Here are the key highlights from the Bureau of Economic Analysis’s Personal Income and Outlays report for May 2025:

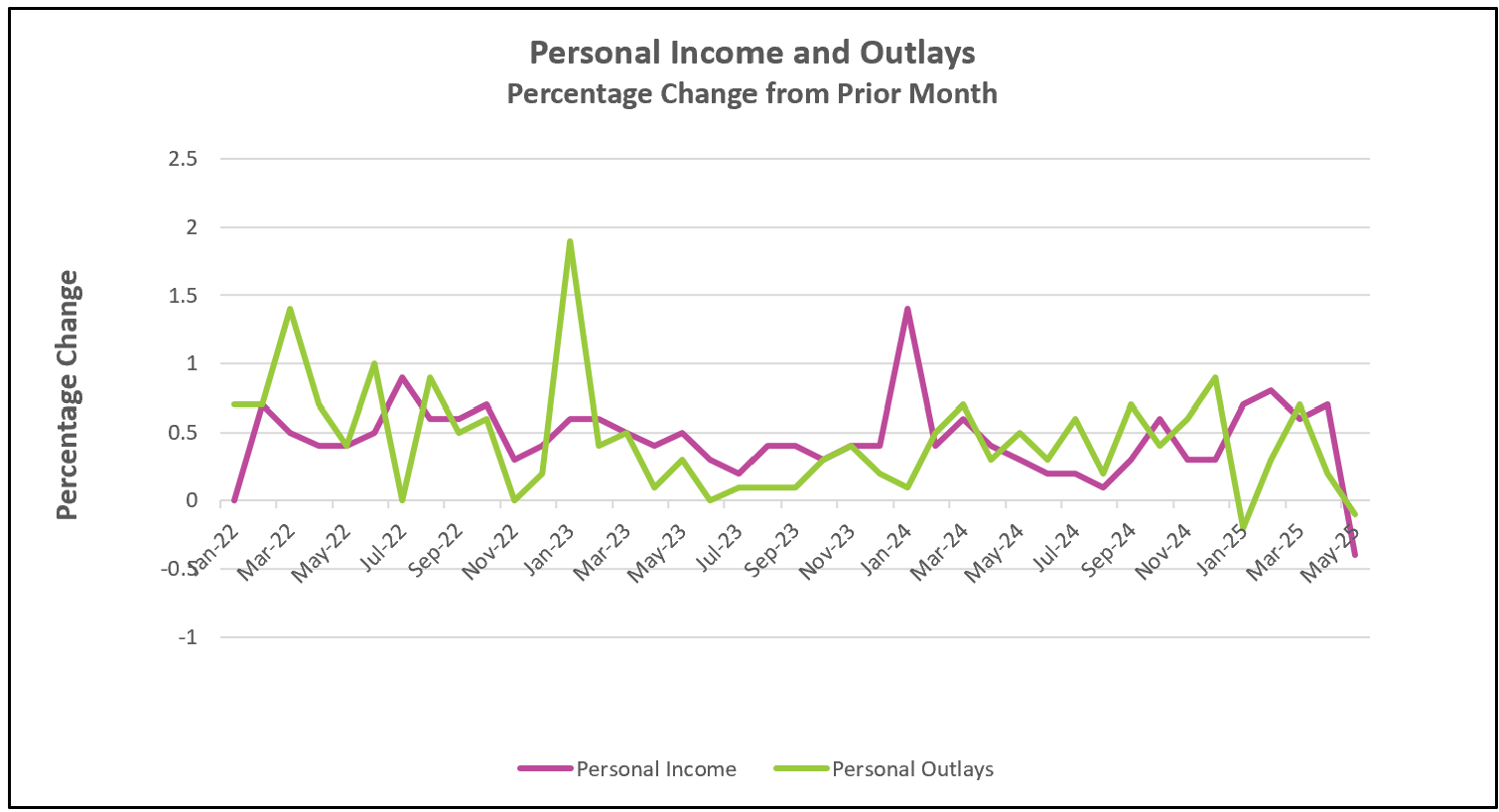

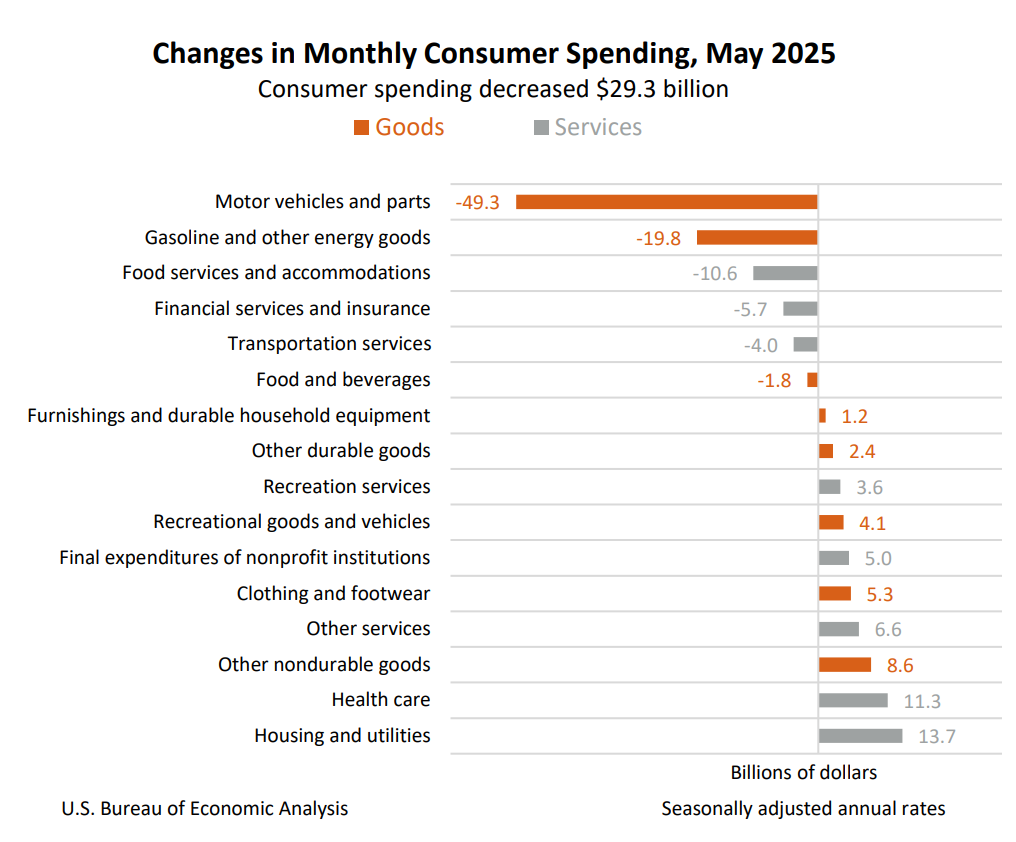

Consumer spending fell for the first time since January, but it is too soon to determine if the US economy is contracting. The 0.1% decrease in May was notably weak, mainly because of a sharp drop in motor vehicle sales. Much of the strength in auto sales during the first quarter resulted from a rush to buy vehicles before President Trump’s new tariffs took effect, but that momentum has now diminished. Consumers also pulled back slightly on discretionary expenditures like dining out and travel, although modest gains in other services offset these.

The subdued overall spending level reflects a more cautious consumer, even as headline sentiment indicators show slight improvements. After reaching historic lows, there was a slight uptick in consumer confidence in May. But underlying worries remain. According to the University of Michigan’s Consumer Sentiment Index, “consumer views are still broadly consistent with an economic slowdown and an increase in inflation to come. Consumers continue to be concerned about the potential impact of tariffs.” The decline in spending suggests that consumers are beginning to adjust their behavior in anticipation of a more challenging economic environment.

In May, households experienced a setback in their income—particularly farmers, who collectively had a nearly 50% plunge in their income. Additionally, there was a one-time downward adjustment in Social Security reimbursements for certain federal and state retirees, following catch-up payments made in March and April. Despite these factors, wages rose by a solid 0.4%, supporting the notion that the labor market continues to provide some underlying strength that could fuel continued economic expansion if inflation remains contained.

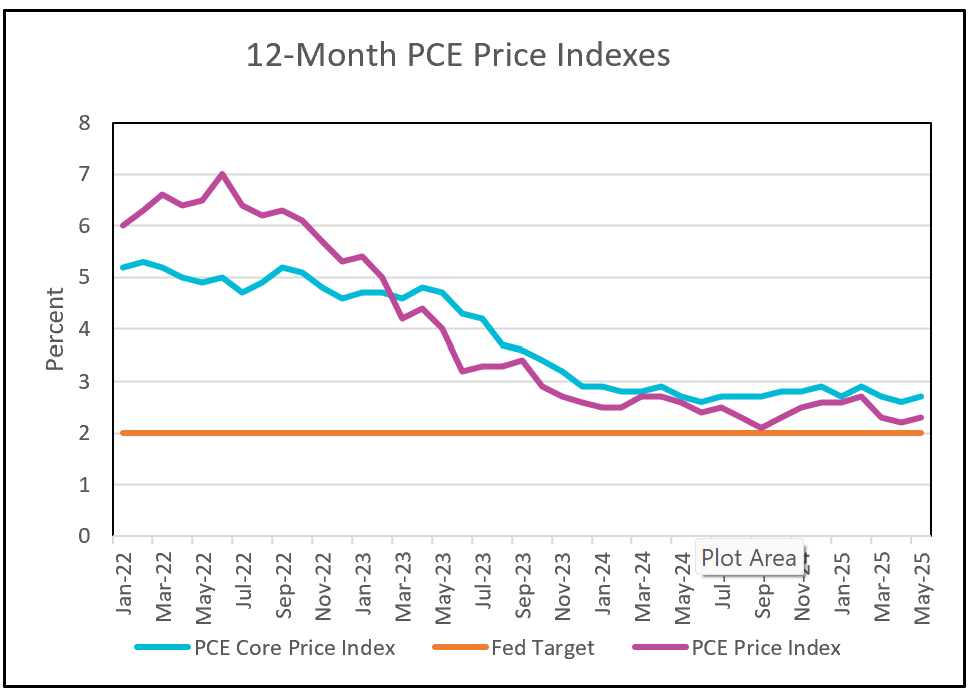

The personal savings rate declined from 4.9% to 4.5% in May, reflecting the tension between stagnant income growth and rising costs. Although inflation remained modest, with overall prices increasing 0.1% in May and 2.3% over the past 12 months, there are signs that underlying inflationary pressures may be building. The core personal consumption expenditures (PCE) index, which excludes volatile food and energy prices, rose to 2.7% year-over-year—it has only dropped 0.2% in eighteen months. While President Trump and some market participants argue that inflation is close enough to the Federal Reserve’s 2% target to justify rate cuts, Fed officials remain cautious. Most expect that the actual inflationary impact of tariffs will emerge later this summer and prefer to wait for more data before adjusting policy.

So far, tariffs have not significantly increased consumer prices because many companies built up inventories ahead of their implementation. This stockpiling has delayed the need for price hikes. In addition, the recent softening in consumer demand has further restrained companies’ ability to pass on higher costs. These forces have helped keep inflation relatively subdued, at least temporarily. However, price dynamics could change as inventories are drawn down over the next few months. The next critical data point will come with the Bureau of Labor Statistics' release of the Consumer Price Index for June on July 15th, which may provide clearer signals about where inflation and consumer activity are heading. Higher Rock Education will provide a summary and analysis shortly after it is published.