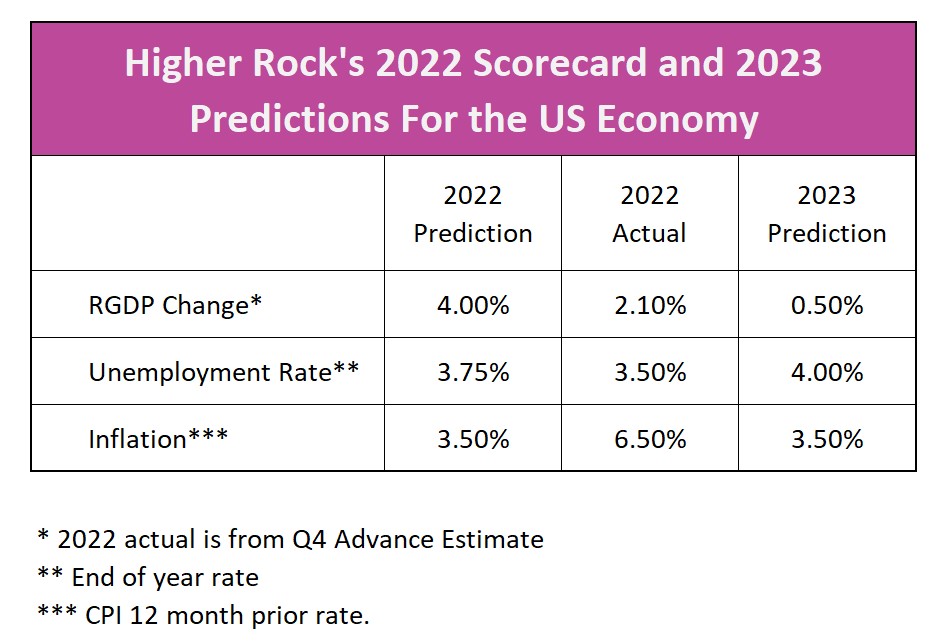

Where is the US economy headed going into 2023? Every year Higher Rock Education predicts the following year’s growth rate, inflation rate, and unemployment rate. The table below provides Higher Rock’s scoreboard and our prognosis for 2023.

Higher Rock’s 2022 predictions were too optimistic, but Russia’s invasion of Ukraine in February was unanticipated. The war immediately increased prices by impacting energy and food supplies while aggravating already stressed distribution channels and supply constraints. The US economy contracted during the first and second quarters. However, a tight labor market prevented the economy from officially entering a recession. It is hard to classify a period with 3.5% unemployment and growing payrolls as a recession. The National Association of Economic Research is responsible for identifying dates when recessions begin and end.

Cost-push and demand-pull inflation sent the price level to its 9.1% peak (we hope) in June. Necessities such as food, gasoline, and shelter were among the most significant price hikes in 2022, bringing much hardship to lower and fixed-income families. Gasoline prices peaked at over $5.00 a gallon in the summer. Since then, they have fallen to just under $3.50 (AAA) and ended the year 1.5% lower than in 2021. Food prices increased by 10.4 percent in 2022. The 12-month shelter index, which includes rent, reached a 20-year high in December (BLS).

Businesses had trouble filling jobs because there were more openings than people willing to fill them. Job competition increased wages and kept the unemployment rate near 3.5%, its 40-year low. The added wages and accumulated savings sustained demand-pull inflation. Consumer spending increased by 2.8 percent after being adjusted for inflation. However, confinement during the COVID-19 pandemic in 2020 and 2021 created a pent-up demand for services. Spending patterns changed from durable goods during the pandemic to entertainment services.

Supply disruptions caused by the war in Ukraine, delays in securing resources and parts, transportation delays, and labor shortages contributed to shortages and higher costs. Suppliers increased their prices to cope with the higher costs and slow the increase in the quantity demanded for the goods they offered. Many of these hurdles have since been lowered, and goods are more readily available.

Policymakers at central banks worldwide raised their benchmark rates to tame inflation. Their objective was to reduce their country’s aggregate demand and lower demand-pull inflation. The Federal Open Market Committee raised rates seven times, increasing the federal funds rate from close to zero to over four percent. (FRED of St. Louis) Unfortunately, the Fed must be very aggressive in its rate hikes because raising interest rates is ineffective in reducing cost-push inflation.

Higher Rock concurs with many economists who predict the US economy will enter a recession in the first half of 2023 but begin to expand in the second half of the year. Current disinflation trends and a slowing economy will continue into the second quarter as the lagging effects of 2022’s tight monetary policy continue manifesting themselves. Furthermore, policymakers will likely increase their benchmark rate between 0.25 percent and 0.5 percent in their next two meetings. After which, the Fed will pause rate hikes to evaluate their impact on the economy. Not until disinflation turns to deflation will the policymakers consider lowering rates.

The escalation of shelter prices in 2022 is probably overstated. Recently leases have trended lower, which should reduce the inflation rate in the early months of 2023. Most economists view the shelter index as a lagging indicator because it measures the average rent of all tenants. They believe new leases provide a better gauge of today’s inflation. The BLS and the Federal Reserve Bank of Cleveland recently developed such an index. The new index has fallen since it peaked in June.

Federal Reserve chairman Jerome Powell believes limiting wage growth is essential in fighting inflation. In 2022 the strength of the labor market and rising wages supported an increasing aggregate demand and provided much resistance to cutting inflation. Record savings also contributed to fewer people entering the labor market. In the first half of 2023, a contraction will slow hiring. Higher prices and prolonged unemployment will induce many people to return to the workforce. A combination of fewer job openings and more people seeking employment will bring the supply and demand for labor closer to balance, which will lessen the upward pressure on wages. The unemployment rate will increase because the number of people added to payrolls will grow at a slower rate than the number of people entering the workforce.

Last week, the US government reached its debt limit ($31.3 trillion). That means the government is forbidden to borrow money to finance its obligations and relies on cash on hand (primarily tax revenues) to fund operations. Given the government’s propensity to spend and the size of the national debt, the current situation is unsustainable. At some point, if the debt ceiling is not lifted, the US government would be forced to default on its debt. The repercussions are enormous. If that day draws near, the economy will contract as interest rates increase; capital becomes more difficult for businesses to secure, and consumer confidence plummets. Higher Rock’s predictions assume Congress increases the debt ceiling – if not, all bets are off.