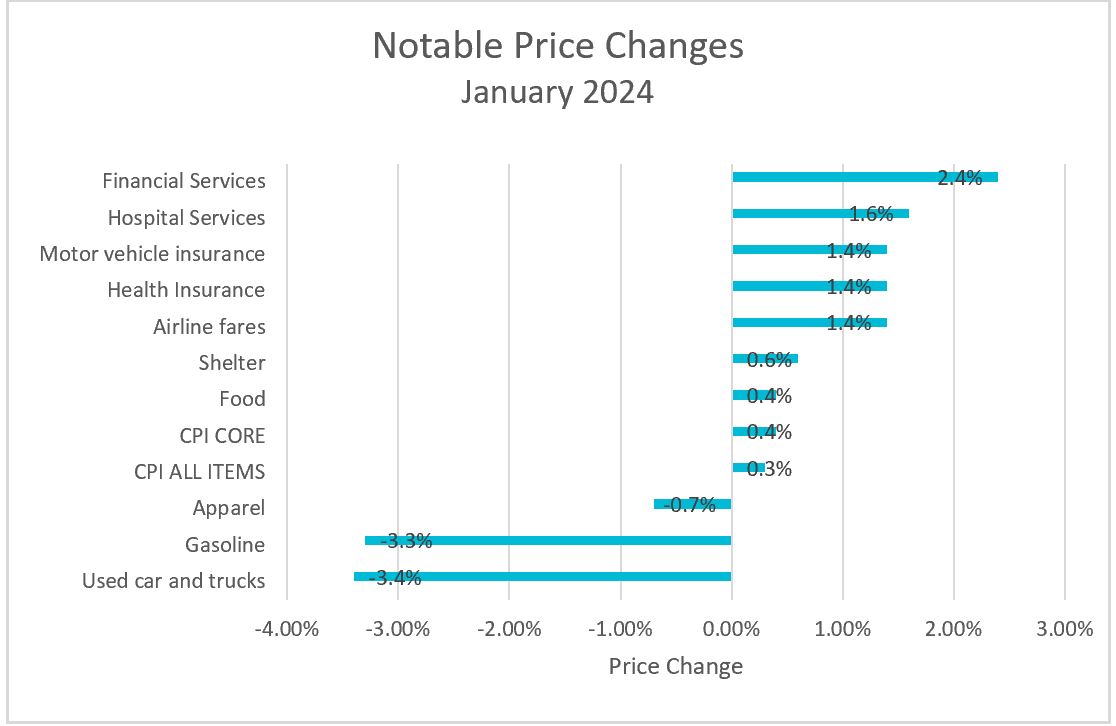

The consumer price index decelerated in January, primarily driven by a significant drop in gasoline prices. Despite this, households experienced a 0.4% increase in food prices, marking the largest rise in a year. Additionally, housing costs surged at the fastest rate since May 2023. However, gasoline prices experienced a 3.2% decline in January, though they have since rebounded. Consumers are in a better financial position than a year ago. Wages have increased by 4.5% over the past year, outpacing the 3.1% rise in the price level. Furthermore, food prices rose at a rate lower than inflation, while gasoline prices fell by 6.4%.

Here are the highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – January 2024:

Recent inflation trends, especially the shift from large increases in the price of goods to the price of services, may concern policymakers at the Federal Reserve. Service price increases tend to be harder to slow due to labor being a significant component of service delivery costs compared to goods. Notably, prices of goods have been on a downward trend, with durable goods prices falling by 0.5% and nondurables becoming 0.4% less expensive. Supply chain challenges that constrained manufacturers when aggregate demand soared precipitated the price surge during the pandemic. However, suppliers have addressed most of these supply chain issues, and higher interest rates have subdued aggregate demand.

Labor shortages were a crucial challenge in the supply chain, particularly affecting service industries where labor constitutes a substantial portion of operating costs. Businesses had to raise wages to attract and retain employees, further exacerbating inflationary pressures, especially in service industries. For instance, grocery prices (goods) have consistently risen at a slower pace than the cost of dining out (a service) since July 2023. Service prices experienced their highest increase in nearly two years. The table below illustrates indexes for notable goods and services, highlighting how prices of goods have generally increased at a lower rate than prices of services.

The most influential service cost, the shelter index, experienced a notable 0.6% rise, constituting over two-thirds of the overall monthly index increase. The acceleration of the shelter index in January raises concerns. However, it may overstate the cost of owning or renting a primary residence because much of the increase resulted from a significant hike in the lodging away from home index. Furthermore, the shelter is resilient because its calculation uses existing rents rather than new lease rates, which have been declining in many regions.

Consumer expectations play a significant role in combating inflation, as businesses are more inclined to adjust prices when consumers anticipate inflation. Until recently, pessimism prevailed regarding the state of the economy. However, January witnessed a remarkable 13% surge in the University of Michigan’s consumer sentiment poll, reaching its highest level since July 2021, largely fueled by people’s outlook on inflation.

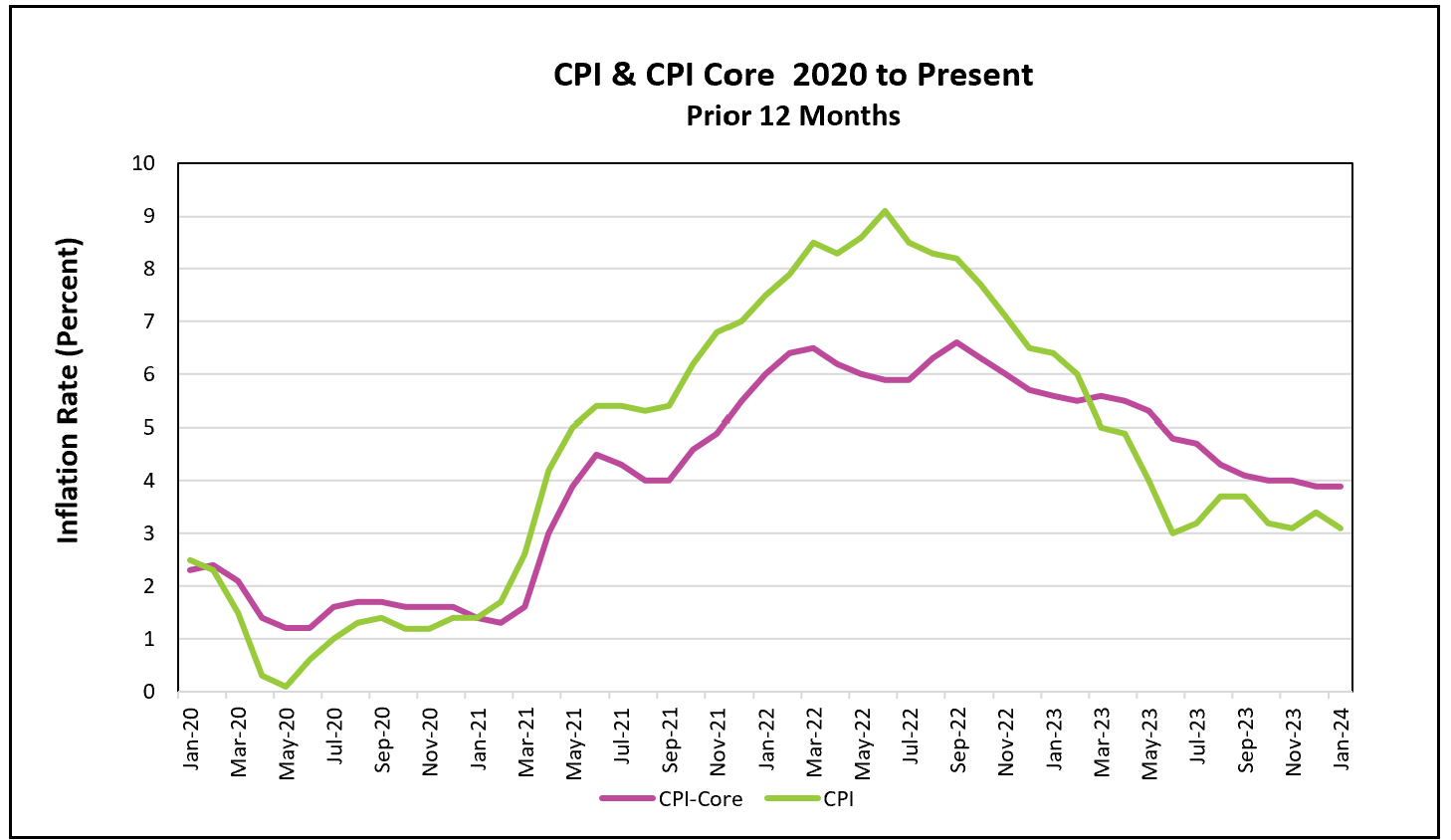

The core price index for January recorded its most substantial increase in eight months, while the 12-month core index remained unchanged. Although showing a downward trend, the index’s 0.1% drop in the last four months indicates that reaching the Fed’s 2% target rate may take considerable time. Federal Reserve policymakers will likely await a more significant deceleration in service prices before considering a reduction in their benchmark rate, as premature rate cuts could reignite inflationary pressures. While one report does not establish a definitive trend, most economists maintain that inflation is headed lower.

Policymakers favor the PCE price index over the CPI, as it reflects changes in purchasing patterns and assigns less weight to shelter costs. The January PCE price index is scheduled for release on February 29th within the Personal Income and Outlays report. The report also provides crucial data on household income and spending. Higher Rock will promptly provide a comprehensive summary and analysis following its release.