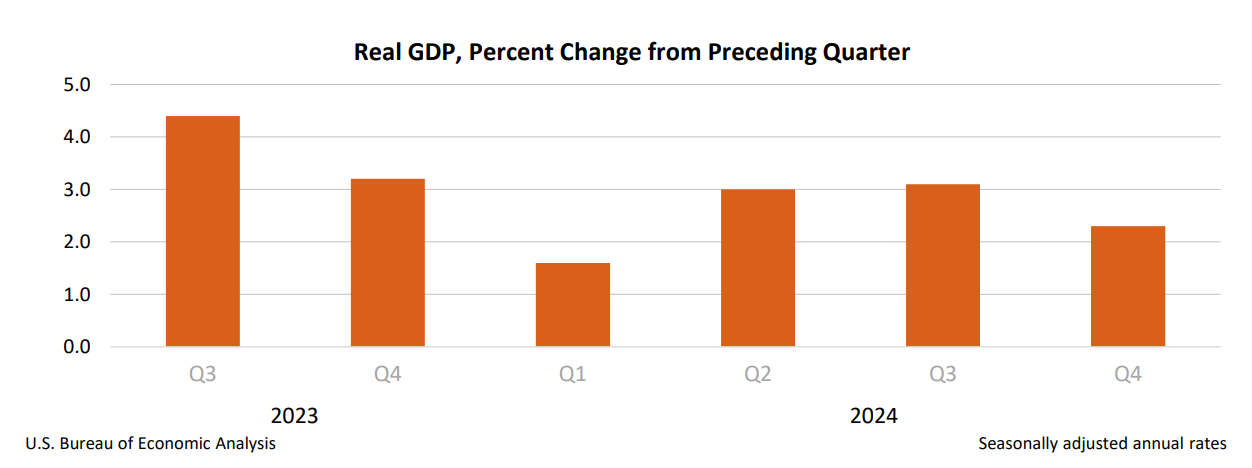

The US economy ends 2024 with 2.3% growth, fueled by consumer spending but with less business investment.

The Bureau of Economic Analysis’s news release Gross Domestic Product, Fourth Quarter 2024 (Advance Estimate) highlights are summarized below.

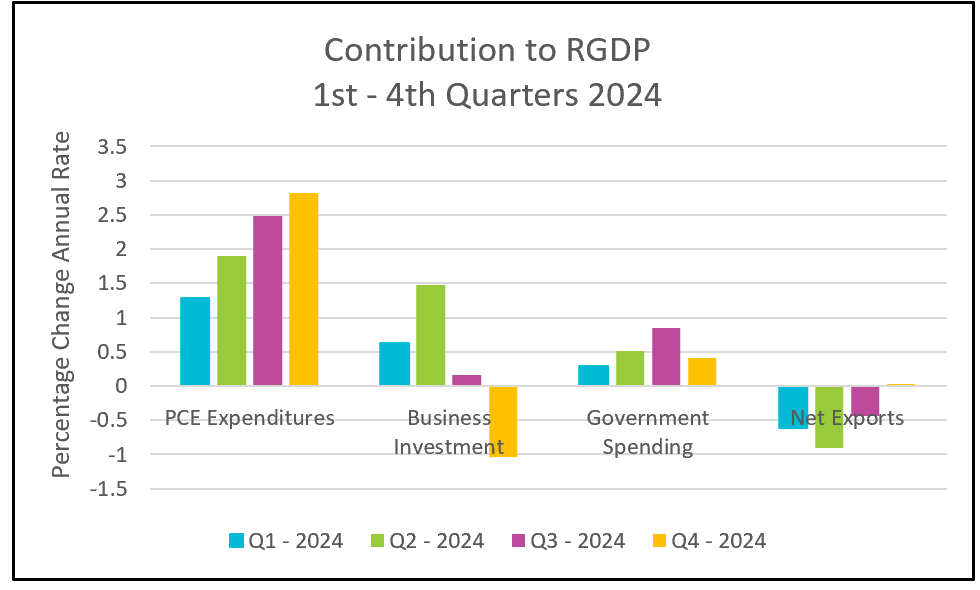

The U.S. economy defied recession fears and grew at a healthy pace in 2024, ending the year on solid footing. Consumer spending was the primary driver, with resilient household demand fueling growth. Spending increased by 4.2%, the largest gain since the first quarter of 2023. Healthcare was the biggest contributor to service-related expenditures, while motor vehicles were the most significant contributor to the rise in consumer goods sales despite higher borrowing costs. Additionally, consumers likely accelerated purchases of large imports ahead of impending tariffs. A strong labor market and rising incomes supported this growth, as real disposable income increased at an annual rate of 2.8% in the fourth quarter, meaning after-tax income outpaced inflation. Income gains and low unemployment boosted consumer confidence, which rose steadily throughout the fourth quarter, experiencing its largest monthly jump since March 2021. Typically, people spend more when they feel optimistic about their financial future. Overall, consumer spending accounted for 2.82 percentage points of the 2.25% increase in RGDP.

Businesses invested substantially in 2024, but investment slowed in the fourth quarter, dragging down RGDP growth by more than one percentage point. Companies pulled back on equipment investments, which declined for the first time since the first quarter of 2023. Economists largely attribute this decline to the eight-week strike at Boeing, which disrupted production and weighed on overall business spending.

Inventories declined, indicating that businesses sold more goods than they produced. While strong sales boosted the economy, falling inventories suggest lower investment in future production, contributing to a slowdown in business investment. This drop in inventories reduced RGDP growth by nearly one percentage point. Meanwhile, residential construction rebounded in 2024 after declining in 2022 and 2023, reversing its downward trend. It also increased in the fourth quarter following declines in the second and third quarters, signaling renewed strength in the housing sector.

Government spending increased by 2.5% in the fourth quarter, driven by a 3.3% rise in defense spending, which remained the largest category.

Both exports and imports declined during the quarter. However, since imports fell slightly more than exports, net exports positively contributed to RGDP growth. President Trump’s tariff policy and how trading partners respond will influence net exports in 2025. HRE will publish a prediction of its effects early next week.

The graph below summarizes the contributions of the major RGDP components to overall growth in 2024’s quarters.

The personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation measure, accelerated from a 1.5% increase in the third quarter to 2.3% in the fourth quarter. The core index, which excludes food and energy prices, also rose, increasing from 2.2% to 2.5%. This uptick in inflation may lead policymakers at the Federal Reserve to delay further reductions in its benchmark interest rate, potentially making interest-sensitive investments less affordable.