Below are the highlights from the Bureau of Labor Statistics press release, Consumer Price Index – April 2024.

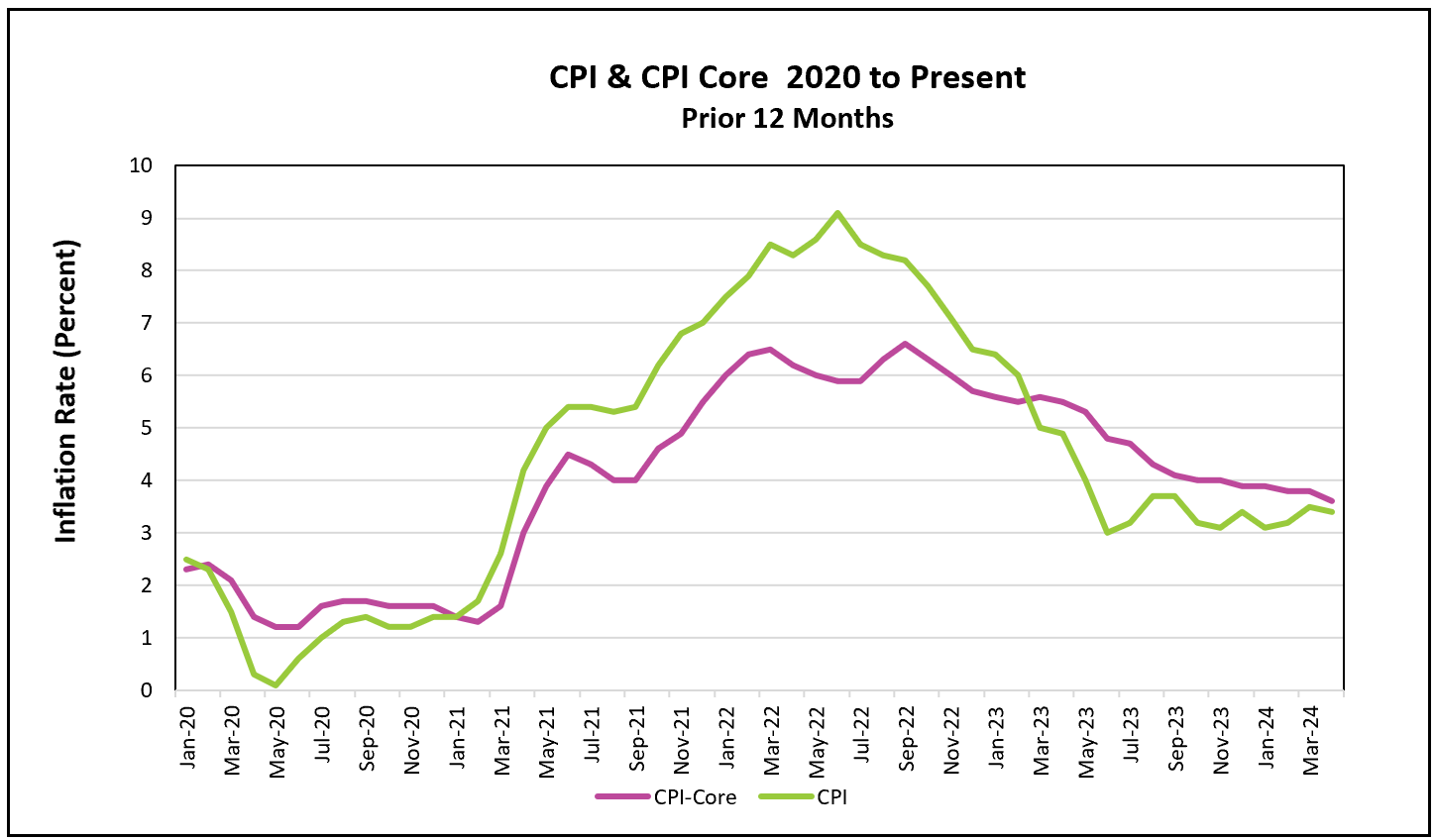

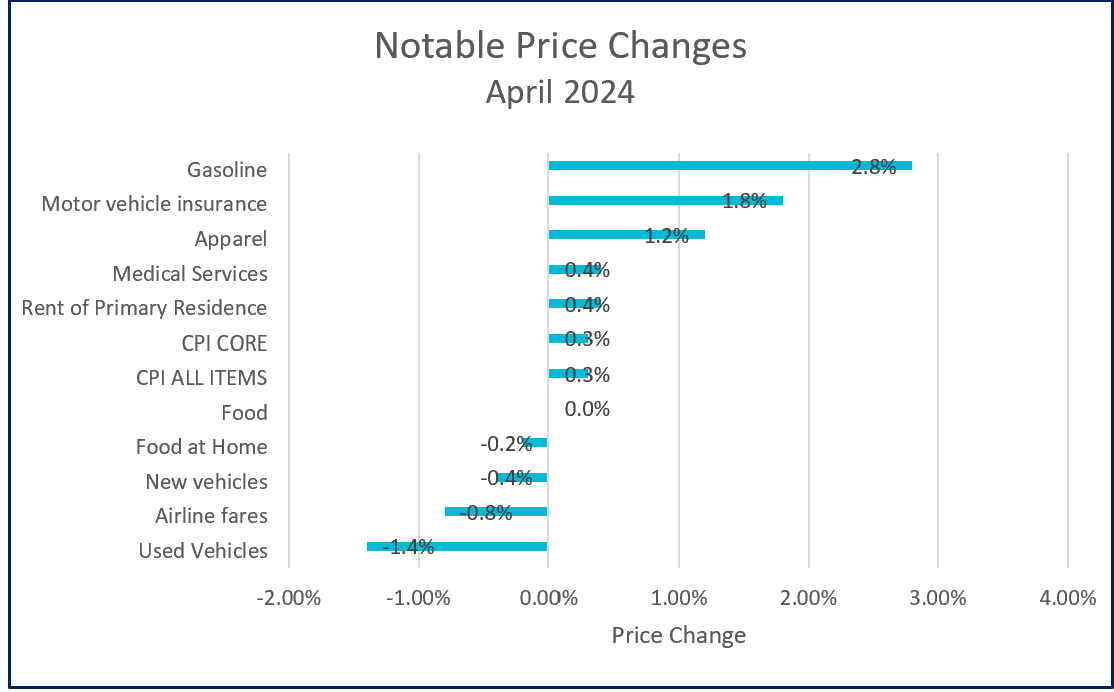

Several measures of inflation decelerated in April, highlighted by the 12-month core index, which reached its lowest rate in two years. Economists favor the core rate when evaluating trends because it excludes the volatile energy and food indexes. The all-inclusive index also decelerated after unexpectedly increasing in February and March. However, the price increases of essentials such as gasoline, shelter, and clothing continue to bring hardship to American households. April’s increases in gasoline and shelter prices contributed over 70% to the rise in April’s all-inclusive index. Grocery prices fell by 0.2%, while medical services increased by 0.4%, down from 0.6% in March. The table below identifies some notable price changes.

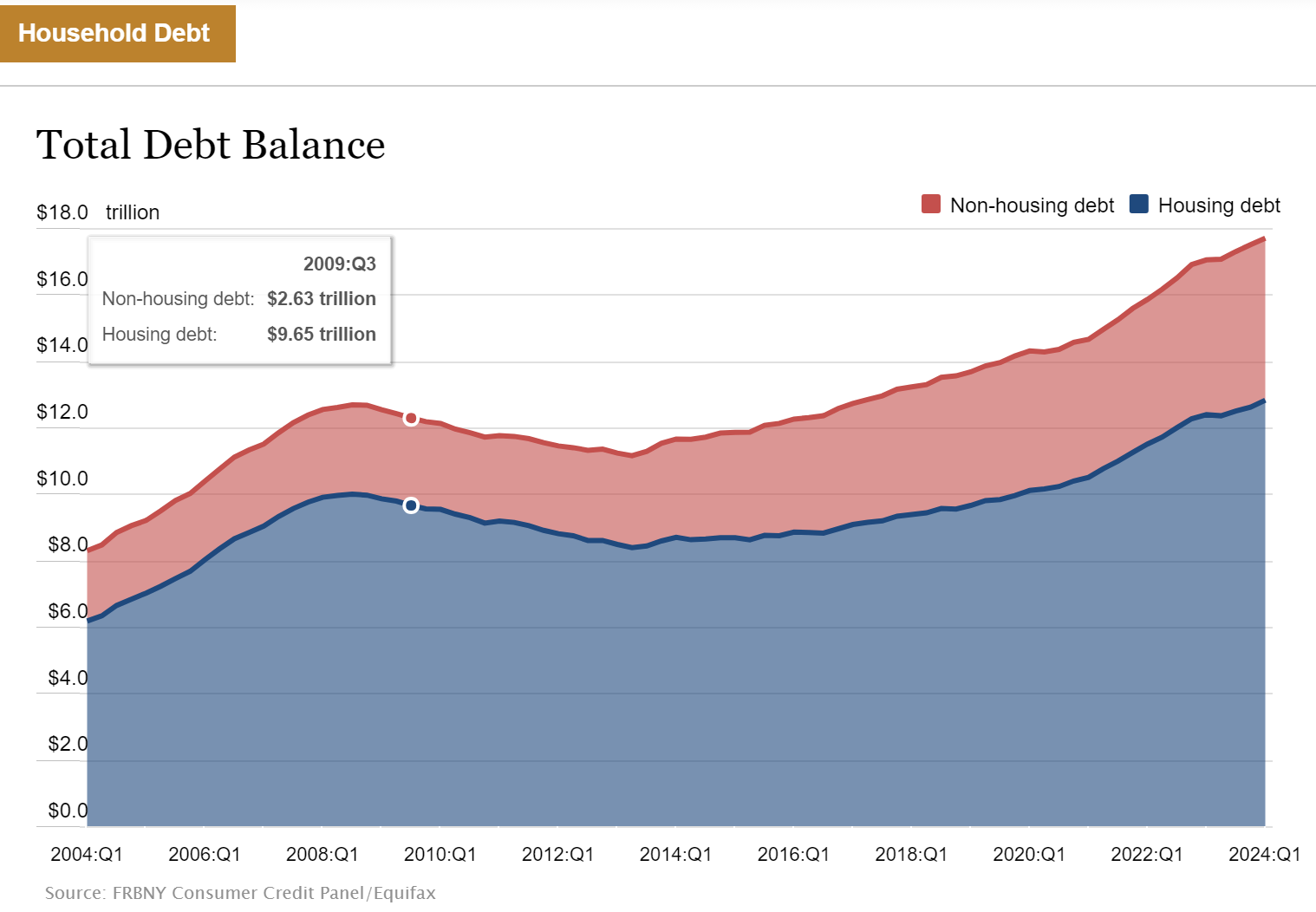

There are signs that May’s prices should continue to decelerate. According to the AAA, gasoline prices have declined since peaking in April. In a separate release, the Census Bureau reported that retail sales, a leading indicator, was unchanged in April after increasing by 0.6% in March and each month since January. During the first quarter, consumer resilience, buoyed by a strong labor market, bolstered the price level. However, in a separate release, the Labor Department reported that wages failed to keep pace with inflation in April. Average weekly wages decreased by 0.2%, while fewer working hours pushed earnings down by 0.4% after being adjusted for inflation. In addition, much of the first quarter’s surge in spending was financed using credit card debt. The Federal Reserve of New York reported that delinquencies are rising, indicating that households may be forced to cut spending by their mounting debt load.

Escalating rents have prevented the consumer price index from falling further, as rent accounts for one-third of the index and has remained stubbornly high. High mortgage rates have discouraged many people from purchasing homes, increasing the demand for rental housing. Additionally, an influx of immigrants has added to this demand. However, housing costs decelerated slightly in April, with year-over-year rent increases slowing compared to the previous year. Federal Reserve Chairman Jerome Powell told reporters that he expects this trend to continue, which will help ease inflation.

People spend less when they are worried about the economy. According to the University of Michigan survey, higher borrowing costs, inflation, and possible unemployment have pushed consumer sentiment lower.

This report will encourage Federal Reserve policymakers. Late in 2023, inflation had subsided quickly enough for many economists to forecast that the Federal Reserve would begin to cut its benchmark rate. However, reports during the first quarter were discouraging and dampened hopes among economists that the Federal Reserve would reduce its benchmark rate in 2024. However, this report brings a September cut back into play if the current trend continues.

Policymakers favor the PCE price index over the CPI and use it when setting their 2% inflation target. The Bureau of Economic Analysis will release April’s measure on May 31st. Analysts expect the PCE price index to be lower than the CPI because it puts less weight on shelter and accounts for people substituting one good for another when the price of a good increases. Higher Rock will provide a summary and analysis shortly after its publication.