Key takeaways from the Bureau of Labor Statistics (BLS) report, The Employment Situation – August 2025, include:

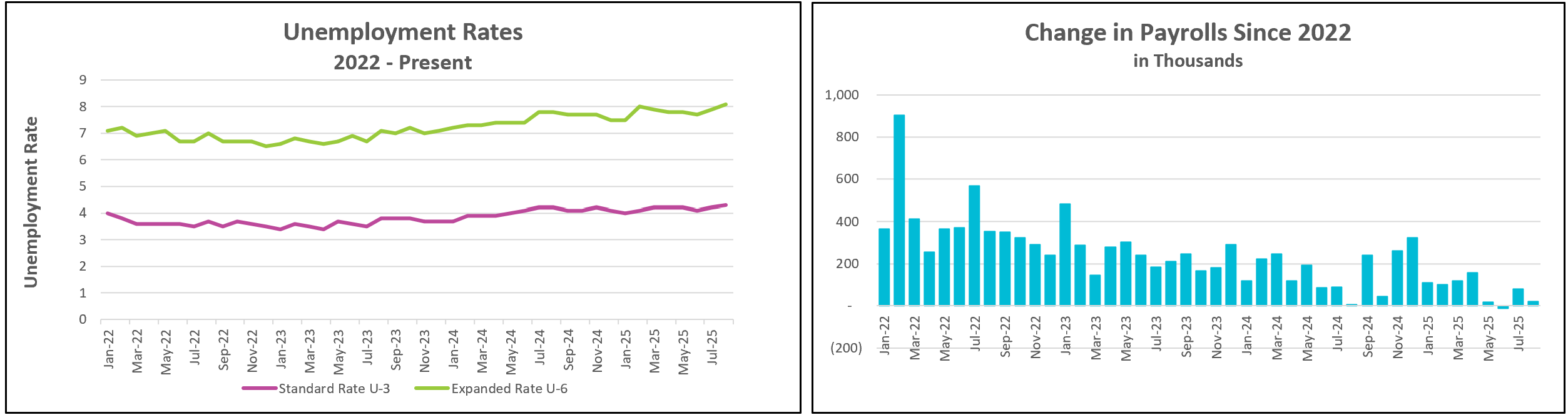

The August labor market report painted a picture of a slowing economy as both the unemployment and underemployment rates rose to their highest levels since October 2021. The unemployment rate climbed to 4.3% as more people entered the workforce but could not secure jobs, and U-6—a broader measure of labor underutilization—also increased to 8.1%. At the same time, employers significantly slowed their pace of hiring, adding only 22,000 jobs, far below the 75,000 monthly average in 2025 and less than half the 168,000 monthly pace recorded last year. This trend reflects a growing labor supply outpacing demand. Downward revisions to June and July payrolls erased another 27,000 jobs, with June marking the first monthly contraction since the depths of the pandemic in December 2020.

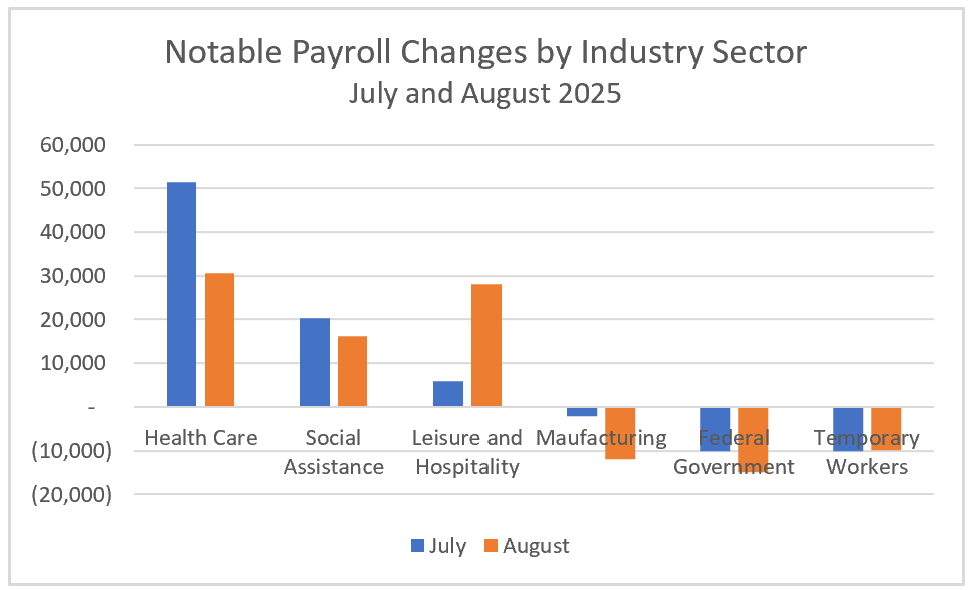

Job gains were concentrated in a few sectors, particularly health care, which added 30,600 positions—well below its typical pace but still accounting for more than 80% of private-sector job creation. Leisure and hospitality also contributed positively, adding 28,000 jobs after several months of stagnation. However, manufacturing continued to struggle, shedding jobs for the fourth straight month. The sector has lost 78,000 jobs so far this year. Federal government employment also contracted, falling by 15,000 in August and by nearly 100,000 since January, with more losses expected as deferred resignations take effect at the end of September. The decline in temporary employment, often a leading indicator of economic conditions, further underscores employers’ hesitancy to expand amid uncertainty.

The weakening job market is making it harder for workers to find employment. The average duration of unemployment rose slightly to 21.5 weeks, while the number of long-term unemployed—those jobless for more than six months—climbed to 1.9 million, an increase of over 400,000 from a year earlier.

The University of Michigan’s widely acclaimed consumer sentiment index has also fallen, suggesting potential further economic strain ahead. Economists warn that softer sentiment could soon translate into less spending. Although wages rose 0.3% in August, matching the increase in monthly compensation, pay growth is barely keeping up with inflation. Employers remain cautious in hiring, reflecting the combined effects of last year’s Federal Reserve interest rate hikes, tariffs aimed at protecting manufacturing, and restrictive immigration policies.

For policymakers, the latest figures present a tricky balancing act. Since the pandemic, the Fed has prioritized controlling inflation by raising rates, but the softening labor market may signal that the economy has peaked. Officials must weigh the risk of loosening too soon against deepening the slowdown. Even though inflation remains above the Fed’s 2% target, the weak August jobs report significantly increases the odds of a rate cut at the Fed’s September meeting, with analysts split between a 0.25% and a 0.5% reduction. Policymakers will consider the August inflation report before making their final decision. HRE will provide a summary and analysis shortly after the CPI is released.