The highlights from the Bureau of Labor Statistics press release, Consumer Price Index – March 2024, are outlined below.

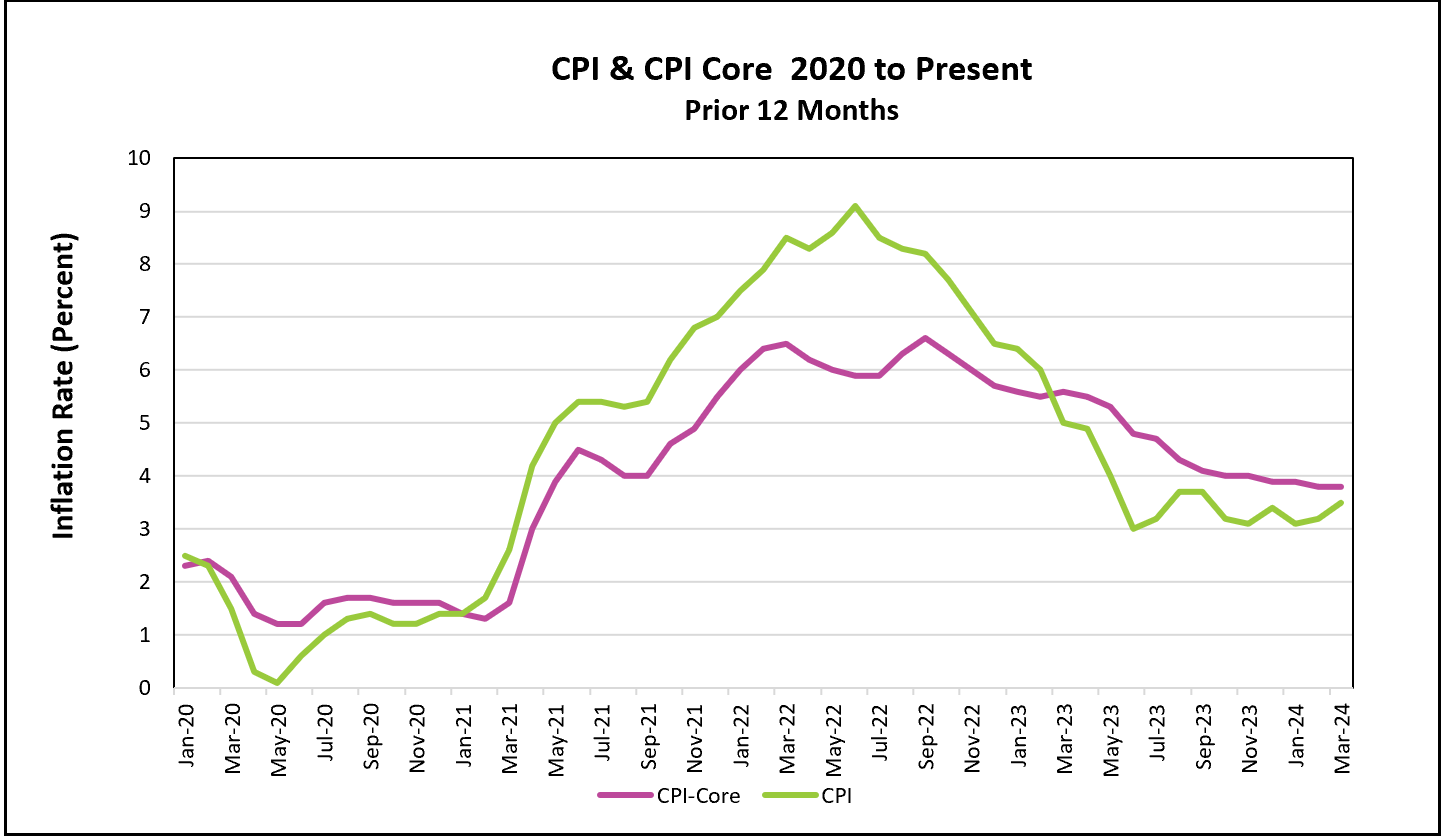

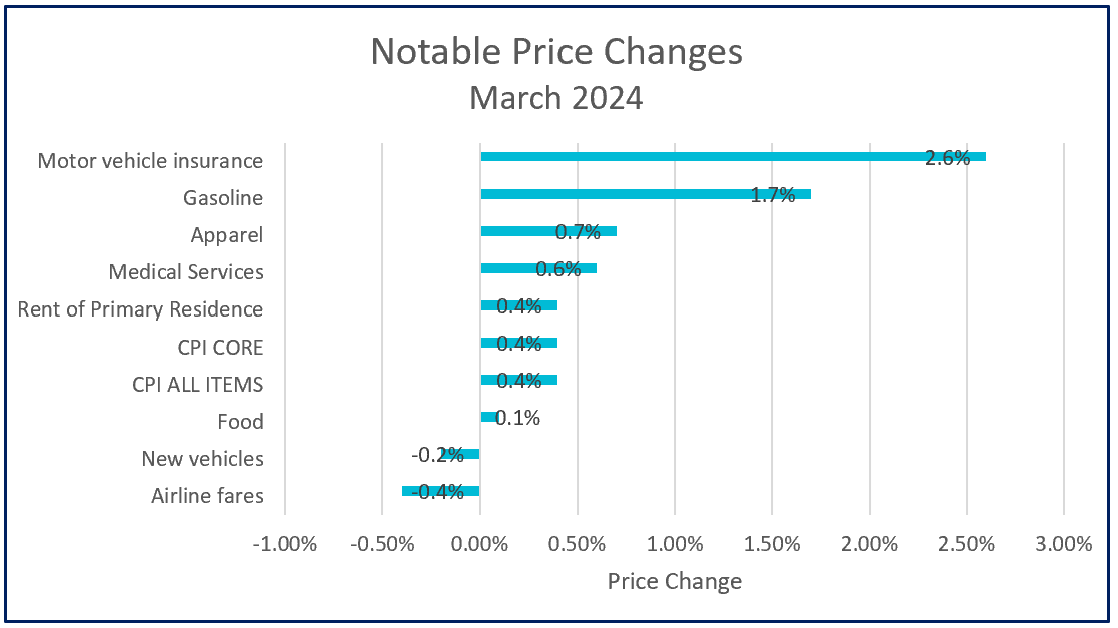

The 12-month comprehensive index reached its highest level since September 2023. A sharp surge in gasoline prices was largely responsible for this uptick. Gasoline prices, which had declined in the final quarter of 2023, sharply reversed course in February and March, increasing by 3.8% and 1.7%, respectively. The inherent volatility of food and energy prices underscores why economists favor core inflation rates when analyzing trends. Although core prices have been on a downward trajectory, the pace of decline has slowed significantly compared to late 2023. From March 2023 to September 2023, the core index dropped by 1.5%, whereas from September 2023 to March 2024, the core rate only decreased by 0.3%.

Price hikes were widespread, particularly within the service industries. The table below provides some notable monthly changes.

There have been signs that prices could increase. The labor market remains robust, with businesses consistently adding over 200,000 jobs per month. Wage growth has outpaced inflation, and consumer spending remains steady. These factors collectively bolster the case for upward price movements. Each of these developments supports higher prices.

This month’s discouraging report has dampened hopes among economists that policymakers at the Federal Reserve will reduce their target federal funds rate at their upcoming meeting. The Fed had raised the federal funds rate from 0% to a range between 5.25% and 5.5% to curb inflation’s surge in late 2021 and early 2022. The CPI has since declined steadily from its peak of 9.1% in June 2022, but it remains above the Fed’s 2% target. While there is little immediate concern about a significant jump in inflation, there is apprehension that inflation may become more entrenched in the economy, making it challenging to return to the 2% target swiftly. Consistently high rates could increase consumer tolerance for inflation, posing difficulties in further lowering the price level without triggering a recession.

Policymakers prefer the PCE price index over the CPI index. The PCE price index tends to be lower than the CPI because it assigns less importance to shelter costs. Additionally, it considers consumers’ tendency to substitute one good for another when prices rise.

Increases in employment, wages, and consumer spending typically translate into economic expansion. Unfortunately, excessive growth can fuel inflation. On April 25th, the Bureau of Economic Analysis will unveil its advance estimate for the US’s real gross domestic product (RGDP) for the first quarter of 2024. The following day, the BEA will publish March PCE’s price index in its report, Personal Income and Outlays - March 2024. This publication will also provide valuable insights into household income and spending patterns, offering a more comprehensive view of the US economy. Higher Rock will promptly deliver a summary and analysis of these reports shortly after their release.