Key takeaways from the Bureau of Labor Statistics (BLS) report, The Employment Situation – November 2025, include:

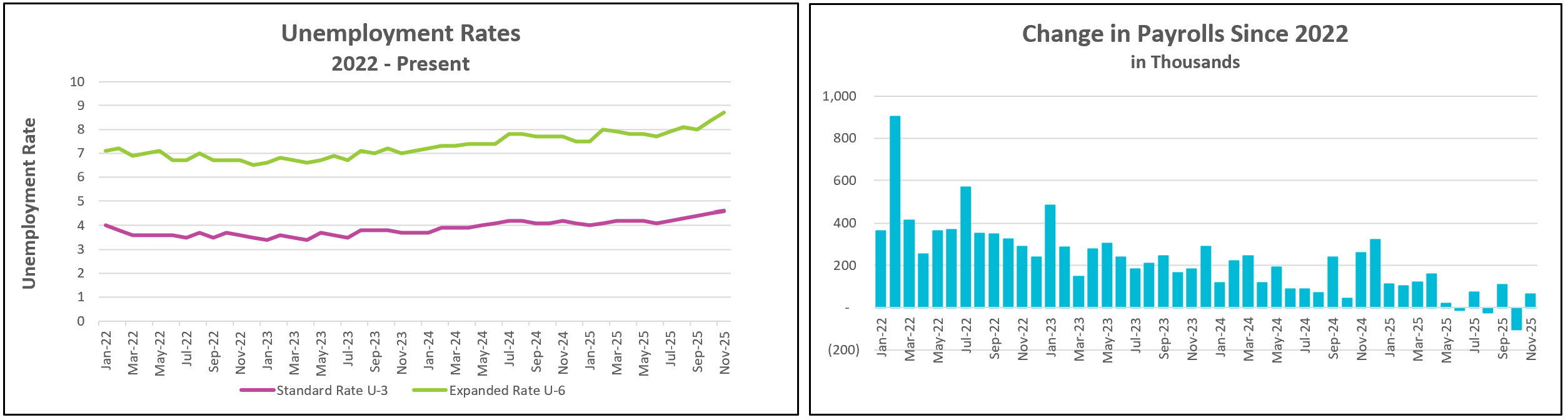

The labor market is losing momentum. Payroll figures have been trending downward as the unemployment rates increase, and worker compensation barely keeps pace with inflation. Payrolls increased by 64,000 after a sharp 105,000 decline in October. That October drop was largely driven by a one-time shock: roughly 162,000 federal employees who accepted the Trump administration’s deferred resignation offers during Elon Musk’s overhaul of government payrolls were removed from payrolls in September. November saw an additional 6,000 federal job losses. Compounding the weakness, government revisions reduced payroll counts by a total of 33,000 in August and September.

Payrolls have contracted in three of the past six months, underscoring the broader loss of momentum in the labor market. Looking ahead, further weakness may emerge when the Bureau of Labor Statistics releases its annual revisions. Fed Chair Jerome Powell has estimated that payroll figures could ultimately be revised down by as much as 60,000 per month because of how the BLS estimates job creation among new firms and businesses that have closed.

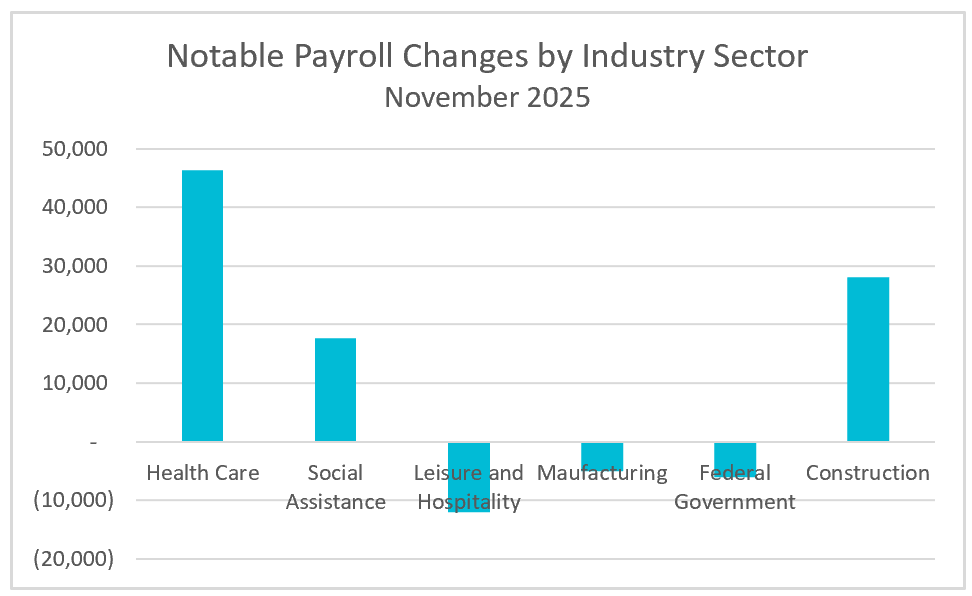

Job growth remains narrowly concentrated. Health care added 46,300 jobs in November, while social assistance contributed another 17,700. Construction also advanced, with strength concentrated in nonresidential specialty trades and weakness in residential specialty trades, reflecting the massive investment many companies are making in AI-related data centers. Manufacturing, however, continues to struggle. Payrolls in the sector have not increased since March, fell by 5,000 in November, and are down 63,000 so far this year, despite President Trump’s tariff policies being aimed at revitalizing domestic manufacturing.

In addition to the sobering payroll figures, the unemployment rate rose to 4.6%, its highest level in four years. Unfortunately, the number of people entering the labor force far exceeded those who secured a job. The removal of federal workers from payrolls in September contributed to the jump in unemployment. The unemployment rate for October is unavailable because the government shutdown prevented the collection of accurate data. However, between September and November, 323,000 people entered the workforce, many of whom were likely former federal employees. Short-term joblessness increased, with 2.5 million people unemployed for less than five weeks in November, up 316,000 from September, while the number of workers employed part-time for economic reasons rose to 5.5 million, an increase of 909,000 over the same period.

Broader measures of labor underutilization also deteriorated. The U-6 unemployment rate, which includes discouraged workers and those working part-time who would prefer full-time jobs, jumped to 8.7%, an increase of 0.7 percentage points since September. As with the headline unemployment rate, U-6 figures were also unavailable for October due to the shutdown.

Wage growth has slowed notably at a time when inflation remains elevated. Average hourly earnings rose just 0.1% in November, the smallest monthly gain since August 2023. Over the past year, wages increased 3.5%, the weakest 12-month gain since 2021 and barely enough to keep pace with the roughly 3% inflation rate. The average worker earned $36.86 per hour; however, this figure is skewed upward by the earnings of top earners. According to Bank of America deposit data, middle-income workers saw wage growth of only 2.3%, while lower-income workers experienced gains of just 1.4%, leaving more households struggling to make ends meet, living paycheck to paycheck.

The overall picture suggests a labor market that is losing momentum. Growing concern about this loss of momentum was a key factor behind the Federal Reserve’s decision to cut its benchmark interest rate last week. November’s consumer price index will be released later this morning. It will provide further insight into the financial strains facing American households, while also being closely reviewed by the Federal Reserve as it weighs whether to cut interest rates ahead of its January meeting. Higher Rock will provide a summary and its analysis shortly after it is released.