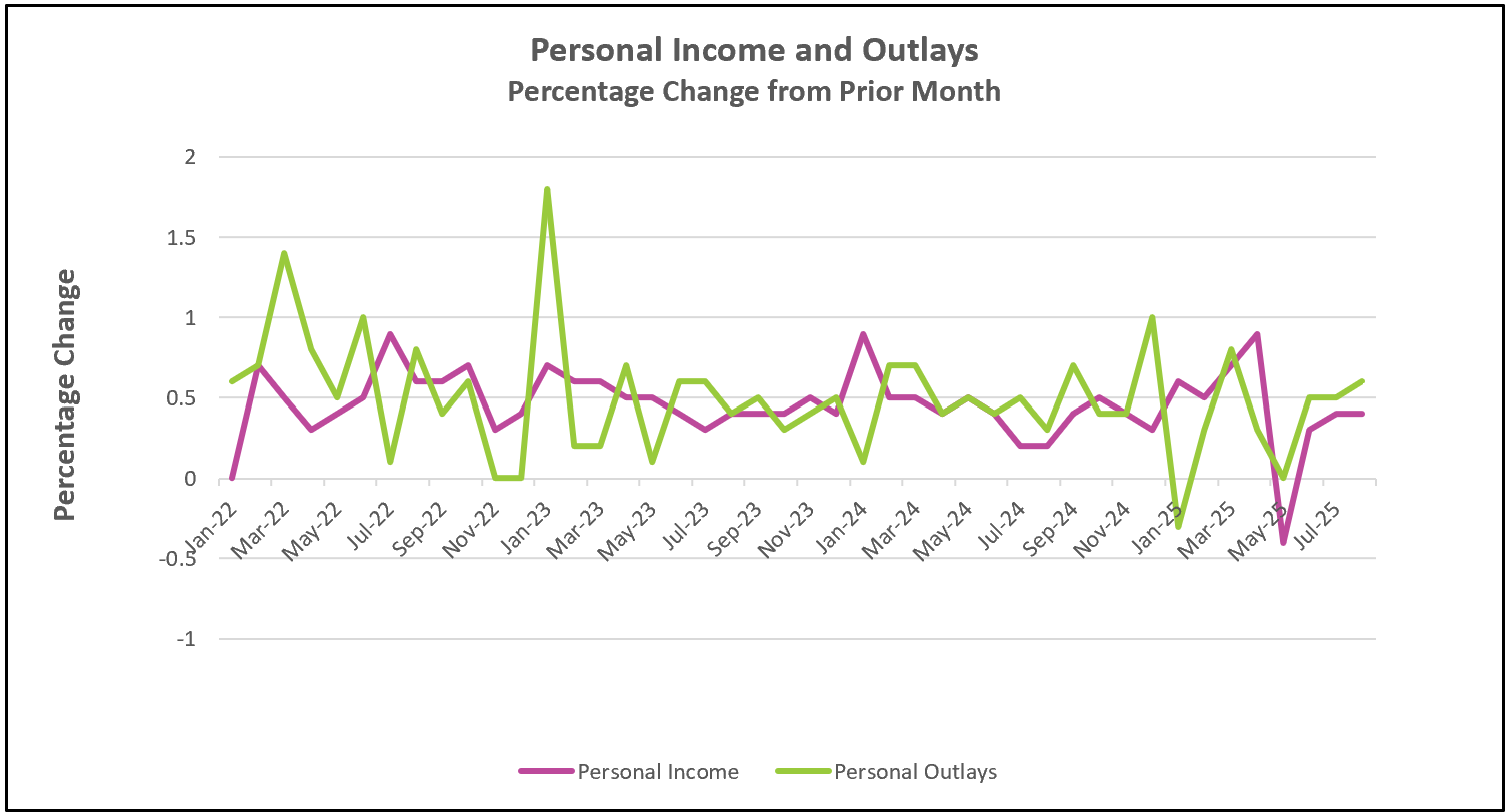

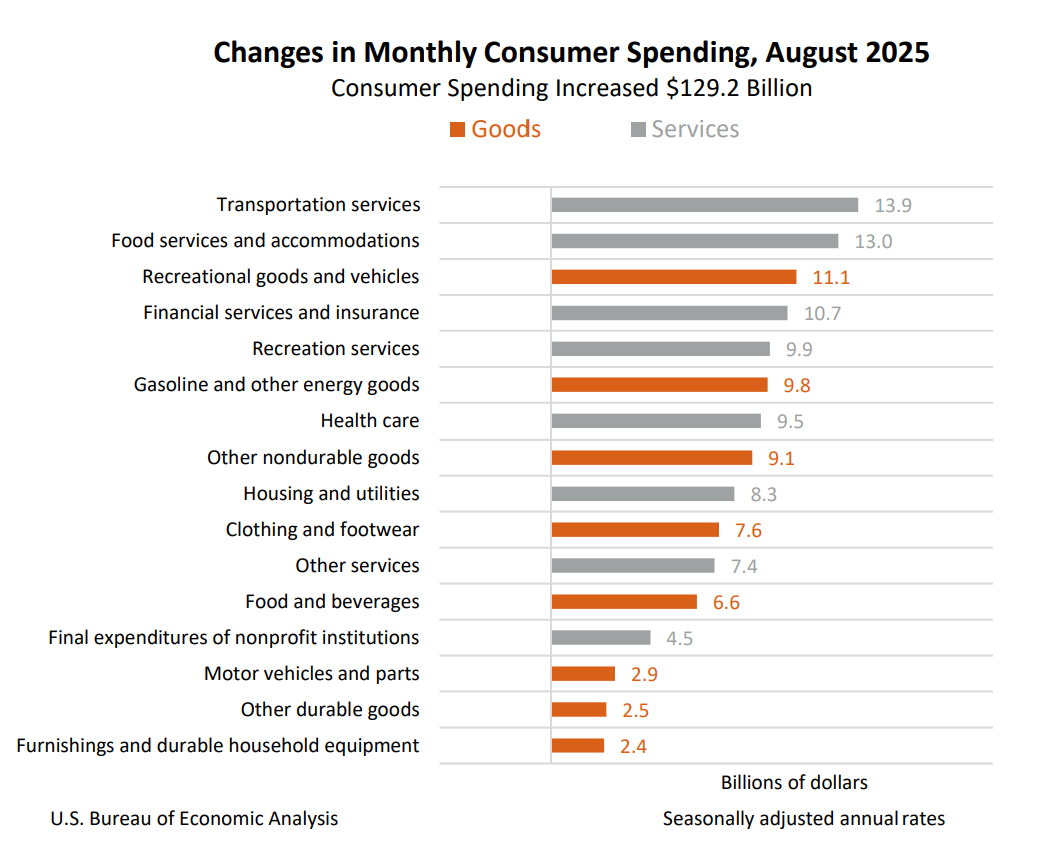

The U.S. economy showed stronger momentum in the second quarter than previously reported. Last week, the Bureau of Economic Analysis (BEA) revised the GDP growth upward to 3.8% from the initial estimate of 3.3%, driven by solid gains in both consumer spending and business investment. Consumer expenditures rose 2.5%, while business investment jumped 7.3%, reflecting confidence from firms and households alike. This momentum extended into August, when consumer spending increased 0.6%. Much of the growth came from transportation services, food services, and recreational goods and vehicles, while purchases of big-ticket household items such as furniture and motor vehicles remained sluggish. Several months of robust spending have provided a reliable foundation for economic growth heading into the third quarter.

Even so, questions about the sustainability of this momentum are emerging. While gains in real disposable income have buoyed spending, the picture beneath the surface is less encouraging. Wages and salaries have barely kept pace with inflation, leaving much of the income growth tied to proprietors’ earnings rather than broad wage gains. Many economists caution that a weaker labor market, combined with tariff-related inflation, could push real disposable income lower. If that trend continues, households would see their purchasing power erode, often forcing them to borrow more or curtail spending. Families are already saving less, with the savings rate falling to its lowest level since December 2024. Combined with historically high credit card balances and rising delinquency rates, these developments point to financial stress for many households.

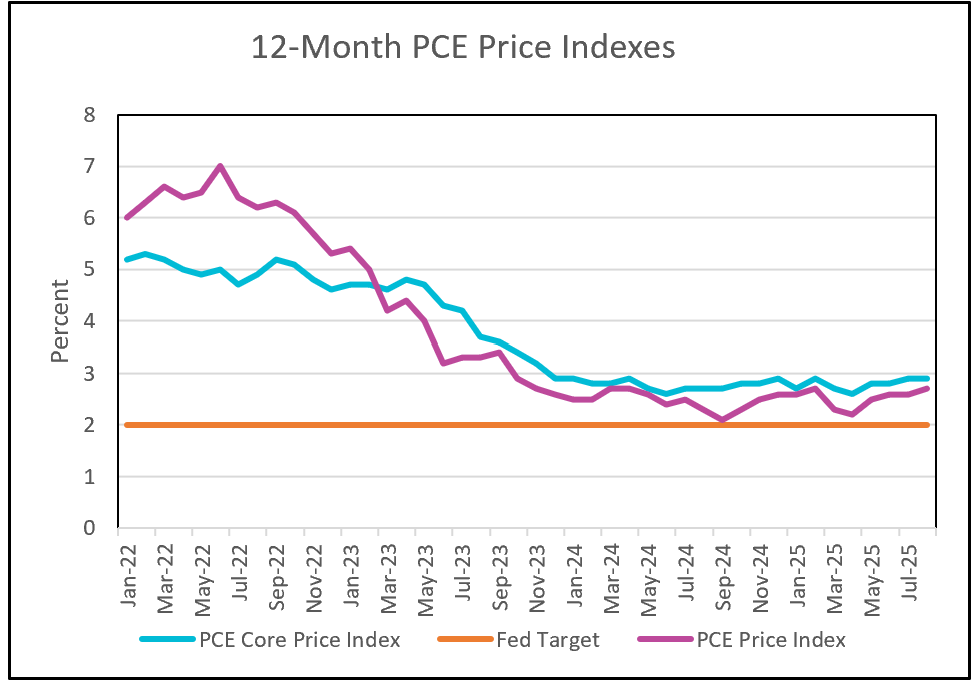

Meanwhile, inflation pressures remain persistent. The PCE price index, the measure of inflation preferred by policymakers at the Federal Reserve, reached its highest level in August since February, and the core index rose 2.9% year over year, matching July’s increase but still at its highest point since November 2023. Inflation combined with softness in the labor market puts the Federal Reserve in a difficult position. Concerned that a softening labor market could tip the economy toward contraction, policymakers cut their benchmark interest rate for the first time this year in their latest meeting. Yet with the PCE price index still running above its 2% target, officials may be cautious about further rate cuts until it becomes clearer whether tariff-related inflation risks will subside.

Additional uncertainties cloud the outlook. A potential government shutdown could weigh on growth by halting pay for furloughed federal workers and disrupting services. The upcoming September Employment Summary from the Bureau of Labor Statistics, due October 3, will be a key test of whether the labor market continues to soften. Clearer signs of weakness could strengthen the case for additional rate cuts, though policymakers will need to balance the risks of inflation against the growing pressures on household finances. Higher Rock Education will provide a summary and analysis shortly after it is published.