The Bureau of Economic Analysis published October and November’s statistics in this release because the government shutdown delayed each. Here are the key highlights from their report, Personal Income and Outlays.

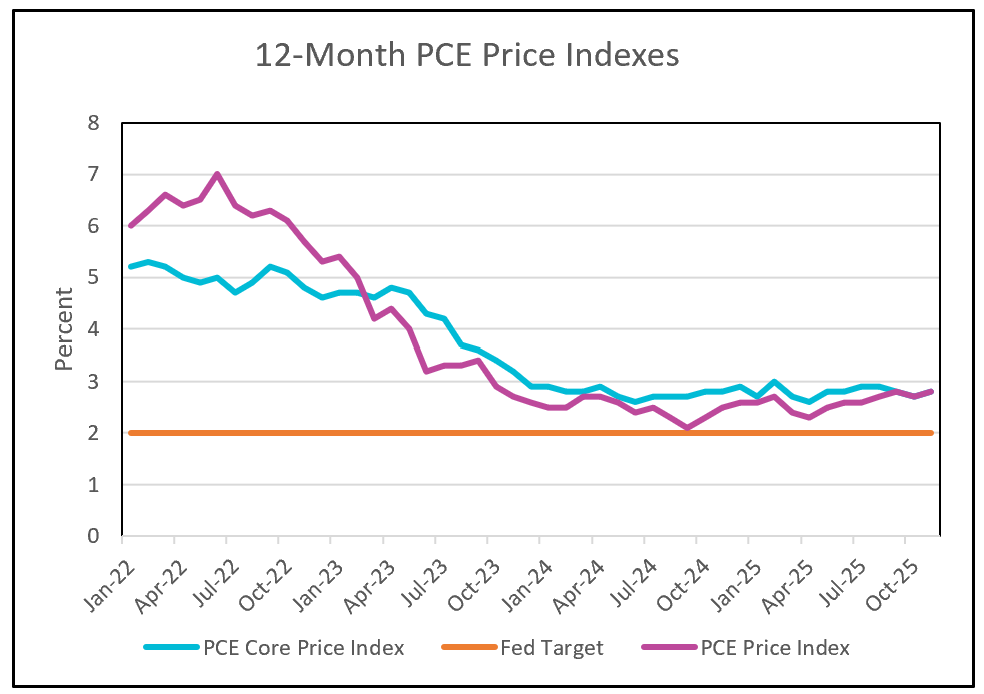

Inflation remains stubborn as key price measures ticked slightly higher in November, continuing to weigh on household budgets. The Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, rose to a 2.8% year-over-year pace in November from 2.7% in October, staying above the Fed’s 2% target. On a monthly basis, both the headline and core PCE indexes increased 0.2% in October and November, underscoring that inflationary pressures, while not surging, are proving challenging to diminish. Goods inflation slowed earlier in the year but has picked up again since President Trump imposed tariffs, adding another layer of pressure on prices.

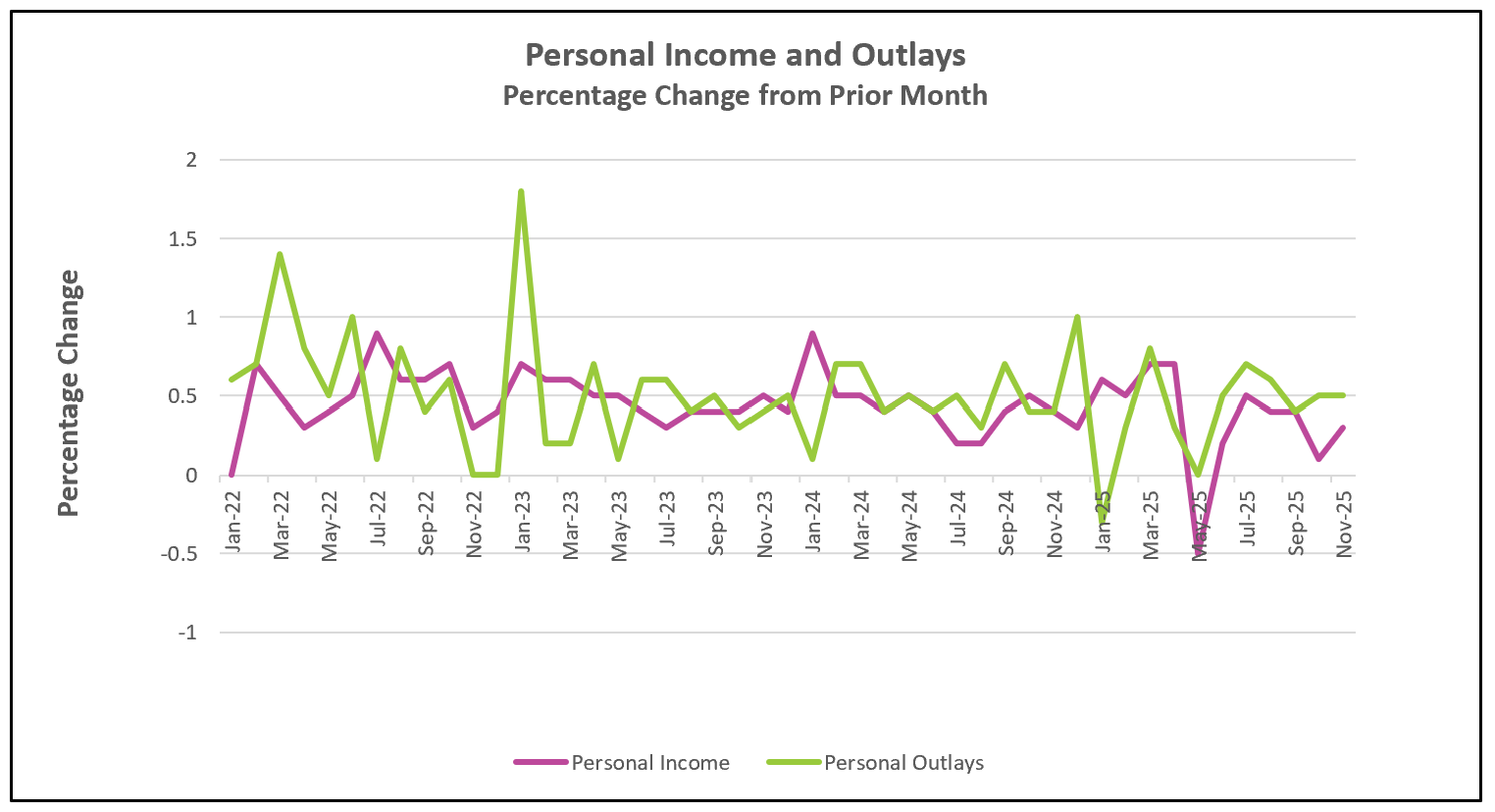

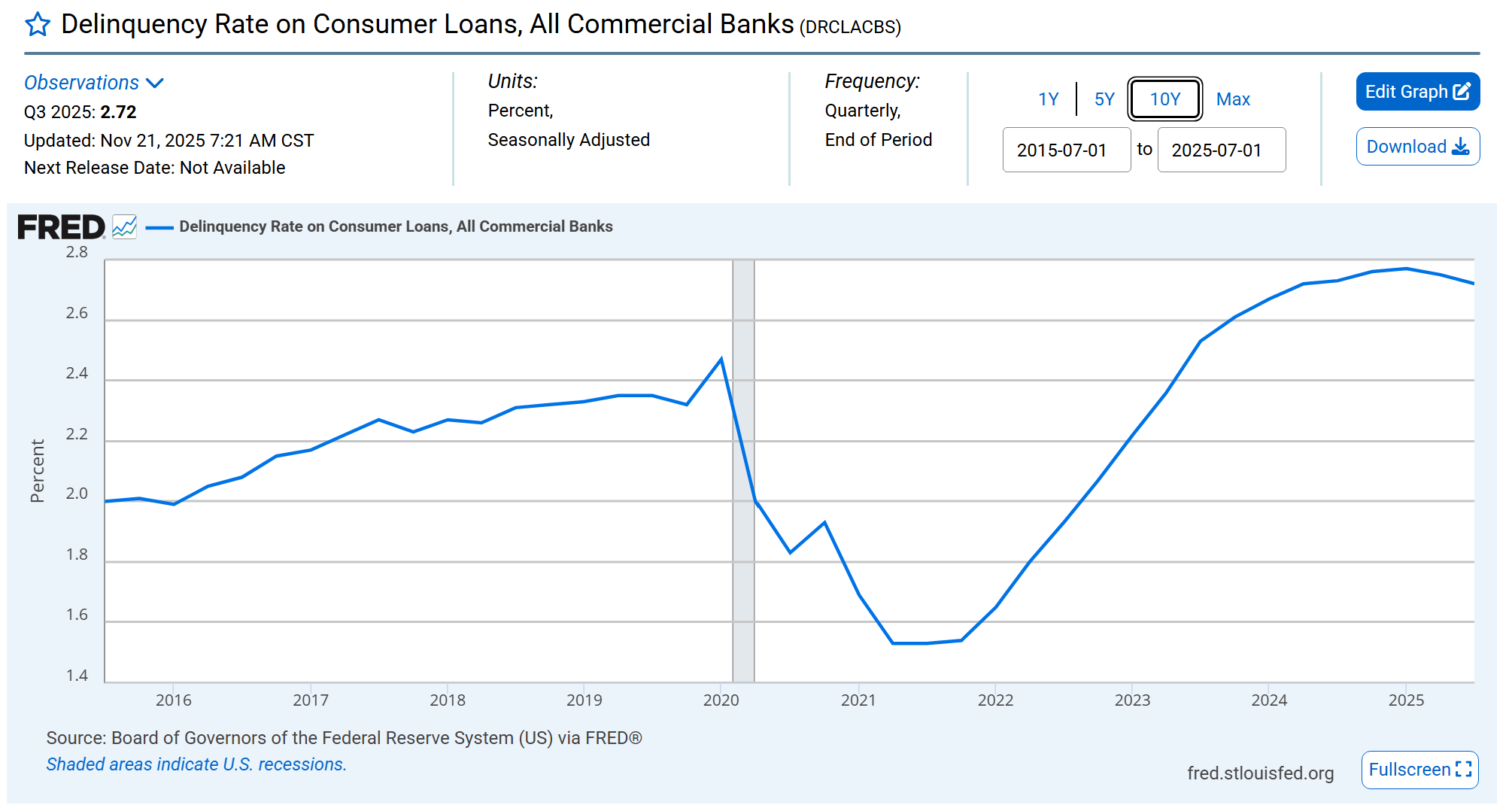

Income growth has improved modestly but has struggled to keep pace with inflation, particularly for lower-income households. Personal income rose 0.1% in October and 0.3% in November, with disposable income posting the same gains. After adjusting for inflation, income dipped slightly in October before recovering somewhat in November, though lower-income families continue to fall behind. Wages and salaries increased 0.4%, a gain that only barely kept pace with rising prices. As a result, many households are increasingly stretched, saving less and relying more on borrowing to maintain their standard of living. Many are dipping into their savings or going deeper into debt. The personal savings rate – measured as savings as a percentage of disposable income has dipped to 3.5% from 5.5% as recently as April. Between 2015 and 2019, households saved 7.6% of their disposable income. Another indication of hardship is delinquency, which is now at its highest level in 12 years.

Despite these challenges, consumer spending continues to advance, offering reassurance for overall economic growth since consumption accounts for roughly 70% of the economy. Personal consumption expenditures (PCE) rose 0.5% in both October and November, with spending on goods accelerating while service spending cooled. Goods purchases climbed 0.7% in November after a modest 0.2% increase in October, while growth in service spending slowed from 0.6% to 0.4%.

The broader economy still appears resilient. The Bureau of Economic Analysis revised third-quarter growth up to a robust 4.4% annual rate, the strongest in two years, even as the labor market shows signs of softening. (BEA - RGDP) Against this backdrop, Federal Reserve policymakers are widely expected to hold interest rates steady at their meeting next week. After cutting rates three times in 2025 to support the labor market, officials remain cautious about easing further while inflation drifts higher. Adding uncertainty is the potential impact of larger tax refunds in the first quarter stemming from recent tax cuts, which could bolster consumer spending—but also risk reigniting inflationary pressures.

The Bureau of Labor Statistics will release January’s Employment Situation report on February 6, offering new insight into the strength of the labor market. In addition, the Bureau of Economic Analysis will publish its advance estimate of fourth-quarter 2025 GDP on February 20. Most economists expect economic growth to slow from its torrid third-quarter pace. Higher Rock will provide timely summaries and analysis of each report shortly after its release. Be sure to watch for our 2026 forecasts for real GDP, employment, and inflation—and a review of how our 2025 predictions performed.