Below is a summary of the inflation figures from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index (CPI) – July 2025.

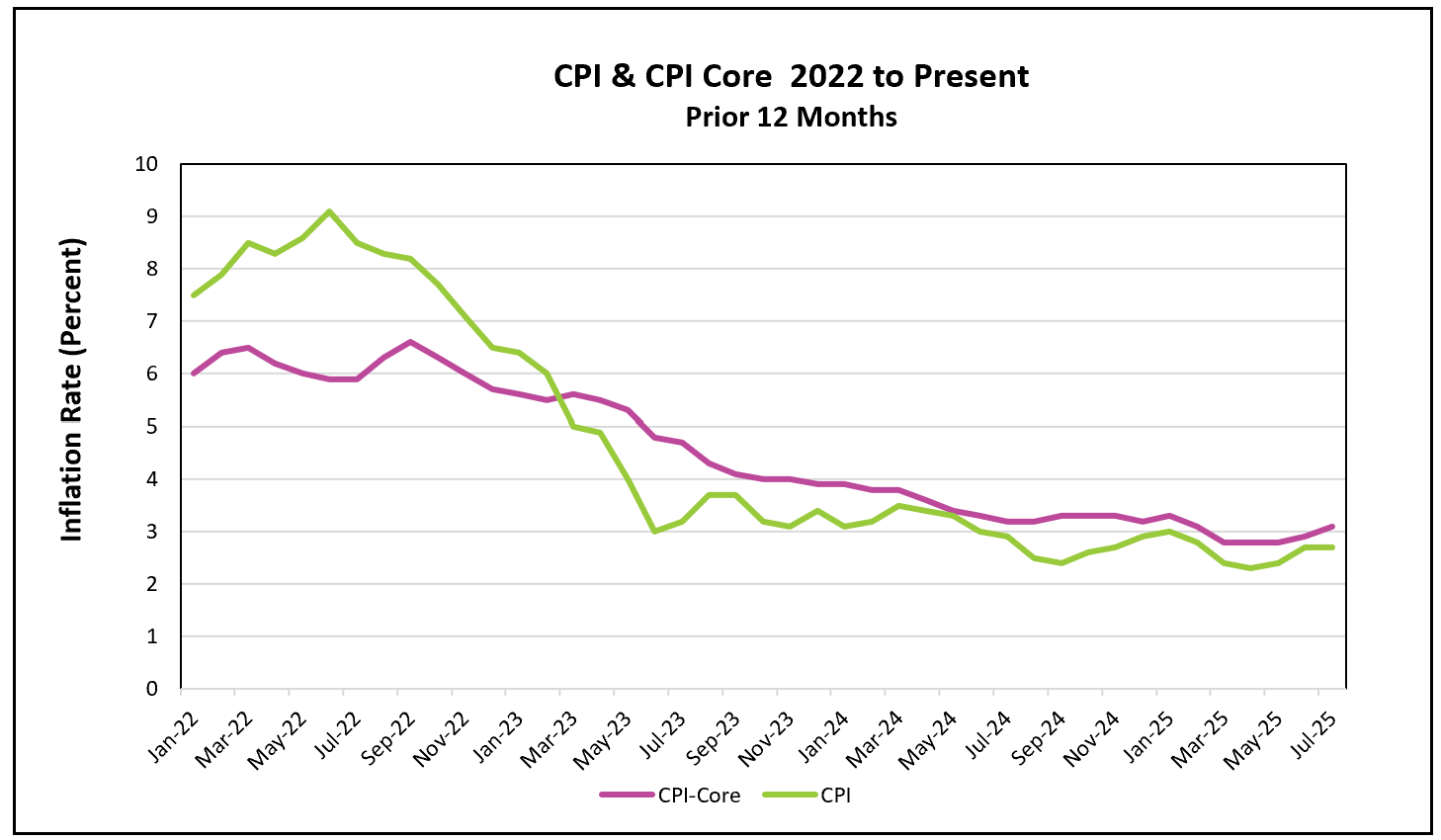

The latest inflation report provided some relief for Americans on low or fixed incomes, as the prices of many essential items—such as groceries, electricity, and gasoline—either decreased or rose at a slower pace in July. Shelter costs were the largest contributors to July’s CPI. The index remained unchanged from June, but the 12-month index has fallen from 5.1% to 3.7% since last July.

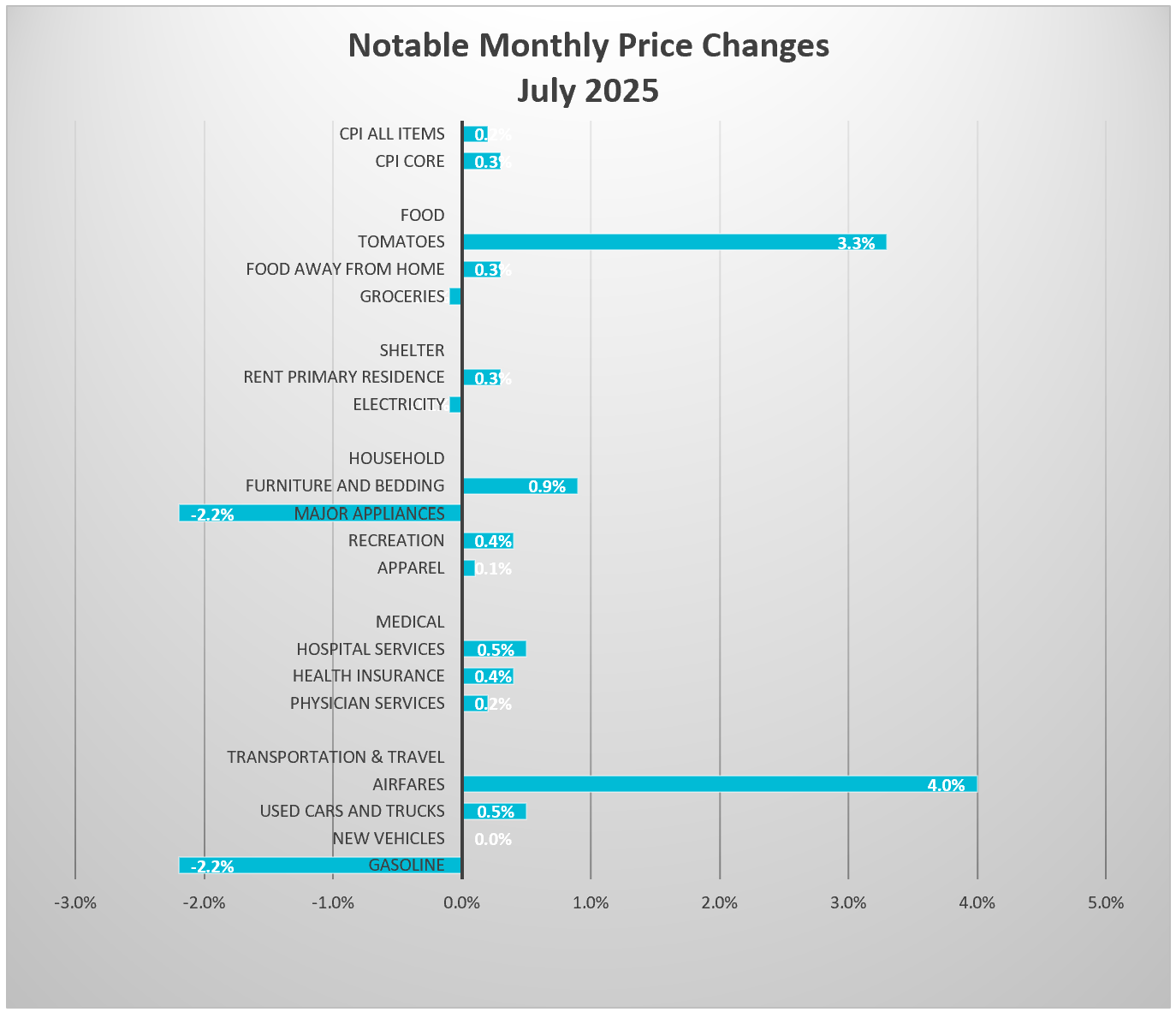

The all-inclusive CPI increased by only 0.2% following a 0.3% rise in June. Gasoline prices, which have fluctuated significantly over the past year, have been a major driver of swings in the CPI, dropping 2.2% in July. This decrease contributed substantially to the slowdown in headline inflation. Meanwhile, the food index was unchanged, though grocery costs declined. Food prices are 2.9% higher than a year ago.

However, the core index tells a different story. Economists often focus on the core price index—which excludes food and energy—to gain a clearer view of inflation trends. In July, it climbed 0.3%, its fastest pace since January. This rise was primarily driven by higher costs for services, such as medical care and airfares. The index for services excluding energy rose 0.4%, the largest increase so far this year, and has been rising for three straight months.

Additionally, real wages increased 0.1% in July and are up 1.2% over the prior 12 months, according to another release by the BLS. (BLS-Real Earnings) Analysts believe stronger wage growth may be fueling service price increases. This trend is concerning because tariffs have less influence on service inflation, suggesting that underlying demand pressures are also at work.

At the same time, tariffs are impacting the cost of many goods. Furniture prices rose 0.9%, tires 1.0%, shoes 1.4%, and tomatoes 3.3%. (Mexican tomatoes are subject to a 17% tariff. APNews) Furthermore, tariffs will likely continue to push prices higher. Most economists believe the impact of tariffs will take months to sift through the economy, as many businesses have relied on built-up inventories before President Trump imposed the tariffs. Businesses are also concerned that raising prices may discourage customers. However, as inventories dwindle and costs mount, many will be forced to raise their prices.

The combination of slowing job growth and rising prices has fueled concerns about stagflation—a stagnant economy paired with inflation. July’s Employment Summary reported that hiring has been slowing for several months. While the growth in wages remains above inflation, job growth is decelerating. Eventually, the drop in labor demand will slow wage appreciation. A slowdown in employment and lower wages could further reduce the growth in consumer spending, the primary engine of the US economy, a condition that would normally prompt a rate cut.

However, leaving rates alone can be justified because tariffs fuel higher prices. Higher prices and a stagnant economy would pose a dilemma to policymakers at the Federal Reserve. The Federal Reserve’s mandate is to maximize employment while maintaining stable prices. Lowering interest rates (as President Trump has demanded) could spur growth while fueling inflation. The Fed has resisted reducing rates because it wants assurances that inflation will not resurge before doing so. However, many analysts believe the Fed will lower rates following the small increase in payrolls in July and the large downward revisions in employment during May and June.

Consumer spending is slowing compared to last year, and businesses are becoming more cautious about hiring, leaving the economic outlook quite fragile. If demand continues to weaken while prices rise due to tariffs, the Fed could face increasingly difficult decisions in the months ahead.

Many Fed governors have stated that rate cuts are necessary to prevent further deterioration in the labor market, especially given relatively modest inflation readings. Other policymakers are concerned that the impact of the tariffs will escalate, and they recommend waiting to reduce their benchmark rate.

Policymakers will benefit from additional data before they meet in September. That includes July’s Personal Consumption Expenditures (PCE) price index, which is their preferred inflation gauge. The Bureau of Economic Analysis will release this on August 29. HRE will provide a summary and analysis shortly after it is published.