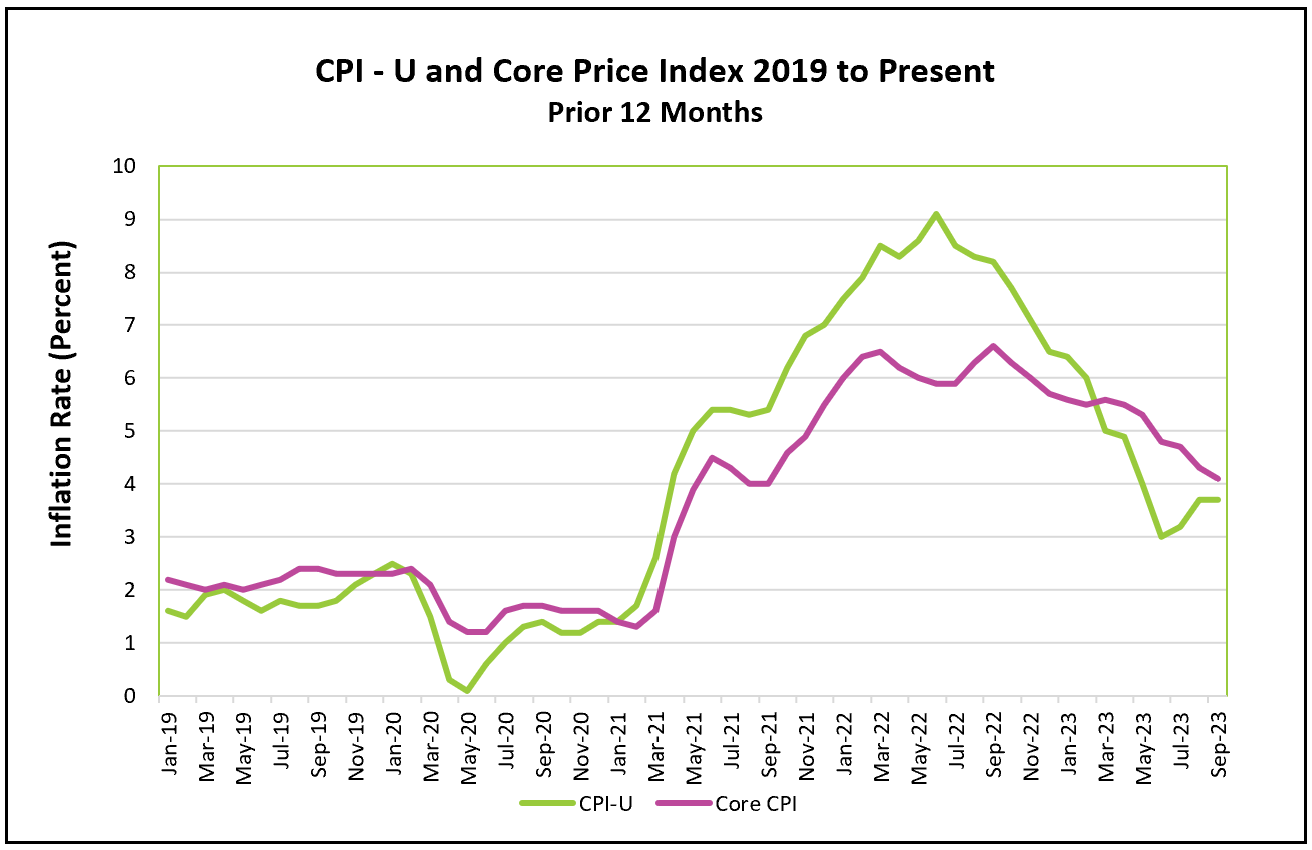

September’s Consumer Price Index report sent mixed messages. Inflation rose briskly for the second consecutive month after moderating between May and July. But the 12-month core index, which excludes food and energy prices, provides evidence that inflation is losing strength.

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – September 2023, are summarized below.

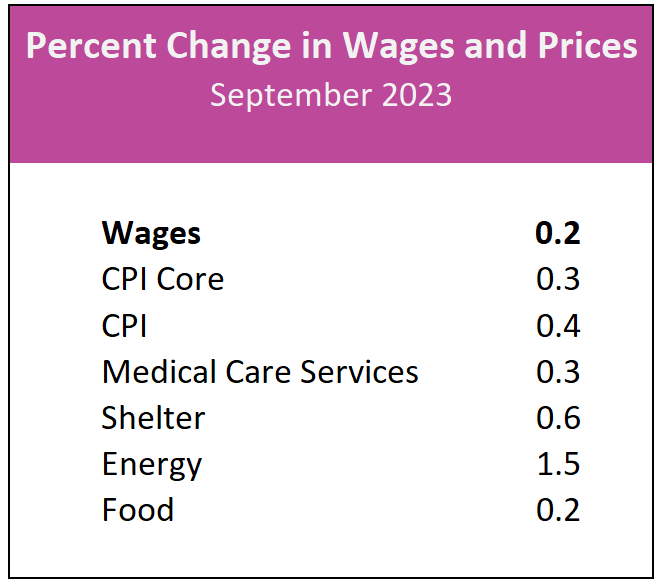

Many households had to tighten their belts further. The price increases of most essential goods and services exceeded the inflation rate, while the average wage increase remained less than the inflation rate for the second consecutive month.

Inflation-adjusted wages exceeded monthly price increases for food and medical expenses between January and August. Energy prices whipsawed during this period but are 0.5% lower than a year ago. But wages have not kept pace with the cost of housing in 2023. The rate of increase in the shelter index exceeded wage increases in every month except April when wages increased 0.5%, and the shelter index rose 0.4%. The large jump in September was unexpected. The shelter index had been trending lower (August’s rise was the smallest in a year.), and economists expected the trend to continue because the shelter index includes rental figures for all homes, not just new leases, and the rental market has recently softened. The table below compares wages and the price indexes of many essential items in September 2023.

Before August, rising real wages helped fuel continued increases in consumer spending and may have prevented a recession. However, they added inflationary pressure. Higher incomes boost the economy’s aggregate demand, which pushes the price level higher. Policymakers at the Federal Reserve have repeatedly said they want wage increases to decelerate because businesses frequently increase their prices to maintain their profit margins – especially in service industries where labor is often a company’s largest expense. They will be pleased that wage growth did not keep pace with inflation in August and September.

Decisionmakers will also be encouraged by the continued deceleration of the core inflation rate. Economists consider the core rate more reliable when evaluating trends because it excludes volatile food and energy prices. The core rate has decelerated for six consecutive months and reached its lowest point in two years. However, there is some evidence the core rate may be nearing a trough. The three-month moving average of the all-inclusive 12-month rate rose for the first time since July 2022.

The Federal Open Market Committee (FOMC) has pushed up its benchmark rate, the federal funds rate, to between 5.25 and 5.5%, the highest it has been since early 2001. The committee aims to tame inflation by slowing the growth rate of the economy’s aggregate demand. Higher short-term rates make it more expensive for people to purchase many goods and services. Inflation has proven stubborn, and the economy has been resilient to the rate increases. Wall Street now believes inflation will remain higher than the Fed’s 2% goal for longer than initially anticipated, which means the Fed will be slower to lower the federal funds rate. Investors are demanding a higher return for longer-term investments. The 10-year Treasury yield has surged to 4.7% from 3.6% over the past six months. Mortgage rates are frequently tied to the 10-year treasury. The 30-year fixed rate mortgage exceeds 7.5% up from 6% a year ago. (Freddie Mac) Higher long-term rates in the financial markets will help the Federal Reserve tame inflation by decelerating business and residential investments.

Source: Yahoo! Finance

Student loan payments resume in October after three and a half years. A recent report by Oxford Economics concluded the resumption of payments could slow the growth of consumer spending by as much as $9 billion per month, thereby increasing the likelihood of a recession.

According to the National Federation of Independent Business survey, business sentiment is worsening. (Bloomberg, October 10, 2023) Lenders have tightened their credit conditions, making it harder for businesses to secure loans. But if they do, higher rates make the loans more expensive. Most business managers surveyed said inflation was their primary concern, and 27% of the companies reported they raised their prices in August. Many businesses are having trouble finding sufficient quality help and have increased wages.

Will policymakers at the Federal Reserve raise their target for the federal funds rate at their next meeting? While inflation accelerated in September, there is sufficient reason to believe the underlying trend remains lower. A jump in volatile gasoline prices and an unexpected increase in the shelter index pushed the inflation rate higher. But gasoline prices have fallen since the survey, and the increase in the shelter index is likely a blip in an otherwise downward trend. The core index continues to decelerate. Policymakers will probably choose to wait and evaluate the impact of high interest rates, the resumption of student loan payments, and deteriorating business sentiment before raising their benchmark rate.

Policymakers at the Federal Reserve favor the PCE price index over the more quoted CPI because it is broader in scope and it considers how price changes influence what consumers purchase. The BEA’s report, Personal Income and Outlays – September 2023, will be released on October 27th, just a few days before the FOMC meets to chart its monetary policy. It will provide September’s PCE price index, consumer spending, and household income data. For a summary and our analysis of the report, visit HigherRockEducation.org shortly after its publication.